FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

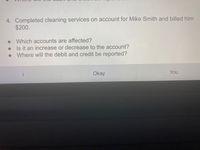

Transcribed Image Text:4. Completed cleaning services on account for Mike Smith and billed him

$200.

Which accounts are affected?

Is it an increase or decrease to the account?

Where will the debit and credit be reported?

Okay

You

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 2. Add two new expense accounts to the chart of accounts you prepared. Assign each account numbers based on where they would be placed in the chart of accounts. Miscellaneous Expense Utilities Expense Answer: Type answer here. 3. Prepare a T account for each transaction. Label the account title for each account affected. Use the chart for accounts you created in question 1. Write the debit and credit amounts for each T account to show how the accounts are affected. The first one is done. c. Received cash from owner, Roger Fisher, as an investment, $10,000.00 d. Paid cash for insurance, $ 2, 400.00 e. Bought supplies on a account to Salmon Slayers, $600.00 Paid cash for fuel, $500.00 Paid cash to owner, Roger Fisher, for personal use, $1,250.00arrow_forwardReview and study the following journal entries and determine which entries have errors.arrow_forwardABC Company has the following T Account at the end of the year: Post to T-Acct (aka Ledger) Asset Cash Liability + C/ stock - Dividend + Acct Payable Commonstah Dividend Revenue 30,000 1,000 500 Common stah Dividend Service Revenue 30,000 480 Expense Rent expense 41000 500 15,000 4,000 5,000 15,000 480 Travel expense 1,000 Insurance expense 5,000arrow_forward

- Journalize the following transactions: i. December 7. Wrote off Wilderness Park Accessories, Inc.'s past-due account as uncollectible. $247.60. M203. ii. iii. December 17. Received cash in full payment of Wilderness Park Accessories, Inc.'s account, previously written as uncollectible, $247.60. M215 and R461. December 23. Wrote off Bart's Landscaping's past-due account as uncollectible, $829.35. M229.arrow_forwardCorrecting the Trial Balance: Alpha received cash of $300 in advance from a customer that has not yet been earned, but incorrectly recorded it as a credit sale. What corrections, if any, should be made to the trial balance? Debit Column Select] Credit Column (Select]arrow_forwardYour new company paid the invoice for their account with Alli's Broom Supply Company. What would your journal entry look like when you record this transaction? a) Debit Cash; Credit Accounts Payable b) Debit Cash; Credit Supplies Expense c) Debit Accounts Receivable; Credit Cash d) Debit Accounts Payable; Credit Casharrow_forward

- Analyze each transaction and match it with the correct journal entry as stated. Be sure to look at each transaction carefully to ensure you make the correct choice. Purchase on account some office equipment Paid for utilities expense Paid the bank back the money previously borrowed on a note Paid the telephone bill received Made a partial payment to a creditor on account Took cash out of the business to pay for a personal bill Record revenues earned, but not collected yet Record internet expenses incurred, but not paid yet Received cash for the return of some equipment that was defective Received Payment from customer on an accounts receivable Made payment to an accounts payable Paid salary for office administrator Dr. Office Equipment; Cr. Acc Dr. Utilities Expense; Cr. Casl Dr. Accounts Payable; Cr. Cas Dr. Telephone Expense; Cr. C✓ Dr. Cash; Cr. Account Receivi Dr. Accounts Payable; Cr. Ca: ✓ Dr. Internet Expense; Cr. Acc Dr. Internet Expense; Cr. Acc Dr. Cash; Cr. Account Receiv:…arrow_forwardH1.arrow_forward8. ABC Cleaning Company paid off the $280 they owe to XYZ Corp, check #104. • Which accounts are affected? Is it an increase or decrease to the account? Where will the debit and credit be reported? Okay Youarrow_forward

- FOR YOU AND THE CLASS: What is the journal entry to record Bad debts expense under the allowance method. In other words ....what account would be debited and what account would be credited? Replyarrow_forwardIf a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forwardAn employee working on her first trial balance discovers that the Equipment account has a credit balance of $2500 and a customer's A/R account has a credit balance of $25. Based on the knowledge you have gained in this course and how account balances are recorded and increase/decrease, has the accountant made a mistake in her records or are these situations possible?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education