FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

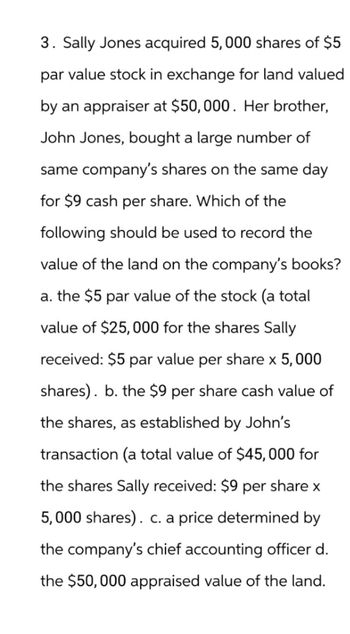

Transcribed Image Text:3. Sally Jones acquired 5,000 shares of $5

par value stock in exchange for land valued

by an appraiser at $50,000. Her brother,

John Jones, bought a large number of

same company's shares on the same day

for $9 cash per share. Which of the

following should be used to record the

value of the land on the company's books?

a. the $5 par value of the stock (a total

value of $25,000 for the shares Sally

received: $5 par value per share x 5,000

shares). b. the $9 per share cash value of

the shares, as established by John's

transaction (a total value of $45,000 for

the shares Sally received: $9 per share x

5,000 shares). c. a price determined by

the company's chief accounting officer d.

the $50,000 appraised value of the land.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Shetland Corporation, a C corporation, has E&P of $1,000,000. The corporation stock is held as follows: Matthew 1,000 shares Aaron 1,000 shares Fay 1,000 shares Marlyebone Partnership 1,000 shares Devon Corp. 1,000 shares Total Shares 5,000 shares Matthew would like to redeem 500 shares of stock. The fair market value of the stock is $200,000. Matthew acquired the stock 10 years ago and has a basis of $200/share in her stock. Note: Since Shetland Corporation is not traded on an exchange, Matthew does not have the option for selling his stock on an open market. Here is additional information about Shetland Corporation: · Aaron is Matthew’s first cousin · Fay is Matthew’s mother · Matthew owns 10% of Marlyebone Partnership · Matthew owns 20% of the shares in Devon Corporation a. Will this redemption of 500 shares of Matthew’s stock be treated as a qualified stock redemption or will it be treated as a distribution? Support your answer with calculations. b. How much tax must…arrow_forwardSarah and James Hernandez purchased 220 shares of Macy's stock at $39 a share. One year later, they sold the stock for $75.00 a share. They paid a broker a commision of $8 when they purchased the stock and a commision of $12 when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.75 a share. Calculate the Hernandez total return for this investment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Total returnarrow_forwardam. 253.arrow_forward

- 5. Warren Peace passed away, with his will leaving the bulk of all his worldly possessions to his friend Leo. The following transactions occurred with respect to Warren's estate. 1. Warren's estate inventory included 10,000 shares of Newberry Industries, selling at the time of Warren's death at $56 per share. There were no outstanding dividends at the time Warren died, but two weeks later, a $1.00 per share dividend was declared. 2. Warren only designated one item that was not to be left to Leo. Warren's family had a signed, first-edition copy of a classic novel that was valued and included in the estate inventory at $67,000, which Warren left to the local library. The book is located and delivered. 3. Funeral expenses are paid in the amount of $7,880. 4. A statement comes from the insurance company indicating there are multiple charges from Warren's final hospital stay that will not be covered and are the responsibility of the estate. These fees amount to $39,000 and were not…arrow_forwardWanda Sotheby purchased 170 shares of Home Depot stock at $150 a share. One year later, she sold the stock for $55 a share. She paid her broker a commission of $44 when she purchased the stock and a commission of $51 when she sold it. During the 12 months she owned the stock, she received $138 in dividends. Calculate Wanda’s total return on this investment.arrow_forward6. Brian owns 25% of Raisman Corporation's single class of stock (Brian owns 500 of 2,000 outstanding shares). Brian's basis in the stock is $12,000. Raisman's E&P is $132,000. If Raisman redeems 200 of Brian's stock for $28,000, Brian must report dividend income (if any) of (show all work and explain your answer): A) $0. B) $11,200. C) $16,800. D) $28,000.arrow_forward

- Miss Wells has purchased the shares of two companies over the years. Each company has only one class of shares. Purchases and sales of shares in the first of these companies, Memo Inc., are as follows: February, 2015 purchase November, 2016 purchase April, 2017 purchase October, 2017 sale September, 2019 purchase November, 2019 sale 60 @ $24 90 @ 28 45 @ 30 (68) @ 36 22 @ 26 (53) @ 40 Purchases and sales of shares in the second company, Demo Ltd., are as follows: April, 2018 purchase December, 2018 purchase July, 2019 sale $24 160 @ (260) @ 36 200 33 Required: A. Determine the cost to Miss Wells of the Memo Inc. shares that are still being held on December 31, 2019. B. Determine the taxable capital gain resulting from the July, 2019 disposition of the Demo Ltd. shares.arrow_forwardAn investor purchases 1,000 shares of XYZ Corp. @ $20. A year later, she sells the shares for $26. During the year, she had collected total dividends of $1.50. What percentage return did the investor earn?arrow_forwardTammy Jackson purchased 109 shares of All-American Manufacturing Company stock at $33.60 a share. One year later, she sold the stock for $41 a share. She paid her broker a $35 commission when she purchased the stock and a $43 commission when she sold it. During the 12 months she owned the stock, she received $198 in dividends. Calculate Tammy's total return on this investment. Note: Round all intermediate calculations and final answer to the nearest whole number. Total returnarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education