FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

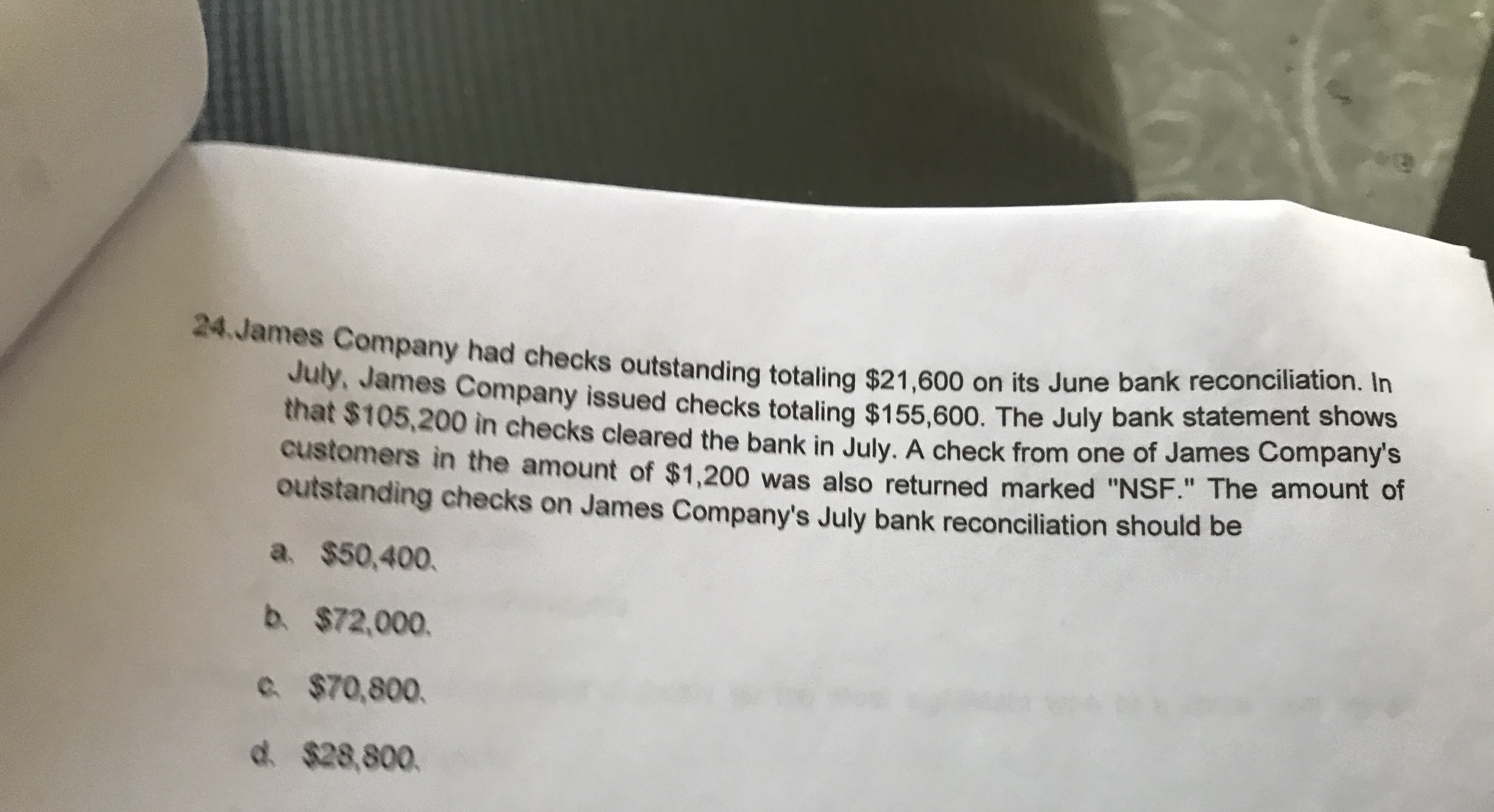

Transcribed Image Text:24.James Company had checks outstanding totaling $21,600 on its June bank reconciliation. In

July, James Company issued checks totaling $155.600. The July bank statement shows

that $105,200 in checks cleared the bank in July. A check from one of James Company's

customers in the amount of $1,200 was also returned marked "NSF." The amount or

outstanding checks on James Company's July bank reconciliation should be

a. $50,400.

b. $72,000.

e $70,800.

