ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

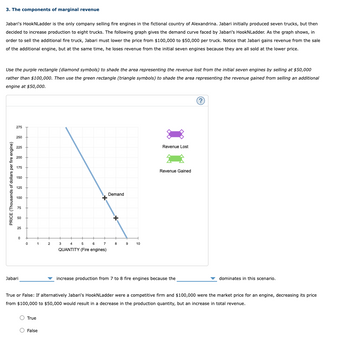

Transcribed Image Text:3. The components of marginal revenue

Jabari's HookNLadder is the only company selling fire engines in the fictional country of Alexandrina. Jabari initially produced seven trucks, but then

decided to increase production to eight trucks. The following graph gives the demand curve faced by Jabari's HookNLadder. As the graph shows, in

order to sell the additional fire truck, Jabari must lower the price from $100,000 to $50,000 per truck. Notice that Jabari gains revenue from the sale

of the additional engine, but at the same time, he loses revenue from the initial seven engines because they are all sold at the lower price.

Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial seven engines by selling at $50,000

rather than $100,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional

engine at $50,000.

PRICE (Thousands of dollars per fire engine)

275

250

225

200

175

150

125

100

75

50

25

0

Jabari

0 1

True

2

O False

3 4 5

6

7

QUANTITY (Fire engines)

Demand

++

8

9 10

Revenue Lost

Revenue Gained

increase production from 7 to 8 fire engines because the

(?)

True or False: If alternatively Jabari's HookNLadder were a competitive firm and $100,000 were the market price for an engine, decreasing its price

from $100,000 to $50,000 would result in a decrease in the production quantity, but an increase in total revenue.

dominates in this scenario.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. The market for EpiPens Consider the pharmaceutical company Mylan that produces epinephrine injection devices called EpiPens. In the presence of other firms producing substitutes for this good, the price of EpiPens is $150. Now suppose that competitors to Mylan no longer produce epinephrine injection devices, so Mylan now has pricing power in this market. As the economist on staff at Mylan, you are charged with the task of figuring out what your company's new pricing strategy should be. The following graph shows the marginal cost (MC), which is assumed to be constant, and the average total cost (ATC) of Mylan. The graph also shows the demand curve (D) for EpiPens and the marginal revenue curve (MR) once the firm has market power. On the graph, use the grey point (star symbol) to indicate the quantity of EpiPens demanded if Mylan continues to charge $150. Dashed drop lines will automatically extend to both axes. PRICE (Dollars per EpiPen) 1000 900 800 700 600 500 400 300 200 100 0 0 +…arrow_forwardhe company can produce the CD with no fixed cost and a variable cost of $5 per CD.a. Find total revenue for quantity equal to 10,000, 20,000, and so on. What is the marginal revenue for each 10,000 increase in the quantity sold?b. What quantity of CDs would maximize profit? What would the price be? What would the profit be?c. If you were Johnny's agent, what recording fee would you advise Johnny to demand from the record company? Why? Johnny Rockabilly has just finished recording his latest CD. His record company's marketing department determines that the demand for the CD is as follows:PriceNumber of CDs$2410,0002220,0002030,0001840,0001650,0001460,000The company can produce the CD with no fixed cost and a variable cost of $5 per CD.arrow_forwardIf Connecting U wants to MAXIMIZE its profits, what should they do? a) Connecting U should maintain their price at $16. Dropping the price would decrease their total revenue and profits. b)Connecting U should drop their price to $14.48. By dropping the price, they would increase their total revenue and profits. is the answer b? Note- look at the info on the right-hand side of the picarrow_forward

- Please, help me ASAP pleasearrow_forwardHersheypark in Pennsylvania mentions the following offer on its Web page: “A military discount is available at Hersheypark during the regular summer operating schedule off of the Regular, Junior and Senior One Day admission. This discount is available to active duty military, reserves, retired military personnel, and members of the National Guard.” This is _____ price discrimination.arrow_forwardThe graph below shows the Market conditions of Honey’s Laundry service, which is the only laundry in Arizon Residential Area. Considering the shop as a Monopoly market, answer the following questions: (a)In order to maximize profit, how many clothes does the shop clean?[Answer in numerical value only without any unit] (b)If the opening of five new laundries turns it into a perfectly competitive market, what should be the price Sunny’s laundry be charging now?[Answer in numerical value only without any unit] (c)Compute the change in total revenue between part a and part b.[Answer in numerical value only without any unit] Note: Bartleby does not accept more than 3 sub-parts, and here are no more than 3. Please solve all parts to get a 'like'. Thanksarrow_forward

- I just need help on c and darrow_forward1. There are two brands of cigarettes X, Y. The demand for each is as follows: Qx = 80 - 2p Qy = 60 - 0.5p Assume that the marginal cost of producing cigarette X is $10, the marginal cost of producing cigarette Y is $8, and that the market for both cigarettes is perfectly competitive. Assume that each pack of cigarette X smoked does $5 worth of health damage to the smoker, and a total of $4 worth of health damage to the smoker’s neighbors via second-hand smoke. Each pack of cigarette Y smoked does $6 worth of health damage to the smoker, and $5 health damage to the smoker’s neighbors. (a) Explain why the public supply curves differ from the private supply curves, and how this represents the externality from second-hand smoke. Highlight the area(s) of your diagram that represents a social loss. (b) Calculate the social loss for both. (c) Suppose the government decides to pursue a Pigouvian solution to eliminate social loss. What's amount of tax or subsidy would the government…arrow_forwardPlease provide answer in 1 hrarrow_forward

- Please read the following article from The Atlantic on the proliferation of price discrimination for online shopping https://goo.gl/EGFynW A.) The article notes that we are moving toward a situation in which perfect price discrimination is no longer “only a classroom thought experiment.” Suppose perfect price discrimination were to become a reality. What would this imply as far as consumer surplus, producer surplus, and market surplus in the market for online retail? B.) The article references a study showing that by using big data online firms are able to boost profits. When firms engage in price discrimination and experience an increase in profits, does this imply that consumers are made worse off as a result? Explain. C.) Do you agree with the author’s belief that the proliferation of price discrimination “makes suckers of us all”? Explain. D.) Do you consider the increased price discrimination in recent years as a net positive or a net negative to society? Explainarrow_forwardIndicate which of the following graphs accurately reflects Crest's demand curve, marginal-revenue (MR) curve, average-total-cost (ATC) curve, and marginal-cost (MC) curve. Price, Cest Revenue Demand X TRO MR ΘΑ OB Quantity of Crest Toothpaste Demand B A ATC MR Quantity of Crest Toothpastearrow_forwardPlease see the images of the article below and help answer questions. 1. Evaluate this statement: "Whereas a competitive firm must sell at the market price, a monopoly owns its market, so it can set its own prices. Since it has no competition, it produces at the quantity and price combination that maximizes its profits." Must a perfectly competitive firm sell at a market-clearing price? Alternatively, is the market-clearing price the profit-maximizing price that a competitive firm chooses to set? Can a monopolist set any (price, quantity) combination? 2. Evaluate this statement: "Monopolies drive progress because the promise of years or even decades of monopoly profits provides a powerful incentive to innovate. Then monopolies can keep innovating because profits enable them to make the long-term plans and finance the ambitious research projects that firms locked in competition can't dream of." Cite a counter-example to this claim in which deregulation of a monopolist led to lower…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education