Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

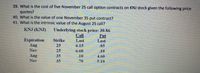

Transcribed Image Text:39. What is the cost of five November 25 call option contracts on KNJ stock given the following price

quotes?

40. What is the value of one November 35 put contract?

41. What is the intrinsic value of the August 25 call?

KNJ (KNJ)

Underlying stock price: 30.86

Call

Last

Put

Expiration

Aug

Strike

Last

25

6.15

.05

Nov

25

6.60

.10

Aug

Nov

35

.10

4.60

35

.70

5.10

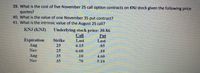

Transcribed Image Text:39. What is the cost of five November 25 call option contracts on KNJ stock given the following price

quotes?

40. What is the value of one November 35 put contract?

41. What is the intrinsic value of the August 25 call?

KNJ (KNJ)

Underlying stock price: 30.86

Call

Last

Put

Expiration

Aug

Strike

Last

25

6.15

.05

Nov

25

6.60

.10

Aug

Nov

35

.10

4.60

35

.70

5.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- F2arrow_forwardCalls Puts Close Hendreeks Strike Price Expiration Vol. Last Vol. Last 103 100 Feb 72 5.20 50 2.40 103 100 Mar 41 8.40 29 4.90 103 100 Apr 16 103 100 Jul 8 10.68 14.30 10 6.60 2 10.10 Suppose you buy 40 July 100 put option contracts. What is your maximum gain? On the expiration date, Hendreeks is selling for $86.40 per share. How much is your options investment worth? What is your net gain? (Do not round intermediate calculations.) Maximum gain Terminal value Net gainarrow_forwardUsing the forward price approach to finish the following blanks. The expected closing basis was -$.15. And the actual closing basis was -$0.25. Date 1-Oct Cash Cash Price $6.30 Futures May Futures $6.75 Cost of holding from Oct 1 to May 1 (including interest) = $0.21 What is the forward price? What is the break-even price? What is the expected profit margin? = 1-Oct 1-May Sell Cash @ $6.40 Sell May Futures @ $6.75 Buy May Futures @ ? What is the futures price on May 1? What is the gain or loss on futures market result? = What is the gain or loss on cash market result? = What is the realized price (or net selling price)? = What is the overall profit? = What is the break-even price?arrow_forward

- Assume a stock price of $31.18, risk-free rate of 3.6 percent, standard deviation of 44 percent, N(₁) value of .62789, and an N(d₂) value of .54232. What is the value of a three-month call option with a strike price of $30 given the Black-Scholes option pricing model? Question 9 options: $3.38 $3.99 $3.68 $1.76 $3.45arrow_forwardYou purchased a call option for $2.50 two weeks ago. The call has a strike price of $65 and the stock is now trading for 68.05. If you exercise the call today, what will be your holding period return and effective annual return? a. 26%; 38,524.53% b. 22%; 17,493.64% c. 26%; 40,603.73% d. None of the options. e. 22%; 18,804.01%arrow_forwardff2arrow_forward

- Q7: TFS stock is eurrently trading at $17.25 per share. In 4 months it will either rise by 24.00% or fall by 20.00% with equal probability. A 4 month put option struck at $22.43 is trading at $2.59. The risk free rate is 5.50%. What is the expected profit or loss (at maturity) of the put option? A) $2.41 B) $1.32 C) $2.63 D) $1.87 E) $2.19arrow_forwardCalculate the leverage from holding a call option with a closing price of $3 on February 18 and a closing price of $6.5 on April 6. The stock price on February 18 was $22 and closed at $27 on April 6.arrow_forwardPut-Call Parity The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $31 and with 1 year until expiration has a current value of $5.58. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education