d. $28,800.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- (a.) The June 30 balance shown on the bank statement is $5,796. (b.) Outstanding checks at June 30 totaled $330. (c.) A deposit of $424 made on June 30 was not included in the balance shown on the bank statement. (d.) The bank statement contained an adjustment of $410 for a note receivable collected by the bank on behalf of Show Me, Inc. ($382 principal and $28 interest). (e.) A bank charge of $34 was made to the account during June. Although the company was expecting a charge, the amount was not known until the bank statement arrived. (f.) The bank erroneously charged a $340 check of Shirt, Inc., against the Show Me, Inc., bank account. (g.) The June 30 balance in the general ledger Cash account, before reconciliation, is $6,026. (h.) The bank statement included a notice that a customer's check for $172 that had been deposited on June 14 had been returned NSF. (1.) Prepare the bank reconciliation for Show Me, Inc., as of June 30. (2.) Prepare the appropriate adjusting entry(ies) or…arrow_forwardPlease solve thisarrow_forwardNeed helparrow_forward

- Refer to the information given below: a. The August 31 balance shown on the bank statement is $9,050. b. There is a deposit in transit of $1,300 at August 31. c. Outstanding checks at August 31 totaled $1,620. d. Interest credited to the account during August but not recorded on the company's books amounted to $68. e. A bank charge of $44 for checks was made to the account during August. Although the company was expecting a charge, the amount was not known until the bank statement arrived. f. In the process of reviewing the canceled checks, it was determined that a check issued to a supplier in payment of accounts payable of $142 had been recorded as a disbursement of $412. g. The August 31 balance in the general ledger Cash account, before reconciliation, is $8,436. Required: a-1. Show the reconciling items in a horizontal model that should be prepared to reflect the reconciling items as on August 31. (Use amounts with + for increases and amounts with for decreases.) Cash Assets…arrow_forward5. Bank Reconciliation Johnson Corporation's bank statement for October reports an ending balance of $22,381, whereas Johnson's cash account shows a balance of $22,025 on October 31. The following additional information is available: 6. A $855 deposit made on October 31 was not recorded by the bank until November. 7. At the end of October, outstanding checks total $1,222. 8. The bank statement shows bank service charges of $125 not yet recorded by the company. 9. The company erroneously recorded as $973 a check that it had actually written for $379. It was correctly processed by the bank. 10. A $480 check from a customer, deposited by the company on October 29, was returned with the bank statement for lack of funds. Required: 1. Prepare the October bank reconciliation for Johnson Corporation.arrow_forwardNonearrow_forward

- Using the following information, prepare a bank reconciliation. Bank balance: $6,788 Book balance: $6,525 Deposits in transit: $1,688 Outstanding checks: $569 and $1,523 Bank charges: $75 Bank incorrectly charged the account $75. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $245 but posted in the accounting records as $254. This check was expensed to Utilities Expense. Bank Reconciliation Bank Statement Balance at (date) $fill in the blank 1 Add: Deposits in Transit Outstanding Checks Less: - Select - Adjusted Bank Balance $fill in the blank 8 Book Balance at (date) $fill in the blank 9 Add: - Select - Less: - Select - Adjusted Book Balance $fill in the blank 14arrow_forwardThe Cash account of ReeseCorporation had a balance of $3,540 at October 31, 2018. Included were outstanding checkstotaling $1,800 and an October 31 deposit of $300 that did not appear on the bank statement.The bank statement, which came from Turnstone State Bank, listed an October 31 balance of$5,570. Included in the bank balance was an October 30 collection of $600 on account froma customer who pays the bank directly. The bank statement also showed a $30 service charge,$10 of interest revenue that Reese earned on its bank balance, and an NSF check for $50.Prepare a bank reconciliation to determine how much cash Reese actually had at October 31.arrow_forwardUsing the following information: The bank statement balance is $3,718. The cash account balance is $4,086. Outstanding checks amounted to $866. Deposits in transit are $1,177. The bank service charge is $48. A check for $78 for supplies was recorded as $69 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31.arrow_forward

- The June 30 bank statement shows a balance of $7,100. The following information as discovered while the bank reconciliation was prepared: A bookkeeper error where a $400 check written to a supplier was incorrectly recorded as $500 Two outstanding checks totaling $840 A bank service charge of $29 A deposit in transit of $330 Bank interest revenue of $20 What is the adjusted bank balance?arrow_forwardYou are the bookkeeper of Mel Traders. You undertake a bank reconciliation at the end of every month. Mel Traders received its bank statement for the month ending 31 May 2021. The bank reconciliation at the end of April showed a deposit in transit of $11,700 and two outstanding cheques (no. 663 for $3,060and no. 671 for $6,300). The adjusted cash balance in the entity’s records was $106,305 debit at the end of April. Below are theentity’s May bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of May: AU Bank - Bank Statement For the period 01/05/2021 – 31/05/2021 Mel Traders Dr Cr Balance $ Balance brought forward 103,965 CR 1 May Deposit 11,700 115,665 CR 3 May Deposit 10,620 126,285 CR May Cheque # 682 4,680 121,605 CR 6 May Deposit 6,120 127,725 CR 8 May # 671 6,300 121,425 CR…arrow_forward25. You are doing the bank reconcilement. The company wrote 30 checks this month and all have cleared the bank except for three checks totaling $43,908. How would this be handled on the bank reconcilement?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education