Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

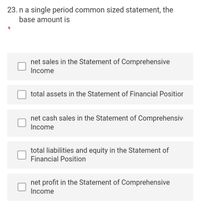

Transcribed Image Text:23. n a single period common sized statement, the

base amount is

net sales in the Statement of Comprehensive

Income

total assets in the Statement of Financial Positior

net cash sales in the Statement of Comprehensiv

Income

total liabilities and equity in the Statement of

Financial Position

net profit in the Statement of Comprehensive

Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Question: Which financial ratio measures the proportion of net income generated per dollar of revenue? A) Return on Investment ( ROI) B) Operating Profit Margin C) Return on Sales (ROS) D) Earnings per Share (EPS)arrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Profitability.arrow_forwardDefine each of the following terms:a. Annual report; balance sheet; income statement; statement of cash flows; statement ofstockholders’ equityb. Stockholders’ equity; retained earnings; working capital; net working capital; net operatingworking capital (NOWC); total debtc. Depreciation; amortization; operating income; EBITDA; free cash flow (FCF)d. Net operating profit after taxes (NOPAT)e. Market value added (MVA); economic value added (EVA)f. Progressive tax; marginal tax rate; average tax rateg. Tax loss carryback; carryforward; alternative minimum tax (AMT)h. Traditional IRAs; Roth IRAsi. Capital gain (loss)j. S corporationarrow_forward

- Which of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forwardB4.arrow_forwardThe monetary value of the net assets is reported at its historical cost on the balance sheet? a. physical capital b. excess capital c. net capital d. financial capitalarrow_forward

- Using the information from 27A prepare the following ratios: gross profit margin profit margin return on assets earnings per share current ratio acid test ratio debt ratio Indicate what each is used for (ie: measuring efficiency, solvency etc)arrow_forwardB Net sales Cost of goods sold Selling and administrative expenses Interest expense Other income (expense) Income tax expense Net income Current assets. Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets Total stockholders' equity Current liabilities Total liabilities Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Cash dividends paid 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Ratio Current ratio Accounts receivable turnover Average collection period Inventory turnover Days in inventory Profit margin Asset turnover Return on assets Debt to assets ratio Walmart Inc. Income Statement Data for Year Times interest earned Target Corporation Return on common stockholders' equity Free cash flow $66,900 44,000 14,400 750 (95) 1,500 $6,155 $17,000 26,800 $43,800 Balance Sheet Data (End of Year) $10,000 17,300 16,500 $43,800 13,400 10,000…arrow_forward1. Which of the following is referred to as the Accounting Equation? Assets Liabilities + Equity Equity Liabilities + Assets Liabilities Assets + Equity Assets = Liabilities - Equity = 2. Which of the following make up the Finance Equation? (select all that apply) Revenues = Price x Volume Costs = Fixed + