Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

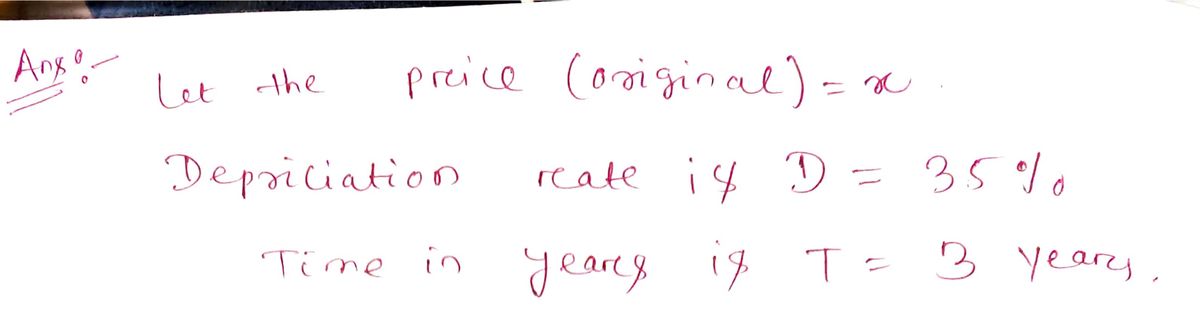

A certain vehicle loses 35% of its value each year. Compute the value of the vehie at the end of the 3rd year

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Similar questions

- A mutual fund pays a yearly interest of 3.4%. If you invested $7,000 for 5 years, what is the value of your investment after 5 years?arrow_forward1 102 F Partly sunny Devon invested $7500 in three different mutual funds. A fund containing large cap stocks made a 5.4% return in 1 yr. A real estate fund lost 13.2% in 1 yr, and a bond fund made 4.2% in 1 yr. The amount invested in the large cap stock fund was three times the amount invested in the real estate fund. If Devon had a net return of $108 across all investments, how much did he invest in each fund? Devon invested S in the large cap fund, S Check 14 f5 16 4- in the real estate fund, and S Q Search f7 ♫+ fa 00 s b fg 144 liji in the bond fund. f10 DII fi Save For Later Submit Assig © 2023 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | A DDI X 112 5 deletearrow_forwardA pension fund manager decides to invest a total of at most $40 million in U.S. Treasury bonds paying 6% annual interest and in mutual funds paying 9% annual interest. He plans to invest at least $5 million in bonds and at least $10 million in mutual funds. Bonds have an initial fee of $100 per million dollars, while the fee for mutual funds is $200 per million. The fund manager is allowed to spend no more than $7000 on fees. How much should be invested in each to maximize annual interest? What is the maximum annual interest? View an example Get more help. 8 20 F3 The amount that should be invested in Treasury bonds is $ funds is $ $million. S4 $ gog R F V F4 % 5 T F5 B 10 6 Y F6 H & 7 N F7 U J * 8 A M million and the amount that should be invested in mutual ( 9 K Clear all A O ) 0 A L F10 Check answer P V 7 + 11 #0 10 1arrow_forward

- Ten cavemen with a remaining average life expectancy of 10 years use a path from their cave to a spring some distance away. The path is not easily traveled due to 100 large stones that could be removed. The annual benefit to each individual if the stones were removed is $9.25. Each stone can be removed at a cost of $1.75. The interest rate is 2%. Click here to access the TVM Factor Table Calculator Part a Compute the benefit/cost ratio for the individual if he alone removed the 100 stones. Carry all interim calculations to 5 decimal places and then round your final answer to 2 decimal places. The tolerance is 10.02.arrow_forwardPlease help: A savings plan James begins a savings plan in which he deposits $100 at the beginning of each month into an account that earns 9% interest annually or, equivalently, 0.75% per month. To be clear, on the first day of each month, the bank adds 0.75% of the current balance as interest, and then James deposits $100. Let Bn be the balance in the account after the nth payment, where Bn = $0. Write the first five terms of the sequence {Bn}. Find a recurrence relation that generates the sequence {Bn}. How many months are needed to reach a balance of $5000?arrow_forwardDClever niips://media.aese. 国 Re Question 3/10 > NEXT A BOOKMARK V CHECK ANSWER Dave puts $200 in a savings account earning 2.5% annual simple interest. Assume Dave makes no other deposits or withdrawals on the account. How much interest does Dave earn on the account after 5 years? In how many years will the account have $255? 3 After 5 years, the interest earned on the account will be $ The account will have $255 after years.arrow_forward

- If You have this information about return of stock in 3 periods: -12%, 20% and 25%. calculate: The arithmetic average. The geometric average.arrow_forwardA store shows a net profit of $65,250 for the year. If the store profit increases by 3.75% per year for the next 15 years what will the net profit be at that point?arrow_forwardA couple just had a baby. How much should they invest now at 5.6% compounded daily in order to have $40,000 for the child's education 17 years from now? Compute the answer to the nearest dollar. (Assume a 365-day year.) The couple should invest $now. (Round to the nearest dollar as needed.) Next MacBook Pro 6 Search or type URL esc & 2 3 4 5 6 delete Q E R T Y tab A D F G H K retu caps lock く V B M shift command option control option command しの + 00 つ のarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,