ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

-

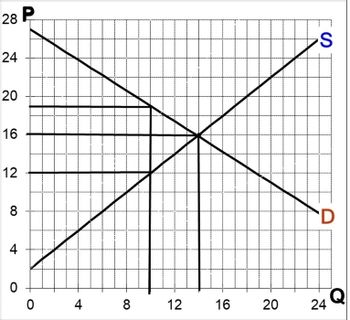

35. Assuming a $7 per unit tax is imposed, the total welfare loss to both sellers and buyers will be $______.

a) 10

b) 12

c) 14

d) 16

e) 19

f) 28

g) 36

h) 48

i) 66

j) 70

k) 84

Transcribed Image Text:28 P

24

20

16

12

8

4

0

0 4 8

12

16

20

S

D

24 Q

Expert Solution

arrow_forward

Step 1

Demand curve is the downward sloping curve.

Supply curve is the upward sloping curve.

Equilibrium is where the quantity demanded is equal to quantity supplied.

Consumer surplus is the area below demand curve and above price.

Producer surplus is the area below price and above supply curve.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the supply and demand schedules for a local electric utility are as follows:Price 17 16 15 14 13 12 11Quantity supplied 9 7 5 3 1 - -Quantity demanded 3 4 5 6 7 8 9The price is in cents per kilowatt hour (kWh), and the quantity is millions of kilowatt hours. The utilitydoes not operate at prices less than 13 cents per kWh.(a) Using graph paper and a ruler, or a computer spreadsheet or presentation program, carefully graphand label the supply curve for electricity.(b) On the same graph, draw and label the demand curve for electricity.(c) What is the equilibrium price of electricity? The equilibrium quantity? Label this point on yourgraph.(d) At a price of 17 cents per kWh, what is the quantity supplied? What is the quantity demanded? Whatis the relationship between quantity supplied and quantity demanded? What term do economists useto describe this situation?(e) At a price of 14 cents per kWh, what is the relationship between quantity supplied and quantitydemanded? What…arrow_forwardContinuos income streams(total value, present value,future value) Consumers surplus and producers surplus A national study of U.S. colleges results in a demand equation q=20000-2p where q is the enrollment at a public college or university and p is the average annual tuition (plus fees) it charges. Officials at ESU have developed a policy to guide the number of students it will accept at a tuition level of p dollars. It is summarized in the equation q=7,500=0.5p. find the quilibruim tuition price p. find the consumers surplus for price p. find the producers surplus for pruce p. Find the total social gain.arrow_forward4. We say that rent stabilization creates rationing because . . .(a) Those who are in rent stabilized housing are issued ration booklets which they use to pay therent. (b) Some people don’t want to live in rent stabilized apartments because they tend to be old (pre- 1974).(c) So long as rent stabilization keeps rents below the market level, demand must exceed supply,which is the very definition of rationing.(d) Supply will not be at its first best level.(e) So long as rent stabilization keeps rents below the market level, the intervention in the marketkeeps some sellers from reaching buyers, meaning there is excess supplyarrow_forward

- Problem 1. a) Identify the additional area of producer surplus as a result of increase in price. b) Estimate the corresponding values. c) Explain how these changes came to be. Price PhP120.00 - P. PhP100.00 P₁ D B A E C F LL Q₂ 50,000 70,000 Supply Quantityarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward2- The demand curve for a good is q = 100 p/c where c is a constant and c ≥ 0. The supply curve for the good is q=10+p. A quantity tax of t=$10 per unit is imposed on this product. a. By how much will the price of the product rise? b. What are the maximum and minimum possible changes in price? C. What is the producer's share of the tax? d. Find the elasticity of demand at p=10. (Assuming c≥ 0.1).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education