FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

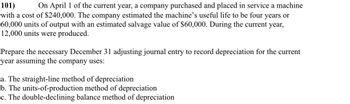

Transcribed Image Text:101)

On April 1 of the current year, a company purchased and placed in service a machine

with a cost of $240,000. The company estimated the machine's useful life to be four years or

60,000 units of output with an estimated salvage value of $60,000. During the current year,

12,000 units were produced.

Prepare the necessary December 31 adjusting journal entry to record depreciation for the current

year assuming the company uses:

a. The straight-line method of depreciation

b. The units-of-production method of depreciation

c. The double-declining balance method of depreciation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Emir Company purchased equipment that cost $110,000 cash on January 1, Year 1. The equipment had an expected useful life of six years and an estimated salvage value of $8,000. Emir depreciates its assets under the straight-line method. What are the amounts of depreciation expense during Year 3 and the accumulated depreciation at December 31, Year 3, respectively? Multiple Choice $68,000 and $17,000 $17,000 and $68,000 $17,000 and $51.000 $17,000 and $17,000arrow_forwardEquipment was acquired at the beginning of the year at a cost of $77,580. The equipment was depreciated using the straight-line method based on an estimated useful life of six years and an estimated residual value of $7,620. a. What was the depreciation expense for the first year? b. Assuming the equipment was sold at the end of the second year for $58,600, determine the gain or loss on sale of the equipment. c. Journalize the entry to record the sale. If an amount box does not require an entry, leave it blank. Debit creditarrow_forwardanswer correct step by step with all workarrow_forward

- Splish Company purchases equipment on January 1, Year 1, at a cost of $612,000. The asset is expected to have a service life of 12 years and a salvage value of $55,080. (a) Compute the amount of depreciation for each of Years 1 through 3 using the straight-line depreciation method. (Round answers to O decimal places, e.g. 5,125.) Your answer is correct. Depreciation for Year 2 (b) Depreciation for Year 1 Depreciation for Year 3 (c) eTextbook and Media Depreciation for Year 1 Your answer is correct. Depreciation for Year 2 Depreciation for Year 3 $ eTextbook and Media $ $ Compute the amount of depreciation for each of Years 1 through 3 using the sum-of-the-years-digits method. Depreciation for Year 2 $ $ $ Depreciation for Year 1 $ 46,410 $ 46,410 Depreciation for Year 3 $ 46,410 85.680 78.540 Compute the amount of depreciation for each of Years 1 through 3 using the double-declining-balance method. (Round depreciation rate to 2 decimal places, e.g. 15.84% and final answers to 0 decimal…arrow_forwardA plant asset was purchased on January 1 for $59000 with an estimated salvage value of $9000 at the end of its useful life. The current year's Depreciation Expense is $5000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $30000. The remaining useful life of the plant asset is O 10.0 years. O 11.8 years. ○ 4.0 years. O 6.0 years.arrow_forwardDuring the current year, Yost Company disposed of three different assets. On January 1 of the current year, prior to the disposal of the assets, the accounts reflected the following: Accumulated Depreciation Asset Machine A Machine B Original Cost Residual Value Estimated Life $33,000 $3,000 12 years 16,800 10 years Machine C 5,100 17 years 140,000 75,600 (straight line) The machines were disposed of during the current year in the following ways: a. Machine A: Sold on January 1 for $7,500 cash. $25,000 (10 years) 98,560 (8 years) 49,765 (12 years) b. Machine B: Sold on December 31 for $54,120; received cash, $43,296, and an $10,824 interest-bearing (12 percent) note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost. P8-5 Part 1 Required: 1. Give all journal entries related to the disposal of each machine in the current year. a. Machine A. b.…arrow_forward

- A copy machine acquired on May 1 with a cost of $2,545 has an estimated useful life of 3 years. Assuming that it will have a residual value of $745, determine the annual depreciation expense using the straight-line method (no journal entry necessary; show math).arrow_forwardOn August 3, Franko Construction purchased special - purpose equipment at a cost of $8, 900, 000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $20,000. Required: Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight - line depreciation method (half- year convention). Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining - balance method (half-year convention) with a switch to straight line when it will maximize depreciation expense. Which of these two depreciation methods (straight line or double - declining - balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use?arrow_forwardA plant asset was purchased on January 1 for $120000 with an estimated salvage value of $10000 at the end of its useful life. The current year's Depreciation Expense is $10000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $60000. The remaining useful life of the plant asset is 5 years. O. 11 years. O 12 years. O 7 years.arrow_forward

- Required information [The following information applies to the questions displayed below] On January 1, Year 1, a company purchased equipment for $148,000. The estimated service life of the equipment is 10 years and the estimated residual value is $16,000. The equipment is expected to produce 400.000 units during its life. Required: Calculate depreciation for Year 1 and Year 2 using each of the following methods. 3. Units of production (units produced in Year 1, 48,000; units produced in Year 2, 43,000). Note: Round "Depreciation per unit rate" answers to 2 decimal places. Select formula for Units of Production Depreciation: Calculato Year 1 depreciation expense Depreciation per unit rate Units produced in Year 1 Depreciation in Year 1 Calculate Year 2 depreciation expense: Depreciation per unit rate. Units produced in Year 2 Depreciation in Year 2arrow_forwardIn 2020, Schedule 1 of Form 1040 is used to report: a. Capital gains and losses. b. Unemployment compensation. c. Salary income. d. Withholding on wages.arrow_forwardThe Bandor Group sold one of its plant assets on June 1 of the current year for $70,000. The asset had an original cost of $300,900 and an estimated residual value of $9,000. The firm used the straight-line method of depreciation assuming an estimated useful life of 7 years. The asset was in service for 5 years as of January 1 of the current year. Read the requirements Requirement a. Prepare the journal entry required to record the depreciation for the current year. (Record debits first, then credits. Exclude explanations from any journal entries) Account Depreciation Expense-Plant Asset Accumulated Depreciation-Plant Asset June 1 Requirement b. Prepare the journal entry required to record the sale of the asset. (Record debits first, then credits Exclude explanations from any journal entries.) Account June 1 Cash Accumulated Depreciation Plant Asset Loss on Sale of Plant Assetsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education