FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

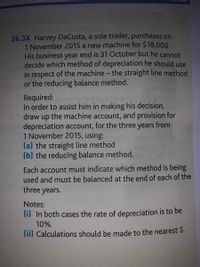

Transcribed Image Text:26.3X Harvey DaCosta, a sole trader, purchases on

1 November 2015 a new machine for $18,000.

His business year end is 31 October but he cannot

decide which method of depreciation he should use

in respect of the machine - the straight line method

or the reducing balance method.

Required:

In order to assist him in making his decision,

draw up the machine account, and provision for

depreciation account, for the three years from

1 November 2015, using:

(a) the straight line method

(b) the reducing balance method.

Each account must indicate which method is being

used and must be balanced at the end of each of the

three years.

Notes:

li) In both cases the rate of depreciation is to be

10%.

lii) Calculations should be made to the nearest $.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- H6. Denver Inc. has an old computer system. The computer originally costs Denver $90,000 and its current book value is $35,000. Answer the following questions: Do not use the account name of book value. There is no such account name as book value in accounting* 1) What is accumulated depreciation on the Denver's computer? 2) Journal entry if Denver discards the computer (for nothing). 3) Journal entry if Denver sells the computer for $90,000. Show proper calculationarrow_forward3 Amanda Company purchased a computer that cost $10,600. It had an estimated useful life of five years and a residual value of $1,300. The computer was depreciated by the straight-line method and was sold at the end of the third year of use for $5,150 cash How much of a gain or loss should Amanda record? 024701arrow_forward5arrow_forward

- 3arrow_forwardNonearrow_forwarduppose a computer software developer for a certain company purchased a computer system for $75,000 on April 27, 2017. The computer system is used for business 100% of the time. The accountant for the company elected to take a $30,000 Section 179 deduction, and the asset qualified for a special depreciation allowance. (a) What was the basis for depreciation (in $) of the computer system? (See Table 17-4.) $ (b) What was the amount (in $) of the first year's depreciation using MACRS? $ (Table 17-4) Certain QualifiedAsset Placed into Service Special AllowanceSeptember 11, 2001–May 5, 2003 30%May 6, 2003–January 1, 2005 50%December 31, 2007–September 27, 2017 50%September 28, 2017–December 31, 2022 100%arrow_forward

- Sophia purchased the following assets in 2020. 4-15-20 New Computer $2,600 7-02-20 Office Furniture $10,000 10-2-20 Office Equipment $16,200 Sophia does not want to take any 179-expense deduction or any additional first year depreciation. Calculate the cost recovery for 2020.arrow_forwardI need correct solutionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education