ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

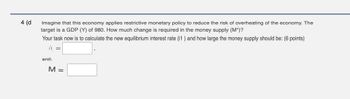

Transcribed Image Text:4 (d

Imagine that this economy applies restrictive monetary policy to reduce the risk of overheating of the economy. The

target is a GDP (Y) of 980. How much change is required in the money supply (M*)?

Your task now is to calculate the new equilibrium interest rate (i1 ) and how large the money supply should be: (6 points)

11

and

M =

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TOPIC: Classical economists and interest rate flexibilityarrow_forwardINTEREST RATE (Percent) 12 11 10 9 co 5 4 3 2 1 0 Supply Demand 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 LOANABLE FUNDS (Billions of dollars) ? Investment is the source of the supply of loanable funds. As the interest rate falls, the quantity of loanable funds supplied decreases Suppose the interest rate is 5.5%. Based on the previous graph, the quantity of loanable funds supplied is greater than the quantity of loans demanded, resulting in a surplus of loanable funds. This would encourage lenders to lower the interest rates they charge, thereby decreasing the quantity of loanable funds supplied and increasing the quantity of loanable funds demanded, moving the market toward the equilibrium interest rate of 5%arrow_forwardI need assitance on how to get these answers.arrow_forward

- 2arrow_forwardQuestion: In an economy experiencing stagflation, characterized by simultaneous high inflation and high unemployment, which of the following policy combinations would most likely exacerbate the situation? a) Increasing government spending and reducing interest rates b) Decreasing government spending and increasing taxes c) Implementing tight monetary policy and expanding fiscal policy d) Raising interest rates and reducing government spendingarrow_forward1) Suppose gold (G) and silver (S) are substitutes for each other because both serve as hedges against inflation. Suppose also that the supplies of both are fixed in the short run (Qg = 75 and Qs = 300) and that the demands for gold and silver are given by the following equations: PG = 975 – QG + 0.5Ps and Ps = 600 – Qs + 0.5PG. What are the equilibrium prices of gold and silver?arrow_forward

- 11. The U.S. economy slowed significantly in early 2008, and policy makers were extremely concerned about growth. To boost the economy, Congress passed several relief packages (the Economic Stimulus Act of Act of 2009) that combined would deliver about $700 2008 and the American Recovery and Reinvestment billion in government spending. Assume, for the sake of argument, that this spending was in the form of payments made directly to consumers. The objective was to boost the economy by increasing the disposable income of American consumers. a. Calculate the initial change in aggregate consumer spending as a consequence of this policy measure if MPC in the United States is 0.5. Then calculate the resulting change in real GDP arising from the $700 billion in payments. 76177 b. Illustrate the effect on real GDP with the use of a graph depicting the income-expenditure equilib- rium. Label the vertical axis “Planned aggregate spending, AE Planned" and the horizontal axis "Real GDP." Draw two…arrow_forward4. Organize each of the following equations to express P as a function of Q. Q as a function of P P as a function of Q Q=25-P -> %3D Q=12-3P 6Q=14-2Parrow_forwardAnalyse the impact of these events on the price level and total output of an economy in the short term. If policymakers were to use monetary policy to actively stabilize the economy, in which direction should they move the money supply and interest rate and show the effects of these policies? Please discuss your answers with appropriate graphs. - (a) The government raises taxes and reduces expenditures to balance its budget. (b) Enterprises in the economy are pessimistic about the economy in the future. - (c) Foreigners increase their taste for domestically produced beef. (d) The money wage rate rises.arrow_forward

- Consider a different economy currently in recession. If the government wants to change its spending to cause a $10,000 increase in output Y and people in the economy spend 95 percent of each additional dollar they get, how much must G change? Carefully follow all numeric directions. Use a negative number (with negative sign) to depict an increase in G and a positive number (no sign) to depict a decrease.arrow_forward1A.) What do researchers mean when they ask “Why does monetary policy have real effects on the economy?" 1B.)Use the evidence in the table (image) to discuss the research main findings and its implications for macroeconomic policy.arrow_forward2. Suppose that a representative household is part of a two-period economy, with a commodity and a credit market. He holds no initial assets (bonds or money) and no final assets, by the end of the second period. Assume that, for some exogenous reason, the price level decreases at the beginning of period one, before consumption and labor effort decisions are made. This drop is expected to last forever. a) Do you expect this change to yield any real effect? More exactly, are real aggregate output demand (through consumption) or supply (through labor effort) affected? Explain why or why not. b) Imagine now that this household leaves a bequest to the next generation. As a result, a decision is made to hold a fixed real value of bonds (b2/P) by the end of the second period. These will be paid to the children of the household. Under these conditions, will there be any impact from the price level change over the individual consumption and labor effort choices of the representative household…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education