ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

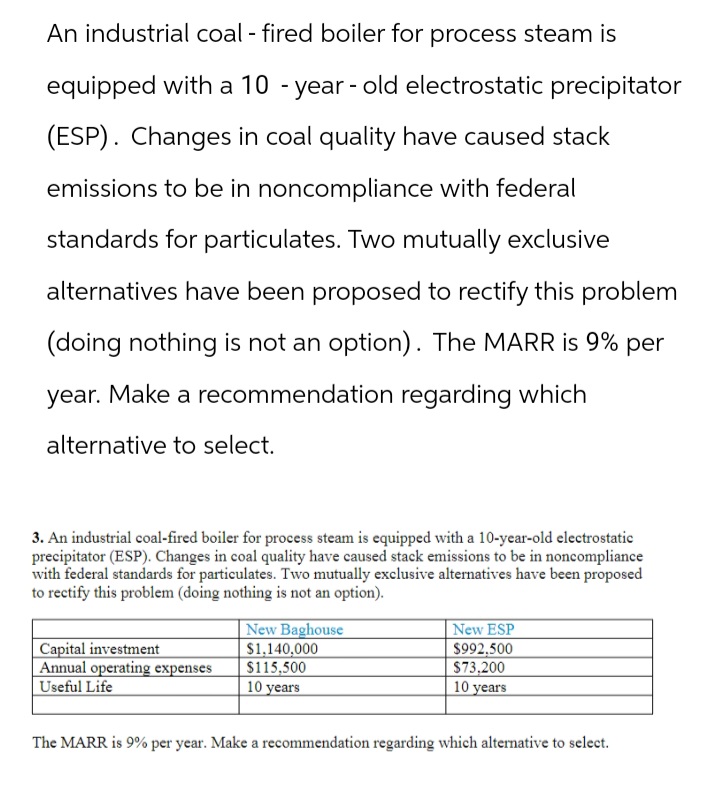

Transcribed Image Text:An industrial coal-fired boiler for process steam is

equipped with a 10-year-old electrostatic precipitator

(ESP). Changes in coal quality have caused stack

emissions to be in noncompliance with federal

standards for particulates. Two mutually exclusive

alternatives have been proposed to rectify this problem

(doing nothing is not an option). The MARR is 9% per

year. Make a recommendation regarding which

alternative to select.

3. An industrial coal-fired boiler for process steam is equipped with a 10-year-old electrostatic

precipitator (ESP). Changes in coal quality have caused stack emissions to be in noncompliance

with federal standards for particulates. Two mutually exclusive alternatives have been proposed

to rectify this problem (doing nothing is not an option).

Capital investment

Annual operating expenses

Useful Life

New Baghouse

$1,140,000

$115,500

10 years

New ESP

$992,500

$73,200

10 years

The MARR is 9% per year. Make a recommendation regarding which alternative to select.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 7. ratio analysis. Interest rate is 4%. For the data below, select the best alternative using the incremental AB/AC Initial cost Annual benefit 45,000 Salvage value Life $230,000 $200,000 39,000 35,000 $220,000 41,000 50,000 50,000 5 yearsarrow_forwardASAP! Please show by hand or if you use excel show the formulas that were used within the cells. Thank You!arrow_forwardEdinburgh Newcastle £000 £000Franchise fee (year 0) 8,700 7,950New buses (year 0) 4,120 3,890Scrap value (year 5) 110 95Forecast net cash inflowsYear 1 3,780 3,500Year 2 4,150 3,850Year 3 4,550 4,200Year 4 5,120 5,150Year 5 4,900 4,950 calculate the payback period for both the…arrow_forward

- Problem 7 A firm is considering the following three alternatives, as well as a fourth choice: do nothing. Each alternative has a 7-year useful life. The firm's minimum attractive rate of return is 9½ %. A Alternative Initial cost $100,000 Uniform annual net income 24,036 Computed rate of return 15.00% B $130,000 30,198 13.87% с $330,000 69,936 10.96% Using incremental rate of return comparisons, determine which alternative should be selected.arrow_forwardQ#2 Graph the EUAC or EUAB of the following two mutually exclusive alternatives. Use interest rate from 0% to 100% Initial cost Annual Cost HP Dell 6800 16,999 1500 1800 Annual Benefits 4000 5500 Salvage Value Useful Life in years 1000 35000 4 8arrow_forwardEconomics Two alternative water purification systems are considered to meet the drinking water needs in Canada. The data of the two alternatives are given in the table below. If the interest is 12% compound, which alternative would be appropriate using the annual equivalent (AE) method? System 1 System 2 System 3 initial investment cost -100 -60 -1000 monthly cost -10 -12 -8 maintenance costs -50 Once in two years -30 once in a year No scrap value economic life (years) 10 8 no 4 3 infinityarrow_forward

- A series of alternative projects have the following series of discount annualized costs and benefits. Which project is your best choice? What is your second-best choice? Please list your calculation details. Project Alternative A B C D E Present Value of Benefits 100 160 90 70 180 Present Value of Costs 60 90 40 30 120arrow_forwardNonearrow_forwardPlease do 8-2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education