A development corporation purchased land that will be the site of a new luxury condominium complex. Management is considering a six month

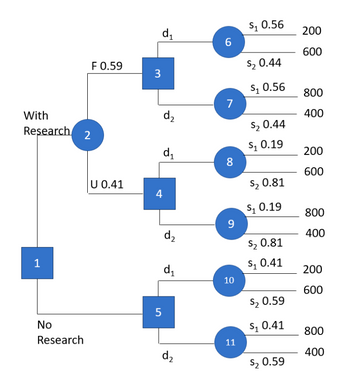

1. Favorable report (F): A significant number of the individuals contacted express interest in purchasing a condominium.

2. Unfavorable report (U): Very few of the individuals contacted express interest in purchasing a condo- minium.

After deciding whether to conduct the market research study, they have the following two decision alternatives.

d1 = a small complex with 30 condominiums

d2 = a medium complex with 60 condominiums

Following this, a chance event concerning the

s2 = weak demand for the condominiums

The payoffs, probabilities, and decision tree associated with this problem are given on the next page.

Note that payoffs are given in thousands of dollars.

Step by stepSolved in 3 steps with 1 images

- Which alternative would you recommend to the client? Why? (select all that apply) Question 4 options: Break-bulk, because it is less expensive FCL, because it is less expensive Break-bulk because there is better schedule availability by general cargo ship from New York to Chile than by container ships from the west coast ports to Chile. Break-bulk, because it can provide better protection for this heavy machinery It comes to the alternative with the best schedule as this equipment needs to be in Chile by a specified date.arrow_forward1. The table below presents hypothetical OLS results with used small SUV price information (in dollars) as the dependent variable. Assume that the model is correctly specified and a significance level (p-value) of 0.05. Variable Coefficient P-Value Constant 10,000 0.001 SUV is in Good Condition (GC) 1,000 0.030 SUV is Green (GRN) 500 0.040 Miles on the SUV (MGE) -0.005 0.019 Age of the SUV (AGE) -200 0.007 SUV has a Sunroof (SUN) 400 0.045 The number of miles on the SUV and the age in years of the SUV are continuous variables. The rest of the variables are dummy variables. a. Write the predictive equation for the price of small used SUVs in this market. b. According to this model, what is the predicted price of a 6 year old blue SUV in poor condition with 80,000 miles on it and no sunroof? c. According to this model, what is the predicted price of an 8 year old green SUV in good condition with only 30,000 miles on it and a sunroof?arrow_forwardQuestion: Common stock value – All growth models. Personal Finance Problem. You are evaluating thepotential purchase of a small business currently generating $40,000 of after-tax cash flow. Thecompany has $25,000 of Preferred Stock and $150,000 of debt.(FCF0 = $40,000). On the basis of a review of similar-risk investment opportunities, you must earn arate of return of Common stock value – All growth models. Personal Finance Problem. You are evaluating thepotential purchase of a small business currently generating $40,000 of after-tax cash flow. Thecompany has $25,000 of Preferred Stock and $150,000 of debt.(FCF0 = $40,000). On the basis of a review of similar-risk investment opportunities, you must earn arate of return of 9% on the proposed purchase. Because you are relatively uncertain about future cashflows, you decide to estimate the firm’s common stock value using three possible assumptions aboutthe growth rate of cash flows. 1. What is the firm's value if cash flows are expected…arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education