ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

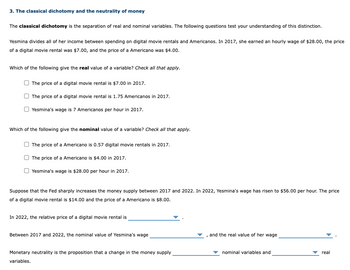

Transcribed Image Text:3. The classical dichotomy and the neutrality of money

The classical dichotomy is the separation of real and nominal variables. The following questions test your understanding of this distinction.

Yesmina divides all of her income between spending on digital movie rentals and Americanos. In 2017, she earned an hourly wage of $28.00, the price

of a digital movie rental was $7.00, and the price of a Americano was $4.00.

Which of the following give the real value of a variable? Check all that apply.

The price of a digital movie rental is $7.00 in 2017.

The price of a digital movie rental is 1.75 Americanos in 2017.

Yesmina's wage is 7 Americanos per hour in 2017.

Which of the following give the nominal value of a variable? Check all that apply.

The price of a Americano is 0.57 digital movie rentals in 2017.

The price of a Americano is $4.00 in 2017.

Yesmina's wage is $28.00 per hour in 2017.

Suppose that the Fed sharply increases the money supply between 2017 and 2022. In 2022, Yesmina's wage has risen to $56.00 per hour. The price

of a digital movie rental is $14.00 and the price of a Americano is $8.00.

In 2022, the relative price of a digital movie rental is

Between 2017 and 2022, the nominal value of Yesmina's wage

Monetary neutrality is the proposition that a change in the money supply

variables.

and the real value of her wage

nominal variables and

real

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. The classical dichotomy and the neutrality of money The classical dichotomy is the separation of real and nominal variables. The following questions test your understanding of this distinction. Poornima spends all of her money on magazines and donuts. In 2015, she earned $27.00 per hour, the price of a magazine was $9.00, and the price of a donut was $3.00. Which of the following give the nominal value of a variable? Check all that apply. O The price of a donut is $3.00 in 2015. O Poornima's wage is $27.00 per hour in 2015. O The price of a donut is 0.33 magazines in 2015. Which of the following give the real value of a variable? Check all that apply. O The price of a magazine is 3 donuts in 2015. O Poornima's wage is 9 donuts per hour in 2015. O The price of a magazine is $9.00 in 2015. Suppose that the Fed sharply increases the money supply between 2015 and 2020. In 2020, Poornima's wage has risen to $54.00 per hour. The price of a magazine is $18.00 and the price of a donut is…arrow_forward2. How does a very high rate of inflation affect individual spending and saving? Explain your answer.arrow_forwardE3arrow_forward

- What is the demand for money? When the nominal interest rate rises, does the opportunity cost of holding money increase or decrease? Does the quantity of money demanded increase or decrease? The demand for money is the relationship between the quantity of money demanded and the _______ when all other influences on the amount of money that people wish to hold remain the same. A. price of bonds B. real interest rate C. inflation rate D. nominal interest rate When the nominal interest rate rises, the opportunity cost of holding money _______ and the quantity of money demanded _______. A. falls; increases B. rises; decreases C. falls; decreases D. rises; increasesarrow_forwardQ47 Which of the following is the definition for the real supply of money? Select one: a. the actual quantity of money, rather than the officially reported quantity. b. the stock of high powered money only. c. the ratio of the real GDP to the nominal money supply. d. the stock of money measured in terms of goods, not dollars.arrow_forwardNonearrow_forward

- Figure 31-3 On the following graph, MS represents the money supply and MD represents money demand. VALUE OF MONEY 0.6 0.45 5000 MS. MS. 9000 QUANTITY OF MONEY MO Refer to Figure 31-3. At the end of the first year, the relevant money-supply curve was the one labeled MS]. At the end of the second year, the relevant money-supply curve was the one labeled MS2. Assuming the economy is always in equilibrium, what was the economy's approximate inflation rate for the second year? 8.3 percent -33 percent 33 percent -25 percentarrow_forwardplease do not copy and paste from internet, thanksarrow_forwardQUESTION 3 When a customer takes cash from a drawer in his home and deposits it into his saving account, the composition of the money supply will change immediately and the size of the money supply may eventually change. Illustrate and explain the process by which this action may change the money supply in economy. ***END OF QUESTION PAPER*** States) E Accessibility: Investigatearrow_forward

- I need help with this questionarrow_forwardTyped plzzzarrow_forwardWhat effect does inflation have on the purchasing power of money? A. It increases the purchasing power of money. B. It decreases the purchasing power of money. C. It has no effect on the purchasing power of money. D. It initially decreases but then increases the purchasing power of money over time.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education