Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

NEED BOTH ANSWER. ...DON'T ATTEMPT IF YOU WILL NOT SOLVE BOTH PARTS

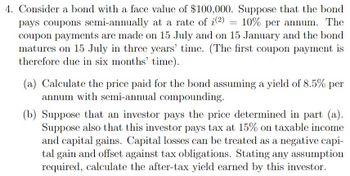

Transcribed Image Text:4. Consider a bond with a face value of $100,000. Suppose that the bond

=

pays coupons semi-annually at a rate of i(2) 10% per annum. The

coupon payments are made on 15 July and on 15 January and the bond

matures on 15 July in three years' time. (The first coupon payment is

therefore due in six months' time).

(a) Calculate the price paid for the bond assuming a yield of 8.5% per

annum with semi-annual compounding.

(b) Suppose that an investor pays the price determined in part (a).

Suppose also that this investor pays tax at 15% on taxable income

and capital gains. Capital losses can be treated as a negative capi-

tal gain and offset against tax obligations. Stating any assumption

required, calculate the after-tax yield earned by this investor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can you explain b more? I'm not entirely comprehending it.arrow_forwardner question Will save this response. Quèstion 6 Which qualitative characteristic is an ingredient of relevance? O understandability O materiality O neutrality O representational faithfulness A Moving to another question will save this response. Type here to search acer F6 F7 F8 F3 F4 F5 F1 F2 近arrow_forwardI have problems in understanding the concept of "risk aversion" Which of the following is correct? i. A more risk averse person would require less return to face the face same risk as a less risk averse person i. No, he would require more return because his aversion is higher ii. They both would require the same return, because in the final analysis, risk aversion, does not matter. iv. Risk aversion is morally wrong, so forget about the concept, nothing to understand!arrow_forward

- What happened to the solutions to part C and D? It seems they are not available.arrow_forwardCan i have the answers for all in formula steps not excel please. Kind of hard to understand.arrow_forwardA Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forward

- the answer provided does not support the question. which makes the answer incorrect.arrow_forwardWhat is underpricing? Why is it used? What evidence do we have to support the belief that underpricing is a regular problem?arrow_forwardWhat is Descartes's account of error? How do we make one and how can we avoid making one?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education