ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

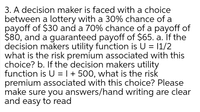

Transcribed Image Text:3. A decision maker is faced with a choice

between a lottery with a 30% chance of a

payoff of $30 and a 70% chance of a payoff of

$80, and a guaranteed payoff of $65. a. If the

decision makers utility function is U = 1/2

what is the risk premium associated with this

choice? b. If the decision makers utility

function is U = | + 500, what is the risk

premium associated with this choice? Please

make sure you answers/hand writing are clear

and easy to read

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that 20 risk neutral competitors participate in a rent seeking game with a fixed prize of $500. Each player may invest as much money as he wishes in the political contest. The probability of winning is directly proportional to the candidate's share of the total rent-seeking investment. 1. What is the expected net benefit of a player if all other players invest $20 each? Write the net benefit as a function of the player's investment. 2. Solve the maximization problem to arrive at the profit-maximizing investment. Round to the nearest cent.arrow_forwardIn a large casino, the house wins on its blackjack tables with a probability of 50.9%. All bets at blackjack are 1 to 1, which means that if you win, you gain the amount you bet, and if you lose, you lose the amount you bet. a. If you bet $1 on each hand, what is the expected value to you of a single game? What is the house edge? b. If you played 150 games of blackjack in an evening, betting $1 on each hand, how much should you expect to win or lose? c. If you played 150 games of blackjack in an evening, betting $3 on each hand, how much should you expect to win or lose? d. If patrons bet $7,000,000 on blackjack in one evening, how much should the casino expect to earn? a. The expected value to you of a single game is $ (Type an integer or a decimal.)arrow_forwardAre the following preferences consistent with von Neumann Morgenstern’s axioms to maximize expected utility? Explain. a. You would rather have a sure $200 to a gamble with p=0.7 chance of $200, p=0.1 chance of $50, p=0.2 chance of $300. b. You prefer the gamble of p=2/3 chance of $300 and p=1/3 chance of $50 than a sure $250 win.arrow_forward

- Do it correctly this timearrow_forwardChoice under uncertainty. Consider a coin-toss game in which the player gets $30 if they win, and $5 if they lose. The probability of winning is 50%. (a) Alan is (just) willing to pay $15 to play this game. What is Alan’s attitude to risk? Show your work.(b) Assume a market with many identical Alans, who are all forced to pay $15 to play this coin-toss game. An insurer offers an insurance policy to protect the Alans from the risk. What would be the fair (zero profit) premium on this policy? i need help with question B please.arrow_forwardAn individual is o ered a choice of either $50 or a lottery which may result in $0and $100, each with equal probability 1/2 . If the individual has a utility function u(w) = 5 + 2w, which one would they choose? If the individual has a utility function u(w) =w1/2 + 1?arrow_forward

- 1. ) Suppose a driver has a 6% of having one accident a year. In case of an accident the value of the car is reduced from $25,000 to $5,000. If driver buys an insurance policy the insurance company would completely cover damage to the car (essentially restoring its value to its initial level). Assume that the driver's utility function is U = VW. a) If price of the insurance policy (premium) is $1500, would this driver be willing to purchase the policy? Explain Show you computations b) What would be the maximum price a driver with 10% chance of accident be willing to pay for the insurance policy?arrow_forward3. A risk-neutral principal hires an agent to work on a project at wage w. The agent's utility function is: v(w)-g(e), where v(w)= Jw and g(e)=e/2 The agent can choose one of two possible effort levels, e¡ = 4 or e, = 6 . If the agent chooses effort level e, = 4 the project yields 100 with probability 1/4 and 0 with probability 3/4. If he chooses e, = 6 the project yields 100 with probability ½ and 0 with probability ½. The reservation utility of the agent is 0. (a) Suppose the effort level chosen by the agent is observable by the principal. Find the contract chosen by the principal. Show graphically in terms of contingent utilities v(w,00) and v(w.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education