FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please don't give image format

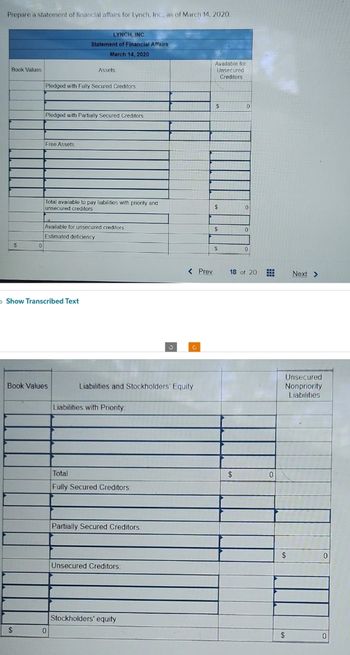

Transcribed Image Text:Prepare a statement of financial affairs for Lynch, Inc., as of March 14, 2020.

Book Values

$

0

$

Pledged with Fully Secured Creditors:

Free Assets:

Pledged with Partially Secured Creditors:

LYNCH, INC.

Statement of Financial Affairs

March 14, 2020

> Show Transcribed Text

Assets.

Total available to pay liabilities with priority and

unsecured creditors

Book Values

Available for unsecured creditors

Estimated deficiency

0

Liabilities and Stockholders' Equity

Liabilities with Priority:

Total

Fully Secured Creditors:

Partially Secured Creditors:

Unsecured Creditors:

< Prev

Stockholders' equity

Available for

Unsecured

Creditors

$

$

$

$

0

$

0

0

0

18 of 20

⠀

Unsecured

Nonpriority

Liabilities

$

Next >

$

0

0

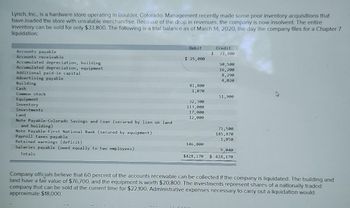

Transcribed Image Text:Lynch, Inc., is a hardware store operating in Boulder, Colorado. Management recently made some poor inventory acquisitions that

have loaded the store with unsalable merchandise. Because of the drop in revenues, the company is now insolvent. The entire

inventory can be sold for only $33,800. The following is a trial balance as of March 14, 2020, the day the company files for a Chapter 7

liquidation:

Accounts payable

Accounts receivable

Accumulated depreciation, building

Accumulated depreciation, equipment

Additional paid-in capital

Advertising payable.

Building

Cash

Common stock

Equipment

Inventory

Investments

Land

Note Payable Colorado Savings and Loan (secured by lien on land

and building)

Note Payable-First National Bank (secured by equipment)

Payroll taxes payable

Retained earnings (deficit)

Salaries payable (owed equally to two employees)

Totals

Debit

$ 25,000

81,800

1,070

32,300

113,000

17,000

12,000

146,000

$428,170

$

Credit

33,800

50,500

16,200

8,290

4,020

51,900

71,500

185,870

1,050

5,040

$ 428,170

Company officials believe that 60 percent of the accounts receivable can be collected if the company is liquidated. The building and

land have a fair value of $76,700, and the equipment is worth $20,800. The investments represent shares of a nationally traded

company that can be sold at the current time for $22,100. Administrative expenses necessary to carry out a liquidation would

approximate $18,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education