Calculus: Early Transcendentals

8th Edition

ISBN: 9781285741550

Author: James Stewart

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

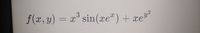

Calculate fxy(1,1)

Transcribed Image Text:f(x,y) = x³ sin(xe")+xe²

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, calculus and related others by exploring similar questions and additional content below.Similar questions

- Solve with minitabarrow_forwardCan you please help me answer this with limited spacearrow_forwardKeystone can only properly market a limited number of properties. They are trying to figure out which property they should select to add to their portfolio among four candidates (and in so doing, gain some insight into how to make such decisions in the future). There is some uncertainty as the selling price (and therefore commission/profit) depends on the state of the real estate market 6 months in the future. Based on their experience, Keystone has provided an estimate of selling prices for a “good” real estate market and a “bad” real estate market for the four candidate properties (see Table 1). Table 1: Sales price (in millions of $) Alternatives Bad Market Good Market Property 1 2.1 3.7 Property 2 1.7 3.8 Property 3 2.8 2.6 Property 4 2.2 2.4 Even with these estimates, though, Keystone managers are unsure which property to choose. Keystone managers consider themselves to be optimistic about the future, but would like to…arrow_forward

- Recreate the given figure for a call center that wants to achieve a 40 percent no hold rate. Suppose that agents only become cost effective (where the revenue they generate exceeds their cost) if they have 90 percent utilization. How large, in terms of number of agents, does the call center need to be to have agents that are generating a positive profit? If mean call time is 5 minutes, what would the arrival rate need to be for 90 percent agent utilization with this many agents?arrow_forwardAssn #3 Pg 13 (1-10) And Works x em/?file=https://drive.google.com/uc?id%3D1CTEVTWK8MB4C_mgM7cZiHsSSPeOAZ 10&export%3Ddownload&filename%3DAttachment:%20PDF:%2 9. The balance in a bank account with an annual interest rate of 2%, compounded annually, can be represented using the function f(t) = 1000(1.02), where t is the time in years after opening the %3D 1 account. What was the approximate account balance 6 years and 3 months, or 6- years, after 4 the account was opened?arrow_forwardCan you help me solve thisarrow_forward

- Please answer no. 4 onlyarrow_forward11. Suppose that in the year 2011, Celestial Electronics planned to produce 950,000 units of its portable GPS devices. Of the 950,000 it planned to produce, a total of 25,000 units would be added t0 the inventory at its new plant in Florida. Also assume that these units have been selling at a price of $100 each and that the price has been constant over time. Suppose further that this year the firm built a new plant for $5 million and acquired S2.5 million worth of equipment. It had no other investment projects, and to avoid complications, assume no depreciation. Now suppose that at the end of the year, Celestial had produced 950,000 units but had only sold 900,000 units and that inven- tories now contained 50,000 units more than they had at the beginning of the year. At $100 each, that means that the firm added $5,000,000 in new inventory. 8. How much did Celestial actually invesı this year? b. How much did it plan to invest? c. Would Celestial produce more or fewer units next year?…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning

Calculus: Early TranscendentalsCalculusISBN:9781285741550Author:James StewartPublisher:Cengage Learning Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON

Thomas' Calculus (14th Edition)CalculusISBN:9780134438986Author:Joel R. Hass, Christopher E. Heil, Maurice D. WeirPublisher:PEARSON Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)CalculusISBN:9780134763644Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric SchulzPublisher:PEARSON Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early TranscendentalsCalculusISBN:9781319050740Author:Jon Rogawski, Colin Adams, Robert FranzosaPublisher:W. H. Freeman

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendental FunctionsCalculusISBN:9781337552516Author:Ron Larson, Bruce H. EdwardsPublisher:Cengage Learning

Calculus: Early Transcendentals

Calculus

ISBN:9781285741550

Author:James Stewart

Publisher:Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:9780134438986

Author:Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:9780134763644

Author:William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:9781319050740

Author:Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:9781337552516

Author:Ron Larson, Bruce H. Edwards

Publisher:Cengage Learning