ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

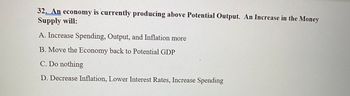

Transcribed Image Text:32. An economy is currently producing above Potential Output. An Increase in the Money

Supply will:

A. Increase Spending, Output, and Inflation more

B. Move the Economy back to Potential GDP

C. Do nothing

D. Decrease Inflation, Lower Interest Rates, Increase Spending

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 8) The Federal Reserve president bumps his head and sets his mind on achieving 2% unemployment using monetary policy. Your country is currently in long-run macro equilibrium with an unemployment rate of 4%. a. To lower unemployment, should the central bank use expansionary or contractionary policy? Expansionary Contractionary b. Illustrate what would happen in the short with a graph. Show the current equilibrium and post policy.arrow_forwardKeynesian economists believe that __________________.Group of answer choices A. the velocity of money is stable B. changes in the money supply do not affect output C. the velocity of money is affected by changes in expectationsarrow_forwardThe Federal Funds Rate is: A. A short-term nominal interest rate B. A short-term real interest rate C. A long-term nominal interest rate D. A long-term real interest ratearrow_forward

- The supply of money increases when a. the price level falls. b. the interest rate increases. c. the Fed makes open-market purchases. d. money demand increases. Click Save and Submit to save and submit. Click Save All Answers to save all answe MacBook Praarrow_forwardThe federal funds market is the market where: a. the federal government raises funds to cover its budget deficit. b. the Federal Reserve System makes loans to commercial banks. c. commercial banks with excess reserves make loans to commercial banks seeking reserves. d. commercial banks make loans to the Federal Reserve.arrow_forwardWhich of the following statements about money that is correct? A. Inflation brings a rising value of money. B. A work of art is an example of money because it can act as a store of value. C. Money is a completely stable store of value. D. Without a medium of exchange, goods and services must be exchanged directly for other goods and services.arrow_forward

- All else equal, suppose the interest rate rise from 3% to 3.5%. What will happen in the supply of money? a. Shifts to the right. b. Shifts to the left. c. An upward movement along the supply curve. d. An downward movement along the supply curve. e. The supply will remain unchanged.arrow_forward16 A change in-----------leads to a change in-----------as well. a) the money supply indirectly; investment b) the interest rate; government purchases c) the money supply; government purchases d) consumption expenditures; the money supplyarrow_forwardAn increase in ________ decreases the quantity of money people want to hold. a. the price level b. real GDP c. the interest rate d. the quantity of moneyarrow_forward

- policy is when a central bank acts to increase the money supply in an effort to stimulate the economy. Select one: a.Deflationary monetary b.Expansionary monetary c.Contractionary fiscal d.Cyclical monetary e.Countercyclical fiscalarrow_forwardA. Discuss, with the help of diagrams, Friedman’s argument concerning the short and long-run effects of an increase in the money supply. B. Now discuss how his argument can be extended to study short and long-run effects of changes in the growth rate of a growing money supply. Both parts please.arrow_forwardWhat effect does inflation have on the purchasing power of money? A. It increases the purchasing power of money. B. It decreases the purchasing power of money. C. It has no effect on the purchasing power of money. D. It initially decreases but then increases the purchasing power of money over time.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education