FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:3l 69% 1 4:18 pm

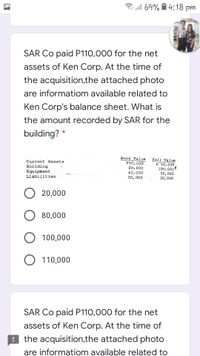

SAR Co paid P110,000 for the net

assets of Ken Corp. At the time of

the acquisition,the attached photo

are informatiom available related to

Ken Corp's balance sheet. What is

the amount recorded by SAR for the

building? *

Book Value

P50,000

80,000

40,000

Fair Value

P 50,000

100, 000

Current Assets

Building

Equipment

50,000

30,000

Liabilities

30, 000

20,000

80,000

100,000

110,000

SAR Co paid P110,000 for the net

assets of Ken Corp. At the time of

9 the acquisition,the attached photo

are informatiom available related to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 10-3 (Algo) Acquisition costs [LO10-1, 10-4, 10-6] The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Accumulated Depreciation $ Land Land improvements Building Equipment Automobiles Plant Asset $ 480,000 245,000 2,150,000 1,184,000 215,000 Transactions during 2021 were as follows: a. On January 2, 2021, equipment were purchased at a total invoice cost of $325,000, which included a $6,800 charge for freight. Installation costs of $40,000 were incurred. b. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $32,000. The fair value of the building on the day of the donation was $21,000. c. On May 1, 2021, expenditures of $63,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those…arrow_forwardGood night 11 mayo 10:04arrow_forwardDo not provide answer in image formatarrow_forward

- Nonearrow_forwardA 7arrow_forwardces Mc Graw Hill Problem 7-3B (Algo) Calculate and record goodwill (LO7-2) Northern Equipment Corporation purchased all the outstanding common stock of Pioneer Equipment Rental for $5,590,000 in cash. The book values and fair values of Pioneer's assets and liabilities were as follows: Accounts Receivable $ 740,000 Book Value Fair Value $ 640,000 Buildings 4,090,000 4,790,000 Equipment 100,000 190,000 Accounts Payable (760,000) (760,000) $ $ Net assets 4,170,000 4,860,000 Required: 1. Calculate the amount Northern Equipment should report for goodwill. 2. Record Northern Equipment's acquisition of Pioneer Equipment Rental. Complete this question by entering your answers in the tabs below. Required Required 1 2 Record Northern Equipment's acquisition of Pioneer Equipment Rental. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 1 Record the acquisition of Pioneer Equipment…arrow_forward

- Mini-Exercise 6-7 (Algo) Goodwill LO 6-9 Backstreets Company recently acquired all of Jungleland Incorporated's net assets in a business acquisition. The cash purchase price was $9.1 million. Jungleland's assets and liabilities had the following appraised values immediately prior to the acquisition: land, $2.5 million; buildings, $4.2 million; inventory, $3.0 million; long-term notes payable, for which Backstreets Company assumes payment responsibilities, $2.3 million. Required: How much goodwill will result from this transaction? Note: Enter your answer in whole dollars. Goodwillarrow_forwardANSWER LETTERS ABCDarrow_forwardok it nces Inventory Building Land Total FMV $ 28,000 210,000 322,000 $560,000 The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market valu corporation's stock received in the exchange was $460,000. The transaction met the requirements to be tax-c under $351. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if op Adjusted basis Adjusted Basis $ 14,000 140,000 420,000 $574,000 Assume the corporation assumed a mortgage of $660,000 attached to the building and land. Assume the fair market building is now $350,000 and the fair market value of the land is $742,000. The fair market value of the stock remain g. What is the corporation's adjusted basis in each of the assets received in the exchange? (Do not round intermedial Inventory Building Landarrow_forward

- Question 6 Week 12 On 1 July 2014 Padma Ltd acquires 25 per cent of the issued capital of Jamuna Ltd for a cash consideration of $360 000.At the date of acquisition, the shareholders’ equity of Jamuna Ltd is:Share capital $450 000Retained earnings $300 000Total shareholders’ equity 750 000Additional information• On the date of acquisition, buildings have a carrying amount in the accounts of Jamuna Ltd of $240 000 and amarket value of $300 000. The buildings have an estimated useful life of 10 years after 1 July 2014.• For the year ending 30 June 2015 Jamuna Ltd records an after-tax profit of $90 000, from which it pays adividend of $30 000.• For the year ending 30 June 2016 Jamuna Ltd records an after-tax profit of $300 000, from which it pays adividend of $150 000.• Assume a tax rate of 30% is assumedRequiredApply equity method of accounting to:(a) Calculate the amount of goodwill at the date of acquisition (b) Prepare the journal entries for the year ending 30 June 2015 (c) Prepare…arrow_forwardLO 9 Assets Cash + Patent + 94,000 ΝΑ + + Exercise 8-20A Computing and recording the amortization of intangibles Texas Manufacturing paid cash to purchase the assets of an existing company. Among the assets purchased were the following items: Goodwill ΝΑ Texas's financial condition just prior to the purchase of these assets is shown in the following statements model: = Patent with 5 remaining years of legal life Goodwill Liab. ΝΑ Equity Rev. + 94,000 ΝΑ Exp. $36,000 40,000 ΝΑ = Net Inc. = ΝΑ Cash Flow ΝΑ Required a. Compute the annual amortization expense for these items if applicable. b. Record the purchase of the intangible assets and the related amortization expense for year 1 in a horizontal statements model like the preceding one. c. Prepare the journal entries to record the purchase of the intangible assets and the related amortization for year 1.arrow_forwardQUESTION 19 On January 1, 20X9, Pirate Corporation acquired 80 percent of Sea-Gull Company's common stock for $160,000 cash. The fair value of the noncontrolling interest at that date was determined to be $40,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Pirate Corp. Sea-Gull Corp. Cash $ 60,000 $ 20,000 Accounts Receivable 80,000 30,000 Inventory 90,000 40,000 Land 100,000 40,000 Buildings and Equipment 200,000 150,000 Less: Accumulated Depreciation (80,000 ) (50,000 ) Investment in Sea-Gull Corp. 160,000 Total Assets $ 610,000 $ 230,000 Accounts Payable $ 110,000 $ 30,000 Bonds Payable 95,000 40,000 Common Stock 200,000 40,000 Retained Earnings 205,000 120,000 Total Liabilities…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education