FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

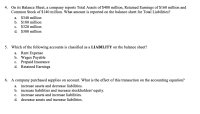

Transcribed Image Text:4. On its Balance Sheet, a company reports Total Assets of $480 million, Retained Earnings of $160 million and

Common Stock of $140 million. What amount is reported on the balance sheet for Total Liabilities?

a. $340 million

b. $180 million

c. $320 million

d. $300 million

5. Which of the following accounts is classified as a LIABILITY on the balance sheet?

Rent Expense

b. Wages Payable

c. Prepaid Insurance

а.

d.

Retained Earnings

6. A company purchased supplies on account. What is the effect of this transaction on the accounting equation?

a. increase assets and decrease liabilities.

b. increase liabilities and increase stockholders' equity.

increase assets and increase liabilities.

с.

d. decrease assets and increase liabilities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- K. Jackson Corporation Assets Cash Accounts receivable Inventory Net fixed assets Total assets Liabilities and owners' equity. Accounts payable ST Notes payable Long-term debt Owners' Equity Total liabilities and owner's equity Balance Sheet $250,000 450.000 500,000 2.100,000 $3,300.000 $100.000 450.000 1,050,000 1,700.000 $3,300,000 Income Statement Sales (all credit) Cost of goods sold Operating expense Interest expense Income taxes Net income $8,000,000 (4.000.000) (2,900,000) (150,000) (380,000) $570,000 Based on the information for K. Jackson Corporation, the current and acid-test ratios are, respectively. OA2.37 and 1.39. OB2 37 and 1.27 OC2 18 and 1.39 OD.2 18 and 1.27 OE None of the above.arrow_forwardCreate a comparative financial statement from the following:arrow_forwardI need help with these please. A. Record transfer of net loss to retained earnings. B. Record transfer of net income to retained earnings. C. Record repurchase of shares for retirement. D. Record declaration of cash dividend. E. Record payment of cash dividend.arrow_forward

- Financial statements for Rundle Company follow. Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other Total noncurrent liabilities. Total liabilities Stockholders' equity. Preferred stock, (par value $10, 4% cumulative, non-participating; 7,000 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Revenues Sales (net) Other revenues RUNDLE COMPANY Statements of Income and Retained Earnings For the Years Ended December 31 Total revenues Expenses Cost of goods sold RUNDLE COMPANY Balance Sheets As of December 31 Selling, general, and administrative Interest expense…arrow_forward1arrow_forward1. A company has the following balance sheet information: cash of $127,536, current assets of $350,647, current liabilities of $289,615, long-term debt of $345,000 and total assets of $1,304,165. It also has sales of $1,600,400. a. What is the company's owner's equity balance? b. What is the company's cash and current ratios? c. What is the company's total asset turnover? d. If the profit margin is 25%, what is the company's net income? e. If you were to create a common size balance sheet, what would the cash line be? What would the long-term debt line be? What is the company's ROE? f.arrow_forward

- Owner’s equity represents which of the following? a. the total of retained earnings plus paid-in capital b. the sum of the retained earnings and accounts receivable account balances c. the business owner’s/owners’ share of the company, also known as net worth or net assets d. the amount of funding the company has from issuing bondsarrow_forwardH1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education