FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

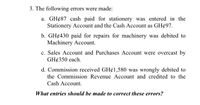

Transcribed Image Text:3. The following errors were made:

a. GH¢87 cash paid for stationery was entered in the

Stationery Account and the Cash Account as GH¢97.

b. GH¢430 paid for repairs for machinery was debited to

Machinery Account.

c. Sales Account and Purchases Account were overcast by

GH¢350 each.

d. Commission received GH¢1,580 was wrongly debited to

the Commission Revenue Account and credited to the

Cash Account.

What entries should be made to correct these errors?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ryan has a suspense account with a debit balance of $740. Upon investigation, the following discrepancies were found: (i) Discounts unexpectedly taken by customers of $229 have only been entered in the receivables control account (ii) Cash sales of $820 has not been recorded to the sales account, the cash has been debited to cash at bank (iii)Bank interest received of $54 has been debited to the interest income account and credited to the cash account. What is the balance on the suspense account after the errors have been corrected? DR or CR?arrow_forwardExercise 228 (Part Level Submission) The percentage of receivables approach to estimating bad debts expense is used by Oriole Company. On February 28 (the fiscal yearend), the firm had accounts receivable in the amount of $573,000 and Allowance for Doubtful Accounts had a credit balance of $1,850 before adjustment. Net credit sales for February amounted to $3,480,000. The credit manager estimated that uncollectible accounts would amount to 6% of accounts receivable. On March 10, an accounts receivable from Mark Dole for $2,100 was determined to be uncollectible and written off. However, on March 31, Dole received an inheritance and immediately paid his past due account in full. (a) Your answer is partially correct. Try again. Prepare the journal entries made by Oriole Company on the below dates: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) 1. February 28 2. March 10…arrow_forwardNoah and Olivia Anderson are a married couple in their early 20s living in Dallas. Noah Anderson earned $73,000 in 2018 from his job as a sales assistant. During the year, his employer withheld $4,975 for income tax purposes. In addition, the Andersons received interest of $350 on a joint savings account, $750 interest on tax-exempt municipal bonds, and dividends of $400 on common stocks. At the end of 2018, the Andersons sold two stocks, A and B. Stock A was sold for $700 and had been purchased four months earlier for $800. Stock B was sold for $1,500 and had been purchased three years earlier for $1,100. Their only child, Logan, age 2, received (as his sole source of income) dividends of $200 from Hershey stock. Although Noah is covered by his company’s pension plan, he plans to contribute $5,000 to a traditional deductible IRA for 2018. Here are the amounts of money paid out during the year by the Andersons: Medical and dental expenses (unreimbursed) $ 200State and local property…arrow_forward

- Ww.202.arrow_forwardPA1. LO 7.2 On June 30, Oscar Inc.'s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $2,820.76, but the accounts receivable subsidiary ledger shows total account balances of $2,220.76. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake? ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Account: Amazoon AR No. 246 Balance Date Item Ref. Debit Credit Debit Beginning Balance Payment 1,200.50 Apr. 5 CR 175 1200.50 0.00 Account: Cadberry AR No. 357 Balance Date Item Ref. Debit Credit Debit Beginning Balance Invoice 210 877.30 Apr. 8 SJ 123 300 1,177.30 Account: Hewlit Pickard AR No. 468 Balance Date Item Ref. Debit Credit Debit Beginning Balance 172.99 Apr. 28 Invoice 211 SJ 123 100 272.99 Account: Neatflicks inc. AR No. 579 Balance Date Item Ref. Debit Credit Debit Beginning Balance Payment 1,570.47 1,070.47 Apr. 6 Apr. 22 CR 175 500 Invoice 212 CJ 123 300 770.47arrow_forwardThe accountant for Kerns company mistakenly posted an expense amount as an asset in the general ledger. What is the financial statement impact of this error?arrow_forward

- E6-3 (Algo) Reporting Net Sales with Credit Sales, Sales Discounts, Sales Returns, and Credit Card Sales LO6-1 Bennett Retailers had the following transactions in November and December: November 20 November 25 November 28 November 29 Customer D returned one of the items purchased on the 28th; the item was defective and credit was given to the customer. December 6 Customer D paid the account balance in full. December 20 Customer B paid the November 20 invoice in full. Sold 20 items of merchandise to Customer B at an invoice price of $5,500 (total); terms 3/10, n/30. Sold two items of merchandise to Customer C, who charged the $600 (total) sales price on her Visa credit card. Visa charges Bennett Retailers a 3 percent credit card fee. Sold 10 identical items of merchandise to Customer D at an invoice price of $9,800 (total); terms 3/10, n/30. Required: Compute net sales for the two months ended December 31. Note: Do not round your intermediate calculations. Round your answer to the…arrow_forwardExercise 228 (Part Level Submission) The percentage of receivables approach to estimating bad debts expense is used by Oriole Company. On February 28 (the fiscal yearend), the firm had accounts receivable in the amount of $573,000 and Allowance for Doubtful Accounts had a credit balance of $1,850 before adjustment. Net credit sales for February amounted to $3,480,000. The credit manager estimated that uncollectible accounts would amount to 6% of accounts receivable. On March 10, an accounts receivable from Mark Dole for $2,100 was determined to be uncollectible and written off. However, on March 31, Dole received an inheritance and immediately paid his past due account in full. (a) Prepare the journal entries made by Oriole Company on the below dates: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) 1. February 28 2. March 10 3. March 31 Date Account Titles and…arrow_forwardThe total of a list of balances in Patricia Co’s receivables ledger was $643,700 on 30 September 20X9. This did not agree with the balance on Patricia Co’s receivables ledger control account. The following errors were discovered: (i) A credit balance on an individual customer’s account of $400 was incorrectly extracted as a debit balance (ii) An invoice for $3,553 was posted to the customer account as £3,535 (iii) The total of the sales returns day book was overcast by $600 What amount should be shown in Patricia Co’s statement of financial position for accounts receivable at 30 September 20X9? A. $642,918 B. $642,882 C. $644,482 D. $643,418arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education