FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

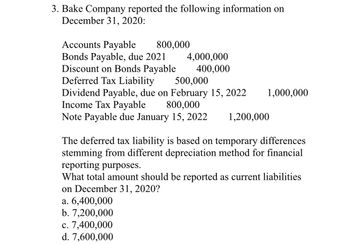

Transcribed Image Text:3. Bake Company reported the following information on

December 31, 2020:

Accounts Payable 800,000

Bonds Payable, due 2021

Discount on Bonds Payable

Deferred Tax Liability

4,000,000

400,000

500,000

Dividend Payable, due on February 15, 2022 1,000,000

Income Tax Payable 800,000

Note Payable due January 15, 2022 1,200,000

The deferred tax liability is based on temporary differences

stemming from different depreciation method for financial

reporting purposes.

What total amount should be reported as current liabilities

on December 31, 2020?

a. 6,400,000

b. 7,200,000

c. 7,400,000

d. 7,600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2025 Vaughn Corporation had pretax financial income of $185,000 and taxable income of $117,000. The difference is due to the use of different depreciation methods for tax and accounting purposes. The effective tax rate is 30%. Compute the amount to be reported as income taxes payable at December 31, 2025arrow_forwardMarrow_forwardThe pretax financial income (or Loss) figures for Limerick co. are as follows: 2017 83,000 2018 (53,000) 2019 (36,000) 2020 115,000 2021 104,000 Pretax financial income( or loss) and taxable income(loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years. Prepare the journal entires for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforward. All income and losses relate to normal operations (in recording the benefits of a loss carryforward assume that no valuation account is deemed necessary.arrow_forward

- Coronado Corporation, a private company, began operations on January 1, 2020. During its first three years of operations. Coronado reported net income and declared dividends as follows: 2020 2021 2022 Net income $50,000 130,000 151,000 Dividends declared Effective tax rate $0 50,000 The following information is for 2023: 50,000 Income before income tax Correction of prior period error: understatement of 2021 depreciation expense (before tax) Cumulative increase in prior years' income from change in inventory method (before tax) Dividends declared (of this amount, $25,000 will be paid on January 15, 2024) $320,000 Coronado Corporation Statement of Retained Earnings 35,000 45,000 100.000 40% Prepare a 2023 statement of retained earnings for Coronado. The company follows ASPE. (List items that increase retained earnings first after adjusted balance. Enter negative amounts using either o negative sign preceding the number e.g. -45 or parentheses e.g. (45).)arrow_forwardMallock Incorporated reports net operating income (loss) for financial reporting and tax purposes in each year as follows ($ in thousands): D Mallock's federal tax rate decreased from 35% to 21% starting in 2018. Mallock accounts for its 2020 NOL under the CARES Act. Required: 1. Prepare the appropriate journal entry to record Mallock's 2020 income taxes. 2. Show the lower portion of the 2020 income statement that reports income tax expense or benefit. 2016 $ 160 2017 $ 50 2018 $ 0 2019 $ 0 2020 $ (240)arrow_forwardShierling Ltd. reported pre-tax accounting income of $750,000 for calendar 2023. To calculate the income tax liability, the following data were considered: Non-taxable portion of capital gains $ 30,000 CCA in excess of depreciation 60,000 Instalment tax payments made during 2023 150,000 Enacted income tax rate for 2023 30% What amount should Shierling report as its current income tax liability on its December 31, 2023 SFP? a) $198,000 b) $75,000 c) $66,000 d) $48,000arrow_forward

- At December 31, 2020, Novak Company had a net deferred tax liability of $445,000. An explanation of the items that compose this balance is as follows. Temporary Differences in Deferred Taxes Resulting Balances 1. Excess of tax depreciation over book depreciation. $ 188,000 2. Accrual, for book purposes, of estimated loss contingency from pending lawsuit that is expected to be settled in 2021. The loss will be deducted on the tax return when paid. $ (55,000 ) 3. Accrual method used for book purposes and installment method used for tax purposes for an isolated installment sale of an investment. $ 312,000 In analyzing the temporary differences, you find that $32,000 of the depreciation temporary difference will reverse in 2021, and $122,000 of the temporary difference due to the installment sale will reverse in 2021. The tax rate for all years is 40%. Indicate the manner in which deferred taxes should be presented on Novak Company's December 31, 2020, statement of financial position.arrow_forwardOriole Co. at the end of 2021, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $ 690,000 Estimated warranty expenses deductible for taxes when paid 1,140,000 (1,632,000) $ 198,000 Extra depreciation Taxable income Estimated warranty expense of $830,000 will be deductible in 2022, $240,000 in 2023, and $70,000 in 2024. The use of the depreciable assets will result in taxable amounts of $544,000 in each of the next three years. Prepare a table of future taxable and deductible amounts. 2022 Future taxable(deductible) amounts Warranties Excess Depreciation Date 2023 Account Titles 2024 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2021. Assuming an income tax rate of 30% for all years. TOTAL Debit Creditarrow_forwardA company reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income (Loss) Tax Rate 2018 $142,000 17% 2019 94,000 17 2020 (208,800) 22 2021 318,500 22 In 2021, what amount of income tax payable should be reported for the company, assuming the loss can carry forward?arrow_forward

- The pretax financial income (or loss) figures for Shamrock Company are as follows. 2017 81,000 2018 (51,000 ) 2019 (35,000 ) 2020 111,000 2021 95,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years.Prepare the journal entries for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 2017 enter an account title to record carryback enter a debit amount enter a…arrow_forwardHow much is the restated balance of AMSTERDAM's retained earnings account at January 1, 2021?arrow_forward1.The Mosaic Company organized on January 2, 2021, had pretax accounting income of $8,000,000 and taxable income of $11,600,000 for the year ended December 31, 2021. The 2021 tax rate was 25%. The only difference between book and taxable income is estimated warranty costs. Expected payments and scheduled enacted tax rates are as follows: 2022 $ 1,200,000 30 % 2023 600,000 30 % 2024 600,000 30 % 2025 1,200,000 35 % Required:Prepare one compound journal entry to record Mosaic's provision for taxes for the year 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education