College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

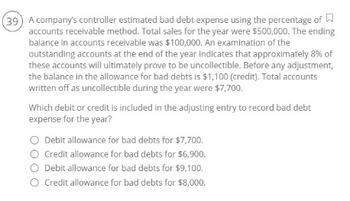

Transcribed Image Text:(39) A company's controller estimated bad debt expense using the percentage of

accounts receivable method. Total sales for the year were $500,000. The ending

balance in accounts receivable was $100,000. An examination of the

outstanding accounts at the end of the year indicates that approximately 8% of

these accounts will ultimately prove to be uncollectible. Before any adjustment,

the balance in the allowance for bad debts is $1,100 (credit). Total accounts

written off as uncollectible during the year were $7,700.

Which debit or credit is included in the adjusting entry to record bad debt

expense for the year?

O Debit allowance for bad debts for $7,700.

O Credit allowance for bad debts for $6,900.

O Debit allowance for bad debts for $9,100.

O Credit allowance for bad debts for $8,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.arrow_forwardBristax Corporation recorded $1,385,660 in credit sales for the year, and $732,410 in accounts receivable. The uncollectible percentage is 3.1% for the income statement method and 4.5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $20,550; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $17,430; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardDetermining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto Parts had an accounts receivable balance of $31,800 and a balance in the allowance for doubtful accounts of $2,980 (credit). During the year, Tennyson had credit sales of $624,300, collected accounts receivable in the amount of $602,700, wrote off $18,600 of accounts receivable, and had the following data for accounts receivable at the end of the period: Required: 1. Determine the desired post adjustment balance in allowance for doubtful accounts. 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 3. Compute bad debt expense. 4. Prepare the adjusting entry to record bad debt expense.arrow_forward

- Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardInk Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardRacing Adventures records bad debt using the allowance, income statement method. They recorded $134,560 in accounts receivable for the year and $323,660 in credit sales. The uncollectible percentage is 6.8%. What is the bad debt estimation for the year using the income statement method?arrow_forward

- Clovis Enterprises reports $845,500 in credit sales for 2018 and $933,000 in 2019. It has a $758,000 accounts receivable balance at the end of 2018 and $841,000 at the end of 2019. Clovis uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably, Clovis changes bad debt estimation to the balance sheet method at 5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Clovis Enterprises in 2019 as a result of its earnings management.arrow_forwardAverage Uncollectible Account Losses and Bad Debt Expense The accountant for Porile Company prepared the following data for sales and losses from uncollectible accounts: Required: 1. Calculate the average percentage of losses from uncollectible accounts for 2015 through 2018. 2. Assume that the credit sales for 2019 are $1,260,000 and that the weighted average percentage calculated in Requirement 1 is used as an estimate of loses from uncollectible accounts for 2019 credit sales. Determine the bad debt expense for 2019 using the percentage of credit sales method. 3. CONCEPTUAL CONNECTION Do you believe this estimate of bad debt expense is reasonable? 4. CONCEPTUAL CONNECTION How would you estimate 2019 bad debt expense if losses from uncollectible accounts for 2018 were What other action would management consider?arrow_forwardEntries for bad debt expense under the direct write-off and allowance methods The following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: A. Journalize the transactions under the direct write-off method. B. Journalize the transactions under the allowance method, assuming that the allowance account had a beginning balance of 36,000 at the beginning of the year and the company uses the analysis of receivables method. Rustic Tables Company prepared the following aging schedule for its accounts receivable: C. How much higher (lower) would Rustic Tables net income have been under the direct write-off method than under the allowance method?arrow_forward

- Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the balance sheet method to record bad debt estimation at 8% during 2018. To manage earnings more favorably, Dortmund changes bad debt estimation to the income statement method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Dortmund Stockyard in 2019 as a result of its earnings management.arrow_forwardAngelos Outlet used to report bad debt using the balance sheet method and is now switching to the income statement method. The percentage uncollectible will remain constant at 5%. Credit sales figures for 2019 were $866,000, and accounts receivable was $732,000. How much will Angelos Outlet report for 2019 bad debt estimation under the income statement method?arrow_forward4. Tooele Company's controller estimated bad debt expense using the percentage of accounts receivable method. Total sales for the year were $500,000 of which 250,000 are on account. The ending balance in accounts receivable was $100,000. An examination of the outstanding accounts at the end of the year indicates that approximately 12 percent of these accounts will ultimately prove to be uncollectible. Before any adjusting entries, the balance in the Allowance for Doubtful Accounts is $700 (CREDIT). Which is part of the correct adjusting entry to record bad debt expense for the year? (The Allowance for Doubtful Accounts is also known as the Allowance for Bad Debts or the Allowance for Uncollectible Accounts.) a. CREDIT Allowance for Bad Debts for $11,300 b. DEBIT Allowance for Bad Debts for $11,300 c. CREDIT Allowance for Bad Debts for $12,000 d. CREDIT Allowance for Bad Debts for $12,700 e. DEBIT Allowance for Bad Debts for $14,700arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning