Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

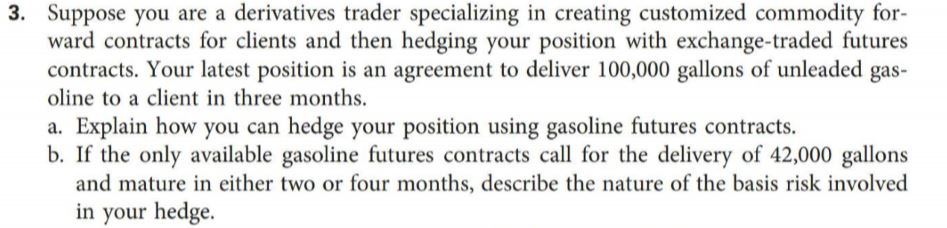

Transcribed Image Text:3. Suppose you are a derivatives trader specializing in creating customized commodity for-

ward contracts for clients and then hedging your position with exchange-traded futures

contracts. Your latest position is an agreement to deliver 100,000 gallons of unleaded gas-

oline to a client in three months.

a. Explain how you can hedge your position using gasoline futures contracts.

b. If the only available gasoline futures contracts call for the delivery of 42,000 gallons

and mature in either two or four months, describe the nature of the basis risk involved

in your hedge.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- June 2019 Mexican peso futures contract has a price of $0.05197 per MXN. You believe the spot price in June will be 0.05831 per MXN a. What speculative position would you enter into to attempt to profit from your beliefs? O Short position O Long Position b. Calculate your anticipated profits, assuming you take a position in three contracts. (Do not round intermediate calculations. Round your answer to the nearest whole number.) Anticipated profit c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number)arrow_forwardMHF believes the price of Amazon is going to fall substantially over the next 8 months. MHF uses an option (use the January 2024 contract with an exercise price of $95) to hedge the risk as it owns 10 million shares of Amazon. It will hedge exactly 50% of its position. Identify the type of option most likely used. Show the total position (please put this in a table) of the spot and derivative at expiration if the price of Amazon at expiration is a) $62; b) $77; c) $93; d) $112; e) $128. Only typed answerarrow_forwardClarke plans to satisfy cash needs in nine months by selling its Treasury bond holdings for $4 million. However, Clarke is concerned that interest rates might increase over the next three months. To hedge against this possibility, Clarke plans to sell Treasury bond futures. Thus, Clarke sells futures contract for a price of 99-12. Assuming that the actual price of the futures contract declined to 97-20, Clarke would make a of $___. from closing out the futures position. a. b. C. d. e. -——— 40; profit; $76,800 40; loss; $76,800 50; profit; $70,000 40; profit; $70,000 none of the abovearrow_forward

- Please answer it with no descriptions or details, with the question numbers and answers, the exact way it should go on according to the red regulations, thank you!arrow_forward9) This is an exercise about financial futures. Can you please check the picture and answer the question? Only one option is right (A, B, C, or D).arrow_forwardJune 2021 Mexican peso futures contract has a price of $0.05194 per MXN. You believe the spot price in June will be $0.04525 per MXN. Required: a. What speculative position would you enter into to attempt to profit from your beliefs? b. Calculate your anticipated profits, assuming you take a position in three contracts. c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate your anticipated profits, assuming you take a position in three contracts. Note: Do not round intermediate calculations. Round your answer to the nearest whole number. Anticipated profitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education