Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer the following questions in detail, provide examples whenever applicable, provide in-text citations.

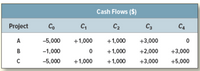

(TABLE IMAGE ATTACHED)

4) If the

5) If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” True or false?

6)If the firm uses the discounted-payback rule, will it accept any negative-NPV projects? Will it turn down any positive NPV projects?

Transcribed Image Text:This table displays the cash flows for three different projects (A, B, and C) over five periods, denoted as \( C_0 \) through \( C_4 \). The amounts are shown in dollars.

- **Project A:**

- \( C_0 \): \(-5,000\)

- \( C_1 \): \(+1,000\)

- \( C_2 \): \(+1,000\)

- \( C_3 \): \(+3,000\)

- \( C_4 \): \(0\)

- **Project B:**

- \( C_0 \): \(-1,000\)

- \( C_1 \): \(0\)

- \( C_2 \): \(+1,000\)

- \( C_3 \): \(+2,000\)

- \( C_4 \): \(+3,000\)

- **Project C:**

- \( C_0 \): \(-5,000\)

- \( C_1 \): \(+1,000\)

- \( C_2 \): \(+1,000\)

- \( C_3 \): \(+3,000\)

- \( C_4 \): \(+5,000\)

The table helps compare the initial investment and expected cash inflows for each project over the specified periods.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Office of Business Administration tells you that Villa Apartment has a project to expand the current operations and the estimated internal rate of return is 12.2%. The Villa Apartment's WACC is 11.8%. Based on all of these, you can safely conclude the: O appropriate discount rate for the project is between 11.8% and 12.2%. O expansion should be undertaken as it has a positive net present value. O project has slightly more risk than the firm's current operations. O project will have a lower debt-equity ratio than the firm's current operations.arrow_forwardBasic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project. Be complete and thorough in your answer.arrow_forwardH5. Discuss the following statement: If a firm has only independent projects, a constant WACC, and projects with normal cash flows, the NPV and IRR methods will always lead to identical capital budgeting decisions. What does this imply about the choice between IRR and NPV? If each of the assumptions were changed (one by one), how would your answer change? Explain with detailsarrow_forward

- 5. I need help with multiple choice finance home work question If a project has a NPV of zero, the project: Has a discounted payback period that is shorter than the life of the project. Has a profitability index that is greater than one. Should be accepted even if the firm has alternative investments with a positive NPV. Should be rejected. Is expected to earn a return equal to the firm's required return.arrow_forwardThis is a multiple choice question.arrow_forward. The payback period The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Cold Goose Metal Works Inc.: Cold Goose Metal Works Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta’s expected future cash flows. To answer this question, Cold Goose’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$6,000,000…arrow_forward

- Which of the following statements is (are) FALSE? Select one or more alternatives: When sales of a new product displace sales of an existing product, the situation is often referred to as cannibalisation. If the IRR of a project is equal to the cost of capital, the NPV will be zero. It is reasonable to assume that a business has a terminal growth rate higher than the long-term growth rate of the economy. The terminal growth rate is the growth rate used to estimate the terminal value of a business. Interest expenses from borrowing should be subtracted from EBIT to estimate free cash flow to firm.arrow_forward5) Brady Brand is evaluating a project with the given cash flow and weighted average cost of capital (WACC) information. Can you determine the project's modified internal rate of return (MIRR)? Keep in mind that the MIRR can be lower than the WACC, or even negative, indicating that the project is not viable and should be rejected. WACC: 10.00% Year Cash flows 0 1 -$850 $300 2 $320 3 $340 4 $360arrow_forwardThe payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies Inc.: Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha’s expected future cash flows. To answer this question, Green Caterpillar’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000…arrow_forward

- Which of the following statements are true? I At higher discount rate, a project is more likely to be rejected. II A project is acceptable if the IRR = 8% while the cost of capital = 5%. III IRR does not account for time value of money. Group of answer choices 1. All of the above. 2. I and II 3. I and III 4. II and IIIarrow_forwardBasic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project?arrow_forward2. Consider the model of Moral Hazard where firms choose between investing one unit of output in a less risky or more risky project. The safer project yields with probability and zero otherwise while the risky project yields 2 with probability and zero otherwise i.e. TG = G = TB B = 2. Suppose firms finance their investment by borrowing 1 unit from a the fiinancial market at interest rate R. The financial market is risk neutral and requires an expected rate of return equal to the risk free rate which is assumed to be zero. Will there be an equilibrium with lending to firms from the financial market A. Yes B. No C. Not enough information D. None of A-Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education