I need help with better explanation of how to do this problem. I have an answer, but it doesn't make sense. I have to know how to do in excel

(note to self - MT practice S18-01)

There are three different outcomes with difference in the expected future free cash flows.

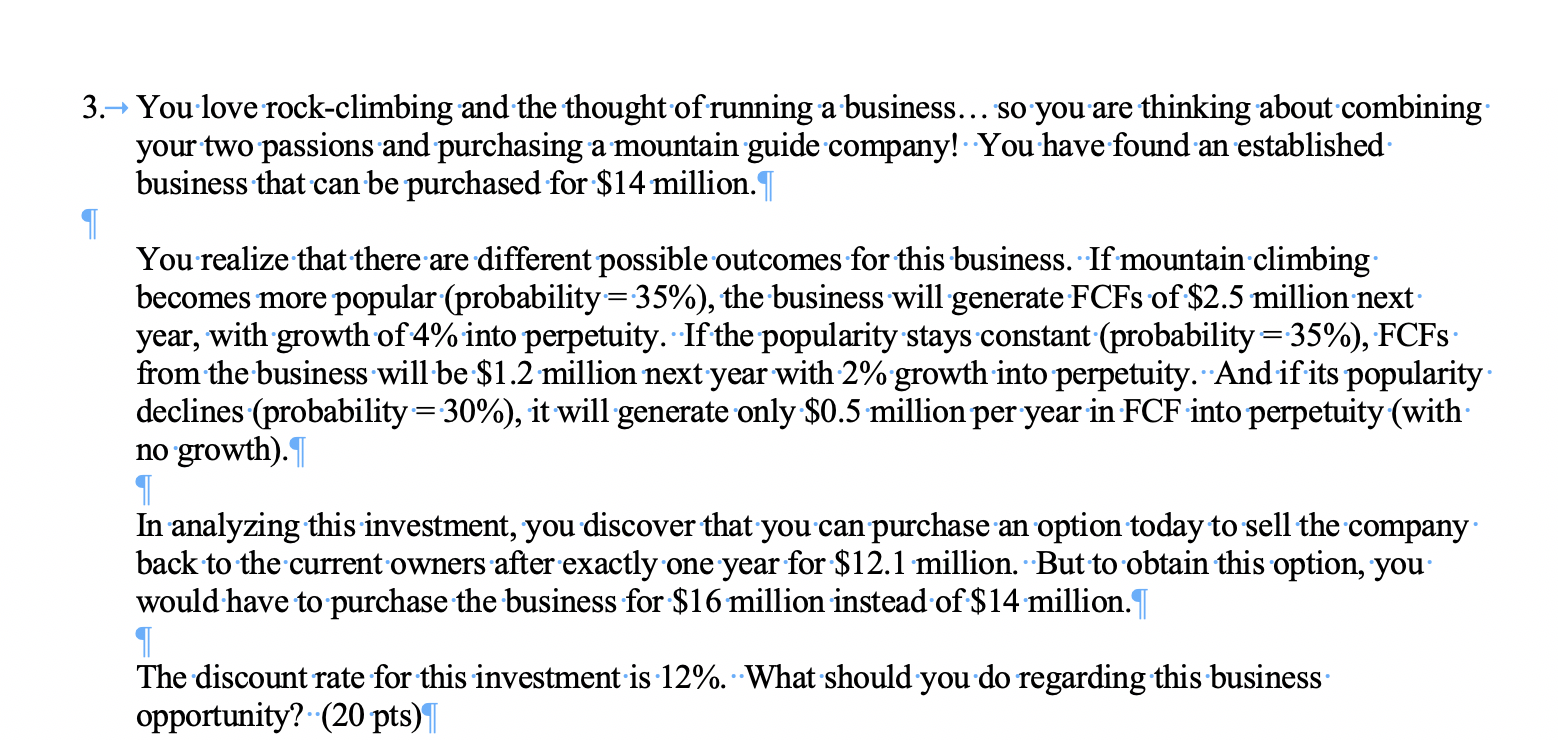

Scenario 1 (Popular):

Probability of 35%, free cash flow next year of $2.5 million which will grow at a rate of 4% in to perpetuity.

Value of the free cash flow () is calculated as below:

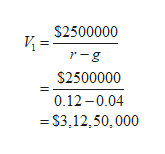

Scenario 2 (Constant):

Probability of 35%, free cash flow next year of $1.2 million which will grow at a rate of 2% in to perpetuity.

Value of the free cash flow () is calculated as below:

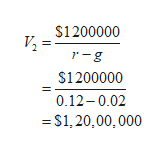

Scenario 3 (declines):

Probability of 30%, free cash flow next year of $0.5 million forever.

Value of the free cash flow () is calculated as below:

Step by stepSolved in 6 steps with 5 images

- I really need help with this item below. I have tried a few different ways to do this problem, but the top box keeps coming back as incorrect. I know that the amounts are correct, but the first box is wrong for some reason. Please read the feedback boxes and include the appropriate formulas and cell references for this item. This is done through Excel. PLEASE HELP!!!!!! Note that the pictures are the same exact problem, but I used two separate formulas to try and solve this problem.arrow_forwardI'm stuck on how to do the excel formulasarrow_forwardQuite often, people may face situations that put them in an ethical conflict. The best way to cope with this is ________. Question 22 options: A) to develop a personal code of ethical conduct about what is right and wrong B) to use the "golden rule" C) to do what makes the largest number of people happy in the situation D) to do nothing and ignore the situation E) to act the same way you have seen others act in similar situationsarrow_forward

- Have you ever felt restricted in your work because of a lack of empowerment? Can you cite any experiences in which you noticed a lack of empowerment in a person who was serving you? Why is this such a difficult concept to implement in organizations? Please provide references and a detailed answer.arrow_forwardWhich of the following is not a way an accounting system can generate motivation? 15 Multiple Cholce Ask The accounting system can provide Information to allocate revwards appropriately. The accounting system can help create and set goals through the bucgeting process. The accounting system can Introduce punitive measures for employees that do nột achleve goals. for example, limiting pay The accounting system can provide feedback and progress updates perlodicalyarrow_forwardCan i have the answers for all in formula steps not excel please. Kind of hard to understand.arrow_forward

- Im having an issue with this problem. Thank you!arrow_forwardA Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forwardSustainability reporting can incorporate which of the following? environmental reporting social reporting business viability reporting I don’t really care I just want a good grade All of the above (excluding “I don’t care…”)arrow_forward

- How specifically do you contribute to or impact the financial health of your organization? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwarddo you not see the solution you provided is the exact one i submitted, it says it's wrong..arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education