FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

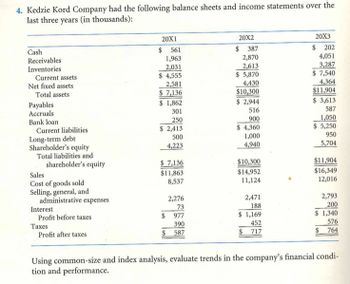

Transcribed Image Text:4. Kedzie Kord Company had the following balance sheets and income statements over the

last three years (in thousands):

Cash

Receivables

Inventories

Current assets

Net fixed assets

Total assets

Payables

Accruals

Bank loan

Current liabilities

Long-term debt

Shareholder's equity

Total liabilities and

shareholder's equity

Sales

Cost of goods sold

Selling, general, and

administrative expenses

Interest

Profit before taxes

Taxes

Profit after taxes

20X1

$ 561

1,963

2,031

$ 4,555

2,581

$ 7,136

$ 1,862

301

250

$ 2,413

500

4,223

$ 7,136

$11,863

8,537

2,276

73

$ 977

390

$ 587

20X2

$ 387

2,870

2,613

$ 5,870

4,430

$10,300

$ 2,944

516

900

$ 4,360

1,000

4,940

$10,300

$14,952

11,124

2,471

188

$ 1,169

452

$ 717

20X3

$ 202

4,051

3,287

$ 7,540

4,364

$11,904

$ 3,613

587

1,050

5,250

950

5,704

$11,904

$16,349

12,016

2,793

200

$ 1,340

576

$ 764

Using common-size and index analysis, evaluate trends in the company's financial condi-

tion and performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements for Castile Products, Incorporated, are given below: Castile Products, Incorporated Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities. Stockholders equity Connon stock, $5 per value. Retained earnings Total stockholders equity Total liabilities and stockholders' equity Castile Products, Incorporated Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net incone before taxes Income taxes (30%) Net income $24,000 230,000 370,000 9,000 633,000 860,000 $1,493,000 $ 290,000 320,000 610,000 $150,000. 733,000 883,000 $1,493,000 $ 2,290,000 1,220,000 1,070,000 580,000 490,000 32,000 458,000 137,400 $ 320,600arrow_forwardVaughn Manufacturing started the year with total assets of $304000 and total liabilities of $244000. During the year the business recorded $628000 in revenues, $335000 in expenses, and dividends of $61000. The net income reported by Vaughn Manufacturing for the year was $232000. $173000. $293000. $563000.arrow_forwardDirections shown in picture attached.arrow_forward

- Please help mearrow_forward10. The Hopewell Pharmaceutical Company's balance sheet and income statement for last year are as follows: CHALLENGE Balance Sheet (in Millions of Dollars) Assets Liabilities and Equity Cash and marketable $1,100 Accounts payable*** $900 securities Accounts receivable* 1,300 Accrued liabilities Inventories** 800 (salaries and benefits) 300 Other current assets 200 Other current liabilities 700 Total current assets $3,400 Total current liabilities $1,900 Plant and equipment (net) 2,300 Long-term debt and other Other assets 1,000 liabilities 1,000 Total assets $6,700 Common stock 1,800 Retained eamings 2,000 Total stockholders" equity $3,800 Total liabilities and equity $6,700 *Assume that average accounts receivable are the same as ending accounts receivable. **Assume that average inventory over the year was the same as ending inventory. ***Assume that average accounts payable are the same as ending accounts payable. Income Statement (in Millions of Dollars) Net sales $6,500 Cost of…arrow_forwardThe following financial data (in thousands) were taken from recent financial statements of Staples, Inc.: Please see the attachment for details: 1. Determine the times interest earned ratio for Staples in Year 3, Year 2, and Year 1? Round your answers to one decimal place.2. Evaluate this ratio for Staples.arrow_forward

- Provide answer this questionarrow_forwardThe year-end financial statements of Calloway Company contained the following elements and corresponding amounts: Assets = $34,000; Liabilities = ?; Common Stock = $6,400; Revenue = $13,800; Dividends = $1,450; Beginning Retained Earnings = $4,450; Ending Retained Earnings = $8,400.The amount of liabilities reported on the end-of-period balance sheet was:arrow_forwardThe year-end financial statements of Greenway Company contained the following elements and corresponding amounts: Assets = $23,000; Liabilities = ?; Common Stock = $5,300; Revenue = $11,600; Dividends = $900; Beginning Retained Earnings = $3,900; Ending Retained Earnings = $7,300. The amount of liabilities reported on the end-of-period balance sheet was A. $11,200. B. $10,400. C. $13,800. D. $9,200.arrow_forward

- Gerardo Company had a net income of $75,000 and other comprehensive income of $12,500 for the year. On January 1, the retained earnings balance was $525,000 and the accumulated other comprehensive income balance was $55,000. a. Determine the comprehensive income for the year. B. Determine the retained earnings balance on December 31. C. Determine the accumulated other comprehensive income on December 31.arrow_forwardPresented below is summary financial data from the Corporal Agarn Soda Enterprises, Inc. annual report: Use the ROE model framework to assess Corporal Agarn Soda’s profitability for both years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education