Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

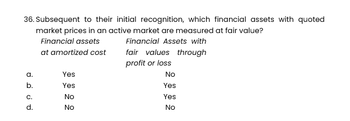

Transcribed Image Text:36. Subsequent to their initial recognition, which financial assets with quoted

market prices in an active market are measured at fair value?

Financial assets

Financial Assets with

at amortized cost

a.

b.

C.

d.

Yes

Yes

No

No

fair values through

profit or loss

No

Yes

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Net Capital gain is an item of income, while net capital loss is not an item ofdeduction. a.true b.falsearrow_forwardWhich of the following is incorrect? A. Capital + Liabilities = Assets B. Assets Liabilities Capital Capital + Liabilities = Capital - Liabilities C. Assets D. Assets -arrow_forward8. Income is: a. An amount for payment of services, interest, or profit from investment b. The gain derived from capital or labor c. Any material gain, not otherwise excluded by law, realized out of a closed and completed transaction, where there is an exchange of economic value for economic value, with a specified taxable period, under the method of accounting employed. d. A flow of service rendered by capital by the payment of money from it or any other benefit rendered by a fund of capital in relation to such fund through a period of time.arrow_forward

- The aounts reflected in the statement of financial position do not reflect the liquadation value of the assets. Which of the following concepts is this applicable to? A. Consistency B Materiality C Conservatism D Going-concernarrow_forward2. Why are investments shown as a current asset?arrow_forwardOn the balance sheet date, the book value (or carrying value) of an asset should always equal the asset's fair value. Select one: True Falsearrow_forward

- 4. The order of the 'fair value hierarchy' nominated by the FASB's SFAS 157 is: i. Quoted prices for similar assets or liabilities in active markets, adjusted ii. Quoted prices for identical assets and liabilities in active reference markets, unadjusted iii. Multiple valuation techniques consistent with the market, income and cost approaches a. Levels ii, i, iii b. b. Levels i, ii, iii c. Levels iii, ii, i d. Levels ii, iii, itarrow_forwardII. When the cárrying amount or the expected ultimate cost of the qualifying asset exceeds its recoverable amount or net realizable period shall not exceed the amount of borrowing costs it incurred I. The amount of borrowing costs that an entity capitalizes during a Which of the following statements is correct? in that period. value, the carrying amount is written down or written off i accordance with the requirements of other Standards. a. Ionly C. Both I and II b. II only d. Neither I nor IIarrow_forwardFor fi nancial assets classifi ed as available for sale, how are unrealized gains and losses refl ected in shareholders’ equity?A . Th ey are not recognizedarrow_forward

- A primary strength of the net present value method for analyzing investments is that it accounts for the amount and timing of earnings for that investment. A. True B. Falsearrow_forward7. Net Working Capital is the difference between Current Assets andLong-Term Liabilities. T/F 8. APR takes into consideration compounding, whereas EAR does notfactor in compounding. T/Farrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education