FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:27

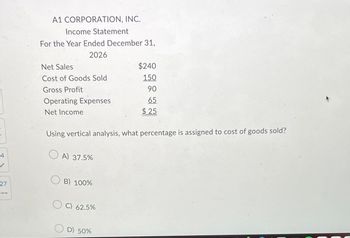

A1 CORPORATION, INC.

Income Statement

For the Year Ended December 31,

2026

Net Sales

Cost of Goods Sold

Gross Profit

Operating Expenses

Net Income

Using vertical analysis, what percentage is assigned to cost of goods sold?

OA) 37.5%

B) 100%

OC) 62.5%

$240

150

90

65

$25

D) 50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- chapter 3 4. Given the information below, what is the profit percent? Round your answer to two decimal places and add a percent sign (i.e. 15.37%) Gross Sales $341,420 Customer Returns 29,870 Cost of Goods Sold 161,570 Expenses 138,140arrow_forwardAndiysis 877 Stargel Inc. Comparative Income Statement Ser the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $10,000,000 $9,400,000 Cost of goods sold. Gross profit Selling expenses Administrative expenses. 5,350,000 $ 4,650,000 $ 2,000,000 4,950,000 $4,450,000 $1,880,000 Total operating expenses Income from operations 1,500,000 $ 3,500,000 $ 1,150,000 1,410,000 $3,290,000 $1,160,000 Other revenue 150,000 140,000 $ 1,300,000 $1,300,000 Other expense (interest) Income before income tax 170,000 150,000 $ 1,130,000 $1,150,000 Income tax expense 230,000 225,000 Net income $ 900,000 $ 925,000 Stargel Inc. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Assets Current assets: Cash $ 500,000 $ 400,000 Marketable securities. 1,010,000 1,000,000 Accounts receivable (net). 740,000 510,000 Inventories 1,190,000 950,000 Prepaid expenses 250,000 229,000 Total current assets. $3,690,000 $3,089,000 Long-term investments. Property, plant, and equipment (net) Total assets…arrow_forwardS18-4 Common-size income statement Data for Muller Pty Ltd and Rose Pty Ltd follow: Muller Rose $18 600 $10 600 6 455 3 541 Net sales Cost of sales Other expenses 13 522 4 185 Profit $ 604 $ 893 Requirements 1 Prepare common-size income statements. 2 Which company earns more profit? 3 Which company's profit is a higher percentage of its net sales?arrow_forward

- harrow_forwardRequired Information Problem 12-6B Use ratios to analyze risk and profitability (LO12-3, 12-4) (The following information applies to the questions displayed below.] Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Incone Statements For the years ended December 31 2022 $12, see, eee 8, 150,eee 4,350,000 2021 Net sales Cost of goods sold Gross profit Expenses: Operating expenses bepreciation expense Interest expense Income tax expense Total expenses $11,0se,000 6,900,000 4,150,000 1,750,eee 200,000 55,000 58e,e00 2,585,000 $ 1,765,000 1,700,000 200, e00 55,000 500,000 2,455,e00 $ 1,695,000 Net incone THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 Assets Current assets: Cash Accounts receivable Inventory Supplics Long term assets: Equipnent Less: Accumulated depreciation $ 240,000 1,005,000 1,740,000 145,800 170,000 755,000 1,370,000 115,000 234,000 775,00e 1,048,eee 90,000 1,700,000 (75e,00e) 1,700,000 (S5e,000)…arrow_forwardA6arrow_forward

- GE MINDTAP omework 5065600. 6500550 36055055 f6 Complete the balance sheet and sales information using the following financial data: 6 Total assets turnover: 1.1x Days sales outstanding: 73.0 daysa Inventory turnover ratio: 4x Fixed assets turnover: 3.0x Current ratio: 2.0x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales Calculation is based on a 365-day year. Do not round intermediate calculations. Round your answers to the nearest dollar. Balance Sheet Cash Accounts receivable Inventories Fixed assets Total assets Sales Q Search 80000 eBook f7 & 7 f8 * 4+ 8 $ $240,000 fg @MO hp IAA 9 ISBN 9780357517642&nbld-3626933&snap... ✰ f10 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold ▶II O 99+ f11 O f12 S $ B + g ins 60,000 84,000 prt sc @ 0 delete Q Check My Wo backspace Check horarrow_forward00 Chapter 1 PROBLEM 1-19 Traditional and Contribution Format Income Statements L01-6 Todrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales..... Beginning merchandise inventory. Purchases..... 1. 2. 3. 4. 5. 6. Ending merchandise inventory Fixed selling expense...... Fixed administrative expense. Variable selling expense. Variable administrative expense Contribution margin. Net operating income $300,000 $20,000 $200,000 $7,000 ? $12,000 $15,000 ? $60,000 $18,000 Required: Prepare a contribution format income statement. Prepare a traditional format income statement. Calculate the selling price per unit. Calculate the variable cost per unit. Calculate the contribution margin per unit. Which income statement format (traditional format or contribution format) would be more useful to managers in estimating how net operating income will change in responses to changes in unit sales? Why?arrow_forwardCP 13–5The following data are taken from the records of Cronkite Corp.:2019$2,5201,890630510$ 1202018$1,440960480430$ 50SalesCost of goods soldGross profitOther expensesNet incomeRequired: Perform horizontal analysis on the above date and interpretyour resultsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education