FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3.

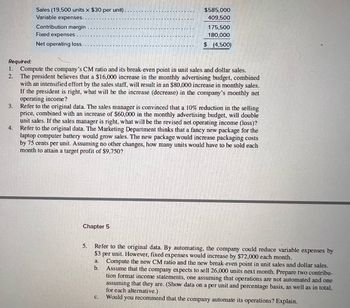

Sales (19,500 units x $30 per unit).

Variable expenses.

Contribution margin

Fixed expenses.

Net operating loss.

4.

Required:

2.

1. Compute the company's CM ratio and its break-even point in unit sales and dollar sales.

The president believes that a $16,000 increase in the monthly advertising budget, combined

with an intensified effort by the sales staff, will result in an $80,000 increase in monthly sales.

If the president is right, what will be the increase (decrease) in the company's monthly net

operating income?

$585,000

409,500

Chapter 5

175,500

180,000

$ (4,500)

Refer to the original data. The sales manager is convinced that a 10% reduction in the selling

price, combined with an increase of $60,000 in the monthly advertising budget, will double

unit sales. If the sales manager is right, what will be the revised net operating income (loss)?

Refer to the original data. The Marketing Department thinks that a fancy new package for the

laptop computer battery would grow sales. The new package would increase packaging costs

by 75 cents per unit. Assuming no other changes, how many units would have to be sold each

month to attain a target profit of $9,750?

5.

Refer to the original data. By automating, the company could reduce variable expenses by

$3 per unit. However, fixed expenses would increase by $72,000 each month.

b.

a. Compute the new CM ratio and the new break-even point in unit sales and dollar sales.

Assume that the company expects to sell 26,000 units next month. Prepare two contribu-

tion format income statements, one assuming that operations are not automated and one

assuming that they are. (Show data on a per unit and percentage basis, as well as in total,

for each alternative.)

C. Would you recommend that the company automate its operations? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The following data are taken from an unadjusted trial balance at December 31, 2015: $ 600 Prepaid Rent Office Supplies Income Taxes Payable Unearned Commissions 700 -0- 1,500 Salaries Expense 5,000 Additional Information: (a) The prepaid rent consisted of a payment for three months' rent at $200 per month for Decem- ber 2015, January 2016, and February 2016. (b) Office supplies on hand at December 31, 2015 amounted to $300. (c) The estimated income taxes for 2015 are $5,000. (d) All but $500 in the Unearned Commissions account has been earned in 2015. (e) Salaries for the last three days of December amounting to $300 have not yet been recorded. Required: a. Prepare all necessary adjusting entries in general journal format. b. Calculate the cumulative financial impact on assets, liabilities, equity, revenue and expense if these adjusting entries are not made.arrow_forwardData concerning Wislocki Corporation's single product appear below: Selling price Variable expenses Contribution margin Per Unit Percent of Sales $ 150 36 100% 24% $ 114 76% Fixed expenses are $1,042,000 per month. The company is currently selling 9,700 units per month. Required: The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $12 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $104,000 per month. The marketing manager predicts that introducing this sales incentive would increase monthly sales by 330 units. What should be the overall effect on the company's monthly net operating income of this change? Change in net operating incomearrow_forwardData for Hermann Corporation are shown below: (See image attached) Fixed expenses are $87,000 per month and the company is selling 2,900 units per month. Required: 1-a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,200 and monthly sales increase by $20,250? 1-b. Should the advertising budget be increased?arrow_forward

- Break-Even Units and Sales Revenue: Margin of Safety Dupli-Pro Copy Shop provides photocopying service. Next year, Dupli-Pro estimates it will copy 2,890,000 pages at a price of $0.06 each in the coming year. Product costs include: Direct materials Direct labor Variable overhead Total fixed overhead $0.009 $0.003 $0.001 $84,320 There is no variable selling expense; fixed selling and administrative expenses total $36,000.arrow_forward1. If Department B is able to reduce its operating assets by $100,000, Department B's new ROI would be 2. If Department A is able to increase its controllable margin by $60,000 as a result of reducing variable costs, Department A's new ROI would bearrow_forwardHelp me solve the requirement belowarrow_forward

- Diamond, Inc.'s most recent contribution margin income statement shows the following: Sales @ $10 per unit Less: Variable expenses Contribution margin Less: Fixed expenses Operating income (loss) $160,000 (120,000) $ 40,000 (50,000) $ (10,000) If Diamond, Inc's advertising costs increased by $5,000, by how much would sales have to increase for the company to achieve an operating income of $4,000? a. $56,000 Ob. $42,000 c. $76,000 Od. $18,000arrow_forward1.) refer to the original data. Compute the company's margin of safety in both dollar and percentage terms ? 2.) what is the company's cm ratio? If he company can sell more units thereby increasing sales by $84000 per month and there is no change in fixed expense, by how much would you expect monthly net operating income to increase?arrow_forwardDiamond, Inc.'s most recent contribution margin income statement shows the following: Sales @ $10 per unit Less: Variable expenses Contribution margin Less: Fixed expenses Operating income (loss) $160,000 (120,000) $ 40,000 (50,000) $ (10,000) If Diamond, Inc's advertising costs increased by $5,000, by how much would sales have to increase for the company to achieve an operating income of $4,000? a. $56,000 b. $42,000 c. $76,000 Od. $18,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education