FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

What accounts are used for the first

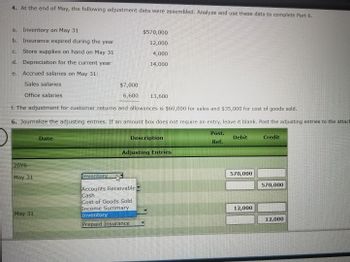

At the end of May the following adjustment data were assembled analyze and use these data to complete part 6

Please dont give handwritten answers thanku

Transcribed Image Text:4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6.

a. Inventory on May 31

b. Insurance expired during the year

C. Store supplies on hand on May 31

d. Depreciation for the current year

Accrued salaries on May 31:

Sales salaries

Office salaries

e.

20Y6

May 31

f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of goods sold.

6. Journalize the adjusting entries. If an amount box does not require an entry, leave it blank. Post the adjusting entries to the attach

May 31

Date

$7,000

6,600

Inventory

$570,000

12,000

4,000

14,000

13,600

Description

Accounts Receivable

Cash

Cost of Goods Sold

Income Summary

Inventory

Prepaid Insurance

Adjusting Entries

Post.

Ref.

Debit

570,000

12,000

Credit

570,000

12,000

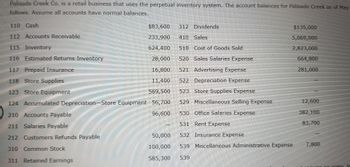

Transcribed Image Text:Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May

follows. Assume all accounts have normal balances.

110 Cash

112 Accounts Receivable

115 Inventory

116 Estimated Returns Inventory

$83,600

312 Dividends

233,900

410 Sales

624,400

510 Cost of Goods Sold

28,000 520 Sales Salaries Expense

117 Prepaid Insurance

16,800

521 Advertising Expense

118 Store Supplies

11,400

522 Depreciation Expense

123 Store Equipment

569,500

523 Store Supplies Expense

124 Accumulated Depreciation-Store Equipment 56,700

529 Miscellaneous Selling Expense

210 Accounts Payable

96,600

530 Office Salaries Expense

211 Salaries Payable

531 Rent Expense

212 Customers Refunds Payable

532 Insurance Expense

539 Miscellaneous Administrative Expense

310 Common Stock

539

311 Retained Earnings

50,000

100,000

585,300

$135,000

5,069,000

2,823,000

664,800

281,000

12,600

382,100

83,700

7,800

an entry le

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hello, can you help me with questions 7,8, and 9 please, thanks!arrow_forwardcam 1 WP NWP Assessment Player UI Application Question 32 of 42 View Policies Current Attempt in Progress A worksheet can be thought of as a(n) optional device used by accountants. permanent accounting record. part of the journal. part of the general ledger. Save for Laterarrow_forwardShow a journal entry writing off an account using both the allowance method and the direct write-off method. NOTE: YOU CAN INCLUDE ANY AMOUNTS AS LONG AS THEY MAKE SENSE, BUT DO NOT FORGET TO INCLUDE ACTUAL NUMBERS FOR THIS JOURNAL SHOWING BOTH METHODS AS STATED ABOVE. THIS CAN BE MADE UP BUT DO NOT FORGET THE NUMBERS.arrow_forward

- Profiles Tab Window Help A CengageNOWv2 | Online teach x K Counseling eAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false MLA Citation Gen. Spinbot.com - Arti. Plagiarism Checke.. edunav cenage Inflaor 围 eBook Show Me How Retained earnings statement Instructions Labels and Amount Descriptions Retained Earnings Statement Instructions Financial information related to Healthy Products Company for the month ended November 30, 2018, is as follows: Net income for November $160,000 Cash dividends paid during November 23,500 Retained earnings, November 1, 2018 371,000 1. Prepare a retained earnings statement for the month ended November 30, 2018. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. If a net loss is incurred or dividends were paid, enter that amount as a negative number using a minus sign. 2. Why is the retained earnings statement…arrow_forwardRequirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forwardQuestion Completion Status: QUESTION 2 Posting: transfers journal entries to ledger accounts. a. transfers ledger transaction data to the journal. Ob. is an optional step in the recording process. c. normally occurs before journalizing. d. QUESTION 3 Q5. All statement are limitations of trial balance Except: Click Save and Submit to save and submit. Click Save AlZ Answers to save all answers.arrow_forward

- ssignments x signment/assignmentOverview.do?filterMode=all&studentCourseSelector=199635 9 Cookie Graces Sady Teels Final Which of the following has the steps of the accounting cycle in the proper sequence? (Some Score steps may be missing.) Attempt a. analyze and record transactions, post transaction to the ledger prepare a trial balance, prepare financial statements, journalize closing entries, analyze adjustment data and prepare adjusting Score entries b. prepare financial statements, journalize closing entries and post to the ledger, analyze and record transactions, post transactions to the ledger, prepare a trial balance, analyze adjustment data, prepare adjusting entries C. prepare a trial balance, analyze adjustment data, prepare adjusting entries, prepare financial statements, journalize closing entries and post to the ledger analyze and record transactions, post transactions to the ledger Commen d. analyze and record transactions, post transactions to the ledger, prepare a…arrow_forwardPrepare journal entries to record the transactions reflected in items a through g.arrow_forwardView History Bookmarks Window Help A education.wiley.com 1 ך WP NWP Assessment Player UI Application DAXMED WALI FURINL Question 26 of 42 View Policies Current Attempt in Progress Which of the following is in accordance with generally accepted accounting principles? Accrual-basis accounting Cash-basis accounting Both accrual-basis and cash-basis accounting Neither accrual-basis nor cash-basis accounting Save for Later OO O Oarrow_forward

- Accounting Homeworkarrow_forwardQUESTION 2 Study the following transactions that occurred during August 2022 for Renwick & Co. Aug 2 - Renwick & Co. sold 40 office desks costing $2,000 each, at a unit price of $4,500 to Shams Ltd. Terms: 2/10, n/30. Aug 7- Shams Ltd. Returned for full credit 6 of the desks acquired on August 2 because they were of the incorrect size and style. Aug 8 - Renwick & Co. returned the office desks to its inventory. Aug 9 - Renwick & Co. received payment by cheque from Shams Ltd. for 30 office desks. Aug 27 - Renwick & Co. received payment in cash from Shams Ltd. in full settlement for the remaining office desks acquired on August 2. Renwick & Co. uses the net method to record sales and cash discounts and the perpetual inventory system. You may copy and paste from this list: Accounts receivable Discount Interest income Bad debt expense Bank Cash Cost of Goods Sold COGS REQUIRED: Interest receivable Inventory Notes receivable Par Premium Sales discounts Sales discounts forfeited Sales returns…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education