Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

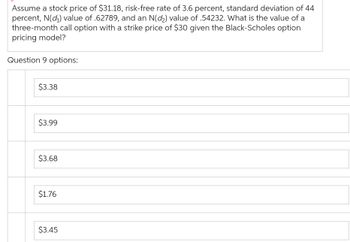

Transcribed Image Text:Assume a stock price of $31.18, risk-free rate of 3.6 percent, standard deviation of 44

percent, N(₁) value of .62789, and an N(d₂) value of .54232. What is the value of a

three-month call option with a strike price of $30 given the Black-Scholes option

pricing model?

Question 9 options:

$3.38

$3.99

$3.68

$1.76

$3.45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that an investor holds the following portfolio: short stock bought at a price 90$, long one 3- month maturity call option on the same stock with an exercise price of $88. a) Show the payoff structure of this portfolio at option expiration both numerically and graphically. b) Calculate the profit/loss on this position if stocks are selling at $80 on the option maturity date. Calculate the profit/loss on the position if the stocks are selling at $110. Call option premium is $5, while put option premium is $3. Ignore the transaction costs. c) Explain what kind of "bet" the investor is making. What must the investor in such a portfolio believe about the stock price to justify this position?arrow_forwardPut together a Black–Scholes option calculator in Excel to answer the following.(a) What is the call-option value withS0 = $45, K = $48, r = 6%, T = 15 months,and volatility = 40%?(b) What is the put-option value withS0 = $60, K = $65, r = 6%, T = 18 months,and volatility = 20%?(c) What is the put-option value withS0 = $38, K = $40, r = 6%, T = 3 months,and volatility = 60%?(d) What is the call-option value withS0 = $100, K = $95, r = 8%, T = 3 years,and volatility = 40%?arrow_forwardAssume that you have been given the following information on Purcell Corporation's call options: Inputs Intermediate Calculations Current stock price = $12 d1 = 0.32863 Time to maturity of option = 9 months d2 = 0.05477 Variance of stock return = 0.10 N(d1) = 0.62878 Strike price of option = $12 N(d2) = 0.52184 Risk-free rate = 7% According to the Black-Scholes option pricing model, what is the option's value? Do not round intermediate calculations. Round your answer to the nearest cent. Use only the values provided in the problem statement for your calculations. $arrow_forward

- what can be best strategy for trailing in Nifty 50 in option trading.arrow_forwardConsider the 1-period binomial model with a bond with A(0) = 60 and A(1) = 70 and a stock with S(0) = 4X and S^u(1) 6Y and S^d(1) = 3Z. = 1. What is the price (payoff) C(1) of a call option with strike price 28? 2. same... with strike price 45? 3. same... with strike price 72? 4. Set up a system of linear equations to determine a replicating portfolio for the call option from part 2 (strike price 45). 5. Solve it and determine the price C(O). 6. Compute, tabulate, and plot the price C(O) as you vary the strike price of the option from 28, 29, ..., 71, 72.arrow_forwardCalculate the implied volatility on a security given the following information: a call option on the security has a premium of 3.5p, the security itself is trading at 50p, the call has an exercise price of 51p and has 120 days to maturity, and the riskless interest rate is 12 per cent. Calculate the implied volatility on a security given the following information: a call option on the security has a premium of 3.5p, the security itself is trading at 50p, the call has an exercise price of 51p and has 120 days to maturity, and the riskless interest rate is 12 per cent.arrow_forward

- Assume that K=61, St =65, t = 0.25 (i.e. time to expiry is 3 months), and the risk-free rate is 0.04. The current price of the put option is p = 4. What would the price of the call option ‘c’ need to be for put-call parity to hold?arrow_forwardpls show full workingarrow_forwardH2. Using the Black-Scholes model (BSOPM), compute the standard deviation that is implied by the following call option data as: the time to the option's maturity is 0.25 years, the price of the underlying option asset is RM30, the continuously compounded risk-free interest rate is 0.12. the exercise or striking price is RM30, and the cost or premium of the call is RM1.90.arrow_forward

- Consider a portfolio that offers an expected rate of return of 11% and a standard deviation of 26%. T-bills offer a risk-free 7% rate of return. What is the maximum level of risk aversion for which the risky portfolio is still preferred to T-bills? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardConsider a portfolio consisting of one share and several European call options with the same expiry, but different strike prices. The payoff diagram of the portfolio is given by the following figure. Find the strike prices and the positions of each call option. Portfolio payoff 25 20 15 10 15 20 25 30 Stock price Payoffarrow_forwardAssume an interest rate of zero. A Call option and a Put option with the same exercise price, X = 100p are priced at 9p for the Call and 4p for the Put. What is the price of the synthetic share?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education