ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

How do I solve for mixed-strategy equilibria?

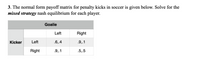

Transcribed Image Text:3. The normal form payoff matrix for penalty kicks in soccer is given below. Solve for the

mixed strategy nash equilibrium for each player.

Goalie

Left

Right

Kicker

Left

.6,.4

.9,.1

Right

.9,.1

.5,.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What is a payoff matrix?arrow_forwardPLEASE CHECK THIS HOW TO SOLVEarrow_forwardSuppose that two corporations, Analytica and Bobmetrics, are negotiating the share of profit from a time sensitive joint project. The total profit generated by the project is £10 million. However, every day that the deal is delayed reduces the value of the total profit by £1 million. The way the negotiation is set up is the following: in the first day, Analytica’s lawyers propose a split of the profits, and Bobmetrics’ lawyers can agree, or they can discuss it some more and make their own offer on the second day. After that the two teams alternate. Analytica gets to make proposals on days 1, 3, 5, 7, and 9, while Bobmetrics makes proposals on days 2, 4, 6, 8 an 10. On day 11, the profit from the joint project becomes 0. The negotiations stop when either company accepts the proposal of the other, or on day 11. Find the subgame perfect Nash equilibria of this dynamic negotiation game. What happens when the loss of value is slower or faster? What conclusions can you draw? Briefly explain…arrow_forward

- Please select the correct option and write clear. Thank you.arrow_forwardJan wants to buy a house, but her friend Kan is a much tougher negotiator. They devise a plan where Kan will tell the seller of the house that she is Jan’s agent and will make all the decisions with respect to any purchase of the house. They also agree that Kan actually will have no such authority and that Jan is the only one who will make any decisions relating to purchasing the house. They meet with the seller, and Kan says that she is Jan’s agent while Jan says nothing. Has an agency been created? Discuss in details the pros and cons of this case.arrow_forwardQ3. Two ice cream trucks operate on a beach and play a simultaneous pricing game. If one of them prices low and the other high it gets all the customers and a pay off of 12 while the other gets zero. If both price high each gets 6, and if both price low each get 5. The best strategy is for both to price high. True/False/Uncertain. Explain.arrow_forward

- **Practice** In order to alleviate their risks, they are considering a risk-sharing agreement. Carol would buy one CC and David would buy one DD. Six months from now, they would sell their coins, add up the total amount of money, and split it equally between them. Thus, if only one of the coins is successful, they would both still have some positive amount of money at the end. Assume that they can verify whether the other really made the investment. They know whether the investment is successful, since the price of the coin is public information, and they trust that the other will pay them as promised. Which of the following statements is accurate?A. They will not make that risk-sharing agreement.B. Carol is willing to take the risk-sharing agreement, but David is not.C. They may be willing to make that risk-sharing agreement, but it depends on information not given in the question.D. They will surely make the risk-sharing agreement.E. None of the statements above is correct.arrow_forwardBernie and Leona were arrested for money laundering and were interrogated separately by the phone. Bernie and Leona were each presented with the following independent offers. If one confesses and the other doesn’t, then who confesses goes free and the other will receive a 20-year prison sentence; if both confess, each receives a 10-year prison sentence; and if neither confesses, each will only receive a 2-year prison sentence.a. Use the above information to construct a payoff matrix for Bernie and Leonab. Does either Bernie or Leona have a dominant strategy? Why or why not?c. Does a Nash equilibrium exist? Why or why not?arrow_forwardWhat does the prisoner’s dilemma teach us about the behavior of oligopolists?arrow_forward

- ____ emphasizes economies of scale and decreases risk.arrow_forwardPlayer 1 and player 2 are playing a simultaneous-move one-shot game, where player 1 can move "up" or "down" and player 2 can move "left" or "right" The payoffs for the game are shown in the payoff matrix. The first number of each cell represents player 1's payoff, and the second number is player 2's. Use the matrix to answer the questions below. Player 1 2nd attempt Part 1 Part 2 Which of the following outcomes is a pure strategy Nash equilibrium of this game? P = (1-P) = Up Down Part 3 9= Left -16, -18 -20,7 Choose one or more: A. There is no pure strategy Nash equilibrium in this game. OB. Player 1 plays up; player 2 plays left. OC. Player 1 plays up; player 2 plays right. □ D. Player 1 plays down; player 2 plays left. O E. Player 1 plays down; player 2 plays right. Player 2 Suppose player 1 assigns probability p to playing up and (1 - p) to playing down. What do p and (1-p) have to be such that player 2 is indifferent between playing left and right? Round all answers to two decimal…arrow_forwardOlivia is thinking about opening a new bakery (the entrant). There is already a bakery open in her neighborhood (the incumbent), and the owner of the incumbent bakery makes it clear that if Olivia enters the market, they will cut their prices in an attempt to drive the new bakery out of business. Based on the payoff matrix below, is the incumbent’s threat credible? That is, if Olivia opens a new bakery, will the incumbent actually lower their prices? Note: the entrant chooses the row, the incumbent chooses the column High price Low price Enter 1, 2 -1, 1 Don’t enter 0, 10 0, 1 a. Yes, the threat is credible b. No, the threat is not crediblearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education