FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the adjusted balance of accounts payable on December 31, 2021?

a. P158,000

b. P138,000

c. P118,000

d. P108,000

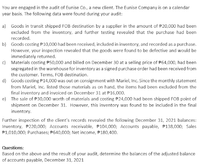

Transcribed Image Text:You are engaged in the audit of Eunise Co., a new client. The Eunise Company is on a calendar

year basis. The following data were found during your audit:

a) Goods in transit shipped FOB destination by a supplier in the amount of P20,000 had been

excluded from the inventory, and further testing revealed that the purchase had been

recorded.

b) Goods costing P10,000 had been received, included in inventory, and recorded as a purchase.

However, your inspection revealed that the goods were found to be defective and would be

immediately returned.

c) Materials costing #50,000 and billed on December 30 at a selling price of #64,000, had been

segregated in the warehouse for inventory as a signed purchase order had been received from

the customer. Terms, FOB destination.

d) Goods costing P14,000 was out on consignment with Mariel, Inc. Since the monthly statement

from Mariel, Inc. listed those materials as on hand, the items had been excluded from the

final inventory and invoiced on December 31 at P16,000.

e) The sale of P30,000 worth of materials and costing P24,000 had been shipped FOB point of

shipment on December 31. However, this inventory was found to be included in the final

inventory.

Further inspection of the clients records revealed the following December 31, 2021 balances:

Inventory, P220,000; Accounts receivable, P104,000; Accounts payable, P138,000; Sales

P1,010,000; Purchases; P640,000; Net income, F180,400.

Questions:

Based on the above and the result of your audit, determine the balances of the adjusted balance

of accounts payable, December 31, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- H6arrow_forward11/26 1216 12/11 8. What is the partial payment credit given for a $650 payment on a $2500 invoice dated April 29th with terms of 3/10 EOM if the partial payment is received on June 10th of the same year?arrow_forwardIn the beginning of January of 1994, what was the repo rate in the United States? 3.25 3.00 2.80 3.00 Was this rate higher or lower compared to previous years? lower higher O unchanged How is the repo rate determined? The repo rate is determined by an act of Congress. The U.S. Treasury sets the repo rate. MooBook Proarrow_forward

- 2020 commmon size liabilities accounts payable $41,498.00 notes payable $18,064.00 2021 common size common based year 14.67% $46,484.00 6.38% $17,635.00 14.52% 5.50% 1.1201arrow_forwardA partial payment is made on the date indicated. Use the United States rule to determine the balance due on the note at the date of maturity. (The effective date is the date the note was written.) Assume the year is not a leap year. Principal $7000 Rate 3% Effective Date July 15 Partial Payment Date Dec. 24 Amount $4000 Maturity Date Feb. 1arrow_forwardSuppose that today is 13 August 2019 and the current exchange rate is HKD 6.20 per AUD 1.00. The figure below shows your prediction with respect to the HKD's movements relative to the AUD between now and mid-September 2019. HKD per AUD 7.2 6.8 6.4 6.0 13/08 18/08 23/08 28/08 2/09 7/09 12/09 today Note: HKD = Hong Kong Dollar; AUD = Australian Dollar. %3D %3D You intend to capitalize on your prediction by using the 15/9/2019-maturity forward contract, which is currently priced at HKD 6.00 per AUD 1.00. Which of the following are you most likely to undertake today to capitalize on your prediction? (Select the best answer.) O a. Long forward contract to buy AUD O b. Short forward contract to sell AUD O C. Long forward contract to sell HKD O d. Either (a) or (c) will workarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education