Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

maria purchased 1,000 shares of stock for 35.50 per share in 2003. she sold them in 2007 for $55.10 per share.

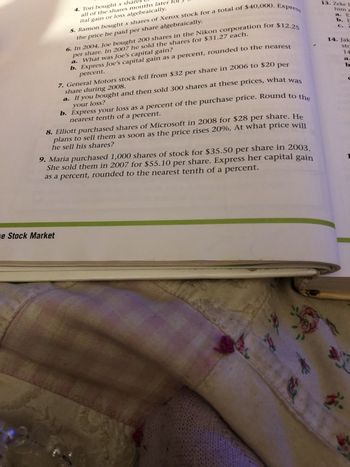

Transcribed Image Text:5. Ramon bought x shares of Xerox stock for a total of $40,000. Express

the

price he paid per share algebraically.

4. Tori bought x share

all of the shares months later

ital gain or loss algebraically.

e Stock Market

6. In 2004, Joe bought 200 shares in the Nikon corporation for $12.25

per share. In 2007 he sold the shares for $31.27 each.

a.

What was Joe's capital gain?

b. Express Joe's capital gain as a percent, rounded to the nearest

percent.

7. General Motors stock fell from $32 per share in 2006 to $20 per

share during 2008.

a. If you bought and then sold 300 shares at these prices, what was

your loss?

b. Express your loss as a percent of the purchase price. Round to the

nearest tenth of a percent.

8. Elliott purchased shares of Microsoft in 2008 for $28 per share. He

plans to sell them as soon as the price rises 20%. At what price will

he sell his shares?

9. Maria purchased 1,000 shares of stock for $35.50 per share in 2003.

She sold them in 2007 for $55.10 per share. Express her capital gain

as a percent, rounded to the nearest tenth of a percent.

d

F

13. Zeke B

him a

a. E

b. E

c. 7

14. Jak

stc

14

a.

b

X

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Tom recently received 2,000 shares of restricted stock from his employer, Independence Corporation, when the share price was $10 per share. Tom's restricted shares vested three years later when the market price was $14. Tom held the shares for a little more than a year and sold them when the market price was $20. What is the amount of Tom's income or loss on the vesting date?arrow_forwardClaire purchased 200 common shares of Clairco Ltd. in 2015 for $100. It is now 2017 and Claire would like to step down from running the company full time and let her child, Junior, take over. Junior's conditions are that they want to own a share of the company if they're going to be running it, though Claire doesn't think they're up to making all the decisions just yet. Claire believes the company is probably worth $2,000,000. She plans to use Section 86 for the restructuring. She'd like $50,000 in income each year in her retirement. List the characteristics Claire's shares after the restructuring should have. Please list at least 3 characteristics, and at least 2 should be unique to her.arrow_forwardRyan Neal bought 1,400 shares of Ford at $15.92 per share. Assume a commission of 2% of the purchase price. Ryan sells the stock for $20.23 with the same 2% commission rate. What is the gain or loss for Ryan?arrow_forward

- Penny owns 501 shares of Mack Co. They have an adjusted cost base of $15.6 per share. On March 31, 2020, Penny sold all of her shares for $13.21 per share. After she sold the shares, the price fell further and on April 15, 2020, Penny purchased 263 of the same class of shares of Mack Co. for $10.67 per share. She was still holding all of the shares at the end of 2020. What is the adjusted cost base of the Mack Co shares Penny holds at the end of 2020?arrow_forwardMaggie owns 100 shares of FloorMart, Inc. The firm pays a semi-annual dividend of $0.75 per share and offers the option to reinvest the cash dividends into additional shares of company stock. If the stock is selling for $55.00 per share, how many shares of stock will Maggie receive each dividend period if she chooses the dividend reinvestment plan?arrow_forwardMari owns 500 shares of stock work $5000. This year she received 100 additional shares of this stock from stock dividend. Her 600 shares are now worth $6,250. Must Mari include the dividend in stock in income?arrow_forward

- please see attached problemarrow_forwardPeter, Brian and Marc, three brothers, were co-owners of Bug-Zappers Inc. They each owned 1,000 shares in the business. Their adjusted cost base was $22 per share. After several years of success, their stock had increased in value to $34 per share, and they decided to execute a cross-purchase buy-sell agreement. In that agreement, they specified a fixed purchase price of $30 per share. This year, Marc died. At the time of his death, his shares were worth $40 each. Peter and Brian purchased his shares from his estate in accordance with the buy-sell agreement. What amount of taxable capital gain will be reported on Marc's final tax return?arrow_forwardJane Ramos owned stock with a cost of $200,000. The stock has a market value on Jane's date of death of $375,000. The stock was willed to Jane's niece Jenny. Which of the following is true? a. Jenny's basis is $200,000; the stock's value in the gross estate is $100,000. b. Jenny's basis is $375,000; the stock's value in the gross estate is $100,000. c. Jenny's basis is $200,000; the stock's value in the gross estate is $375,000. d. Jenny's basis is $375,000; the stock's value in the gross estate is $375,000.arrow_forward

- Rafael purchased 100 shares of corporate stock 7 years ago for $32 a share plus brokerage fees totaling $90. He received quarterly dividends of 40 cents per share. Nathan just sold the stock, immediately after receiving the 28th quarterly dividend, for $41.42 per share less brokerage fees totaling $125. Calculate Rafael's rate of return.arrow_forwardJohn Dufresne purchased 100 shares of Louisiana Power and Light on January 3, 2004 at a total cost of $1,983. On December 29, 2005, he sold these shares and netted $2,689, after commissions. Mr. Dufresne has a marginal tax rate of 25% and an average tax rate of 17%. To the nearest dollar, what is the effect on Marty's tax bill from the sale of these shares? A. $0.00 OB. $177 OC. $106 D. $120arrow_forwardBrett bought 210 shares of stock for $55.70 per share. He sold them 7 months later for $76.34 per share. What was his capital gain?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education