Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:5.

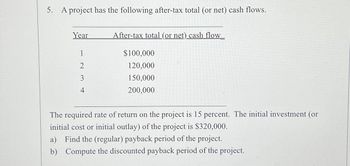

A project has the following after-tax total (or net) cash flows.

Year

After-tax total (or net) cash flow

1

$100,000

2

120,000

3

150,000

4

200,000

The required rate of return on the project is 15 percent. The initial investment (or

initial cost or initial outlay) of the project is $320,000.

a) Find the (regular) payback period of the project.

b) Compute the discounted payback period of the project.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? The initial cost of a project is $18 million. If a project returns $3 million at year 1 and that cash flow increases by $2 million each year afterwards, what is the payback period? 5.77 years 4.25 years 3.33 years 2.66 yearsarrow_forwardA project has cash flows of -$148,000, $43,000, $87,000, and $44,000 for Years 0 to 3, respectively. The required rate of return is 11 percent. Based on the internal rate of return of the project. percent for this project, you shouldarrow_forwardAn investment project costs $14,100 and has annual cash flows of $3,200 for six years. a. What is the discounted payback period if the discount rate is zero percent? Discounted payback period b. What is the discounted payback period if the discount rate is 3 percent? Discounted payback periódarrow_forward

- Your division is considering two investment projects, each of which requires an up-front expenditure of $25 million. You estimate that the cost of capital is 10% and that the investments will produce the following after-tax cash flows (in millions of dollars): Year Project A Project B 1 5 20 2 10 10 3 15 8 4 20 6 . What is the regular payback period for each of the projects? What is the discounted payback period for each of the projects? If the two projects are independent and the cost of capital is 10%, which project or projects should the firm undertake? If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? If the two projects are mutually exclusive and the cost of capital is 15%, which project should the firm undertake? What is the crossover rate? If the cost of capital is 10%, what is the modified IRR (MIRR) of each project?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) -$ 15,456 5,225 8,223 13,013 8,705 0 1 234 -$ 276,363 26,400 51,000 57,000 402,000 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? Payback period b. What is the payback period for Project B? Payback period c. What is the discounted payback period for Project A? Discounted payback periodarrow_forwardA project is expected to produce cash inflows of $5,000 for seven years. What is the maximum amount that can be spent on costs to initiate this project and still consider the project as acceptable, given an 11% discount rate? Select one: Oa. $15,884.15 Ob. $23,340.13 Oc. $25,900.63 O d. $23,560.98 Oe. $26,984.02arrow_forward

- Assuming monetary benefits of a construction project at $50,000 per year, one-time costs (initial investment) of $15,000, recurring costs of $35,000 per year, a discount rate of 10 per cent, and a 4-year time horizon, calculate the net present value (NPV) of an information system's costs and benefits. Calculate the overall return on investment (ROI) of the project. During which year does break-even occur? Use the NPV template provided (modify to suit your answer) and clearly display the NPV, ROI, and year in which payback occurs. Write a paragraph explaining whether you would recommend investing in this project based on your financial analysis. Explain your answer referring to the NPV, ROI and payback for this project. Discount Rate (10%) Year 0 - 1.0000 Year 1 - .9091 Year 2 - .8264 Year 3 - .7513 Year 4 - .6830arrow_forwardPerform a financial analysis for a project. Assume that the projected costs and benefits for this project are spread over 6 years as follows. Estimated costs are $1,100,000 in Year 0, and $50,000 each year in Years 1, 2, 3, 4, 5 and 6. Estimated benefits are $0 in Year 0, and $450,000 each year in Years 1, 2, 3, 4, 5 and 6. Use a 15% discount rate. Suppose the required payback period and discounted payback period are both 3 years. (1) Calculate the payback period (based on the original cash flows without discounting), and evaluate the project based on the payback method. (2) Calculate the discounted payback period (based on discounted cash flows), and evaluate the project based on the discounted payback method. (3) Evaluate the project using the NPV method, and explain whether you would recommend investing in this project.arrow_forwardCalculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $53,000 1 $ 21,000 2 $ 21,000 3 $ 21,000 NPV = Payback = Discounted Payback =arrow_forward

- Calculate the payback period, the discounted payback period and the NPV for the following project using a rate of 5%. Time Cash Flow 0 - $63,000 $ 21,000 $ 21,000 $ 21,000 $ 21,000 Payback = Discounted Payback =arrow_forwardTarget Corporation (TGT) is considering a new delivery system that costs $194,875. Assume a required rate of return of 4.26% and the following cash flow schedule: Year 1: $46,608 .Year 2: $70,559 Year 3: $95,705 Year 4: $11,450 The project's discounted payback period (DPP) is closest to O A. 2.08 years. OB. 2.19 years. OC. 2.31 years. COD. 2.44 years.arrow_forward3) Consider the following two projects: Net Cash Flow Each Period Initial Outlay 1 2 3 4 Project A $4,000,000 $2,003,000 $2,003,000 $2,003,000 $2,003,000 Project B $4,000,000 0 0 0 $11,000,000 Calculate the net present value of each of the above projects, assuming a 14 percent discount rate. What is the internal rate of return for each of the above projects? Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above. If 14 percent is the required rate of return, and these projects are independent, what decision should be made? If 14 percent is the required rate of return, and the projects are mutually exclusive, what decision should be made?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education