FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

This is US Tax and Law

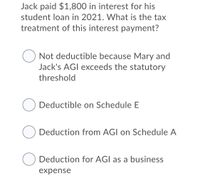

Transcribed Image Text:Jack paid $1,800 in interest for his

student loan in 2021. What is the tax

treatment of this interest payment?

Not deductible because Mary and

Jack's AGI exceeds the statutory

threshold

Deductible on Schedule E

Deduction from AGI on Schedule A

O Deduction for AGI as a business

expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Establishes the tax differences between individuals and corporations in the United States. 2. Explains Form M-1 and what it is used for. 3. Explains Form 1125-A and what it is used for.arrow_forwardWhat are some ways taxpayers can stay up to date on the federal, state and local tax laws applicable to them?arrow_forwardBriefly explain what factors significantly affect tax avoidancearrow_forward

- How are foreign branch income and foreign subsidiary income taxed differently be the United States?arrow_forwardWhy does the United States negotiate income tax treaties with other countries?arrow_forwardFor an individual taxpayer in the United States, what benefit is provided by the foreign earned income exclusion?arrow_forward

- The current federal income tax structure is progressive in nature. First, explain what that means. Second, regarding the proposal for a "flat tax", comment on both justification for and major obstacles to enactment.arrow_forwarddetermine how oil and gas companies in the United States calculate their depletion expense for U.S. income tax purposes. How does this tax practice compare to U.S. GAAP?arrow_forwardWhich of the following statements are correct? i. A tax is a statutory obligation that is imposed by an act of parliament in a country. ii. A tax is any deduction taken from a person’s salary by the government. iii. Taxation is the major source of government income. iv. Direct and indirect taxes are the two broad categories of taxation.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education