FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

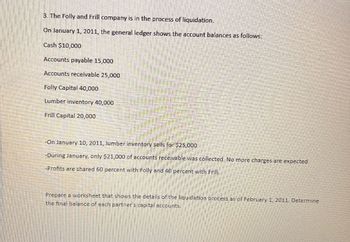

Transcribed Image Text:3. The Folly and Frill company is in the process of liquidation.

On January 1, 2011, the general ledger shows the account balances as follows:

Cash $10,000

Accounts payable 15,000

Accounts receivable 25,000

Folly Capital 40,000

Lumber inventory 40,000

Frill Capital 20,000

-On January 10, 2011, lumber inventory sells for $25,000

-During January, only $21,000 of accounts receivable was collected. No more charges are expected.

-Profits are shared 60 percent with Folly and 40 percent with Frill.

Prepare a worksheet that shows the details of the liquidation process as of February 1, 2011. Determine

the final balance of each partner's capital accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wormold Industries suffered a fire in its warehouse on March 4, 2021. The warehouse was fullof finished goods, and after reviewing the damage, management determined that inventory,with a retail selling price of $90,000, was not damaged by the fire.For the period from January 1, 2021, to March 4, 2021, accounting records showed thefollowing: Purchases $650,000Purchase returns 16,000Sales revenue 955,000 The inventory balance on January 1, 2021, was $275,000, and the company has historicallyearned a gross profit percentage of 35%.Required: Use the gross profit method to determine the cost of inventory damaged by the fire.arrow_forwardMartinez Corp. experienced a fire on December 31, 2020, in which its financial records were partially destroyed. It has been able to salvage some of the records and has ascertained the following balances. December 31, 2020 December 31, 2019 Cash $ 38,100 $ 11,100 Accounts receivable (net) 74,000 128,400 Inventory 204,600 183,400 Accounts payable 50,200 90,600 Notes payable 36,500 64,900 Common stock, $100 par 406,600 406,600 Retained earnings 120,000 106,300 Additional information: 1. The inventory turnover is 3.7 times. 2. The return on common stockholders’ equity is 19%. The company had no additional paid-in capital. 3. The receivables turnover is 11.8 times. 4. The return on assets is 19%. 5. Total assets at December 31, 2019, were $607,100. Compute the following for Martinez Corp.. (Round all answers to 0 decimal places, e.g. 2,150.) (a) Cost of goods sold for 2020. $ (b) Net credit…arrow_forwardOn April 10, 2023, a fire damaged the office and warehouse of Sill Company. Most of the accounting records were destroyed, but the following account balances were determined as of March 31, 2023: Sales Revenue (January 1-March 31, 2023), $180,000; Purchases (January 1- March 31, 2023), $94,000. The company's fiscal year ends on December 31. It uses a periodic inventory system. From an analysis of the April bank statement, you discover cancelled checks of $4,200 for cash purchases during the period April 1-10. Deposits during the same period totaled $18,500. Of that amount, 60% were collections on accounts receivable related to sales made in prior periods, and the balance was cash sales. Correspondence with the company's principal suppliers revealed $12,400 of purchases on account from April 1 to April 10. Of that amount, $1,600 was for merchandise in transit on April 10 that was shipped FOB destination. Correspondence with the company's principal customers produced acknowledgments of…arrow_forward

- In 2022, Sargent Company experienced a major casualty loss. The roof of its warehouse collapsed in an ice storm and destroyed its entire inventory. The company began the year with inventory of $300. It made purchases of $5,640 but returned $80 worth of merchandise. Sales prior to the ice storm were $9,400. Sargent must use the gross profit method to determine inventory on hand on the date of the casualty. The following is an excerpt of its income statement for the last three years. 2019 2020 2021 Net Sales $5,000 $6,000 $9,000 Cost of Goods Sold 2,150 2,340 3,312 General and Administrative Expense 500 600 900 Depreciation Expense 125 200 325 Operating Income $2,225 $2,860 $4,463 Requirement. Assume that Sargent uses the most recent three years of net sales and cost of goods sold to determine its historical gross profit. What are estimated cost of goods sold, estimated gross profit, and estimated ending…arrow_forwardABC Corporation lost most of its inventory in a fire on April 10, 2020. Its books disclose following data: Inventory, January 1, 2020 Purchases in 2020 Purchases returns Sales Sales returns Purchases discounts Rate of gross profit on sales S180,000 400,000 30,000 650,000 25,000 10,000 30% Through the diligence of the local Fire Department, ABC was able to salvage and merchandise costing $4,000. Required: Calculate the amount of the loss from the fire, to be presented as a claim to th company. Show your computations.arrow_forwardLate on the night of August 30, 2021, an arsonist destroyed the FAITHFUL Inc's warehouse which was full of inventory. The accounting records were stored in another facility and not destroyed in the fire. The company is in the process of filing a claim with its insurance company for the inventory loss due to the fire. Beginning inventory P350,500 Purchases through August 30, 2021 470,250 Net sales revenue through August 30, 2021 745,200 The gross profit percent has historically been 40% of net sales revenue. Estimate the value of the inventory destroyed in the fire using the gross profit method.arrow_forward

- The following transactions were completed by Emmanuel Company during the current fiscal year ended December 31: Jan. 29 Received 40% of the $17,000 balance owed by Jankovich Co., a bankrupt business, and wrote off the remainder as uncollectible. Apr. 18 Reinstated the account of Vince Karm, which had been written off in the preceding year as uncollectible. Journalized the receipt of $7,560 cash in full payment of Karm’s account. Aug. 9 Wrote off the $22,380 balance owed by Golden Stallion Co., which has no assets. Nov. 7 Reinstated the account of Wiley Co., which had been written off in the preceding year as uncollectible. Journalized the receipt of $13,220 cash in full payment of the account. Dec. 31 Wrote off the following accounts as uncollectible (one entry): Claire Moon Inc., $22,860; Jet Set Co., $15,320; Randall Distributors, $41,460; Harmonic Audio, $18,890. 31 Based on an analysis of the $2,740,000 of accounts receivable, it was estimated that $113,330 will…arrow_forwardOn November 21, 2024, a fire at Hodge Company’s warehouse caused severe damage to its entire inventory of Product Tex. Hodge estimates that all usable damaged goods can be sold for $26,000. The following information was available from the records of Hodge’s periodic inventory system: Inventory, November 1, 2024 $ 170,000 Net purchases from November 1, to the date of the fire 154,000 Net sales from November 1, to the date of the fire 234,000 Based on recent history, Hodge’s gross profit ratio on Product Tex is 40% of net sales. Required: Calculate the estimated loss on the inventory from the fire, using the gross profit method.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education