FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

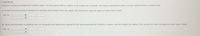

Transcribed Image Text:### Journal Entries for Carpet Purchase and Depreciation

**Scenario:** Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15-year useful life and no residual value.

#### Task:

1. **Record the Journal Entries for the Carpet Purchase**

**Date:** March 31

- **Debit:** Asset (Carpet Purchase) - \$18,000

- **Credit:** Cash/Accounts Payable - \$18,000

2. **Record the Adjusting Entry for Depreciation Expense**

**Date:** December 31

- **Depreciation Method:** Straight-Line

- **Annual Depreciation Expense:** Total Cost / Useful Life = \$18,000 / 15 = \$1,200

- **Partial-Year Depreciation (from March 31 to December 31):** \(\frac{9}{12} \times \$1,200 = \$900\)

- **Debit:** Depreciation Expense - \$900

- **Credit:** Accumulated Depreciation - \$900

**Importance:**

This exercise helps understand basic accounting entries for acquiring and depreciating fixed assets. It illustrates the use of the straight-line depreciation method and emphasizes the need for adjusting entries at year-end to reflect accurate financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, Harding Construction purchases a bulldozer for $228,000. The equipment has an 8-year life with a residual value of $16,000. Harding uses straight-line depreciation. a1. Calculate the depreciation expense for the first year ending December 31. 2$ a2. Provide the journal entry for the first year ending December 31. If an amount box does not require an entry, leave it blank. Dec. 31 b. Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31. If an amount box does not require an entry, leave it blank. Dec. 31 c1. Calculate the last year's depreciation expense. 2$ c2. Provide the journal entry for the last year. If an amount box does not require an entry, leave it blank. Dec. 31arrow_forward34arrow_forwardChuck Company purchases performs a major inspection on its machinery on 1 January 20X4 for $137,000. The company uses the straight-line method of depreciation. The company performs major inspections every 5 years. The bookkeeper erroneously expenses the entire amount to repairs and maintenance. The error is discovered at the end of 20X5. Required: Prepare the journal entry required in 20X5arrow_forward

- Pharoah Company sells office equipment on July 31, 2022, for $23,270 cash. The office equipment originally cost $83,600 and as of January 1, 2022, had accumulated depreciation of $35,030. Depreciation for the first 7 months of 2022 is $3,920. Prepare the journal entries to (a) update depreciation to July 31, 2022, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwardPlease do not give solution in image format thankuarrow_forwardJune 21 A nearly depreciated company truck was traded-in for a new one. The old truck cost $4,800.00 and on March 31, the end of the previous quarter, it had been depreciated $3,180.00. Straight-line depreciation on the old truck is $80.00 per month (DEPRE). The new truck listed for $18,950.00 and Archibald Auto Sales allowed a $2,825.00 trade-in allowance on the purchase of the new vehicle. This trade has no commercial value and no gain or loss will be recognized on this transaction. In addition to the check issued for the new truck, an additional check was issued for $510.00 was issued to the Department of Motor Vehicles the vehicle license fees. Three entries are required for this trade. 1) Record the like-kind asset exchange. Check Number: 31227. Invoice Number: W3571arrow_forward

- On July 1, Andrew Company purchased equipment at a cost of $150,000 that has a depreciable cost of $120,000 and an estimated useful life of 3 years or 60,000 hours. a. Using straight-line depreciation, prepare the journal entry to record depreciation expense for the first year ending December 31. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - b. Using straight-line depreciation, prepare the journal entry to record depreciation expense for the second year ending December 31. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select - c. Using straight-line depreciation, prepare the journal entry to record depreciation expense for the last year ending December 31. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select -arrow_forwardEntries for Sale of Fixed Asset Equipment acquired on January 8 at a cost of $107,330 has an estimated useful life of 12 years, has an estimated residual value of $7,850, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year?$fill in the blank b. Assume that the equipment was sold on April 1 of the fifth year for $65,642. 1. Journalize the entry to record depreciation for the three months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. - Select - - Select - - Select - - Select - 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select -arrow_forwardm/ilrn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSession Locator-assign... eBook Show Me How A ✩ Comparing three depreciation methods Dexter Industries purchased packaging equipment on January 8 for $112,500. The equipment was expected to have a useful life of 3 years, or 22,500 operating hours, and a residual value of $4,500. The equipment was used for 9,000 hours during Year 1, 6,750 hours in Year 2, and 6,750 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the 3 years ending December 31, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the 3 years by each method. Do not round intermediate calculations when determining the depreciation rate. Round the final answers for each year to the nearest whole dollar. Year Year 1 Year 2 Year 3 Total Straight-Line Method Depreciation Expense Units-of-Activity Method 2. What…arrow_forward

- 2. Prepare the year-end Journal entry for depreciation on December 31, 2024. Assume that the company uses the double-declining- balance method instead of the straight-line method. Required Information [The following information applies to the questions displayed below.] Wardell Company purchased a minicomputer on January 1, 2022, at a cost of $56,000. The computer was depreciated using the straight-line method over an estimated five-year life with an estimated residual value of $11,000. On January 1, 2024, the estimate of useful life was changed to a total of 10 years, and the estimate of residual value was changed to $2,000. Note: If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Do not round Intermediate calculations. Round your final answers to nearest whole dollar. No 1 Event 1 Answer is not complete. General Journal Depreciation expense Accumulated depreciation-computer Debit Creditarrow_forwardPlease don't give image formatarrow_forwardInstructions Chart of Accounts General Journal Instructions Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Required: Journalize the following entries: a. Record the depreciation for the one-half year prior to the sale, using the straight-line method. b. Record the sale of the equipment.* C. Assuming that the equipment had been sold for $25,000 cash, prepare the entry to record the sale.* *Refer to the Chart of Accounts for exact wording of account titles. Previous Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education