FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

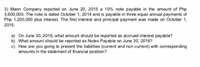

Transcribed Image Text:3) Mann Company reported on June 20, 2015 a 10% note payable in the amount of Php

3,600,000. The note is dated October 1, 2014 and is payable in three equal annual payments of

Php 1,200,000 plus interest. The first interest and principal payment was made on October 1,

2015.

a) On June 30, 2016, what amount should be reported as accrued interest payable?

b) What amount should be reported as Notes Payable on June 30, 2016?

c) How are you going to present the liabilities (current and non current) with corresponding

amounts in the statement of financial position?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On July 1, 2017, Agincourt Inc. rendered services in exchange for a 4%, 8-year promissory note having a face value of $500,000 (interest payable annually). Agincourt Inc. recently had to pay 8% Interest for money that it borrowed from British National Bank. The customer of the above fransaction has credit ratings that require them to borrow money at 12% interest. The present value of 1 at 12% for 8 perlods 0.40388 The present value of an ordinary annuity 4,9676 of 1 at 12% for 8 perlods Instructions By hew much amount Ihe service revue wil be credited? (Please wite your answer without commas or sign of the doliar. For example ifyour answer is SI0.000, Swrite it 10000)arrow_forwardMission Corp. borrowed $25,000 cash on April 1, 2016, and signed a one-year 8%, interest-bearing note payable. The interest and principal are both due on March 31, 2017.What is the amount to be paid to the bank on March 31, 2017 for interest and principal (combined)?arrow_forwardOn October 1, 2017, Chung, Inc. assigns $1,000,000 of its accounts receivable to Seneca National Bank as collateral for a $750,000 note. The bank assesses a finance charge of 2% of the receivables assigned and interest on the note of 9%. Prepare the October 1 journal entries for both Chung and Seneca.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education