FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

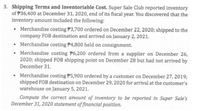

Transcribed Image Text:3. Shipping Terms and Inventoriable Cost. Super Sale Club reported inventory

of P36,400 at December 31, 2020, end of its fiscal year. You discovered that the

inventory amount included the following:

• Merchandise costing P3,700 ordered on December 22, 2020; shipped to the

company FOB destination and arrived on January 2, 2021.

• Merchandise costing P4,800 held on consignment.

• Merchandise costing P6,200 ordered from a supplier on December 26,

2020; shipped FOB shipping point on December 28 but had not arrived by

December 31.

• Merchandise costing P5,900 ordered by a customer on December 27, 2019;

shipped FOB destination on December 29, 2020 for arrival at the customer's

warehouse on January 5, 2021.

Compute the correct amount of inventory to be reported in Super Sale's

December 31, 2020 statement of financial position.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have the following information for Van Gogh Inc. for the month ended October 31, 2025.Van Gogh uses a periodic method for inventory. Date Description Units unit cost Selling price per unit 1-Oct Beginning inventory 60 $24 9-Oct Purchase 120 $26 11-Oct Sale 100 $35 17-Oct Purchase 100 $27 22-Oct Sale 60 $40 25-Oct Purchase 70 $29 29-Oct Sale 110 $40 1. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profitrate under LIFO.2. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profit rateunder FIFO.3. Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profit rateunder Average-cost (round cost per unit to three decimal places.) Please dont provide solution image based thankuarrow_forwardThe following data are available for Sellco for the fiscal year ended on January 31, 2020: Sales 830 units Beginning inventory 230 units @ $ 4 Purchases, in chronological order 290 units @ $ 5 450 units @ $ 7 250 units @ $ 7 Required:a. Calculate cost of goods sold and ending inventory under the cost flow assumptions, FIFO, LIFO and Weighted average (using a periodic inventory system): (Round unit cost to 2 decimal places.) b. Assume that net income using the weighted-average cost flow assumption is $15,300. Calculate net income under FIFO and LIFO. (Round unit cost to 2 decimal places.)arrow_forwardYou have the following information for Bramble Inc. for the month ended October 31, 2022. Bramble uses a periodic method for inventory. Date Description Units Unit Cost or Selling Price Oct. 1 Beginning inventory 54 $23 Oct. 9 Purchase 132 25 Oct. 11 Sale 108 34 Oct. 17 Purchase 103 26 Oct. 22 Sale 55 39 Oct. 25 Purchase 65 28 Oct. 29 Sale 121 39arrow_forward

- 1. Wards’ inventories are determined using FIFO (periodic). Wards provided the following information for thefirst quarter of 2019: Beginning inventory, January 1, 2019 60 units @ $63.00 (1) Purchase 40 units @ $56.25 (2) Purchase 95 units @ $66.00 (3) Purchase 30 units @ $64.50 Ending inventory, March 31, 2019 45 nitsa) Compute the company’s cost of goods sold for the first quarter.b) Compute the ending inventory to be reported on Wards’ balance sheet at March 31, 2019.arrow_forwardUse the following information (M) from Marvel Company for the month of July to answer the question: Perpetual: Assume that Marvel uses a perpetual FIFO inventory system. What is the dollar value of its ending inventory?arrow_forward1. Calculate January's ending inventory and cost of goods sold for the month using FIFO, periodic system.arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardRequired information [The following information applies to the questions displayed below.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug. 1 Inventory on hand-3,600 units; cost $7.70 each. 8 Purchased 18,000 units for $7.10 each. 14 Sold 14, 400 units for $13.60 each. 18 Purchased 10,800 units for $6.60 each. 25 Sold 13,400 units for $12.60 each. 28 Purchased 5,600 units for $5.80 each. 31 Inventory on hand-10,200 units. Required: 1. Using calculations based on a perpetual inventory system, determine the inventory Balance Altira would report in its August 31, 2021, palance sheet and the cost of goods sold it would report in its August 2021 income statement using the FIFO method. Cost of Goods Sold - August 25 Inventory Balance Cost of Goods Available for Sale Cost of Goods Sold - August 14 Cost of Goods # of units in Cost per End # of units sold Total Cost of Goods Sold Perpetual FIFO: Cost per unit Cost…arrow_forwardRequired information [The following information applies to the questions displayed below.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand—3,700 units; cost $7.80 each. 8 Purchased 18,500 units for $7.20 each. 14 Sold 14,800 units for $13.70 each. 18 Purchased 11,100 units for $6.40 each. 25 Sold 13,800 units for $12.70 each. 28 Purchased 5,700 units for $5.80 each. 31 Inventory on hand—10,400 units. Required:1. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the FIFO method.arrow_forward

- Please help with Question Barrow_forwardPlease help mearrow_forwardThe Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2023. Beginning Feb. 10 Aug. 21 640 units @ $75/unit 350 units @ $72/unit 230 units @ $85/unit Stilton Company has two credit sales during the period. The units have a selling price of $135 per unit. Sales Mar. 15 430 units Sept. 10 335 units Stilton Company uses a perpetual inventory system. Required: 1. Calculate the dollar value of cost of goods sold and ending inventory using: (Do not round intermediate calculations. Round "Average cost per unit" to 2 decimal places. Round the final answers to 2 decimal places.) Ending Inventory Cost of Goods Sold a FIFO b. Moving weighted averagearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education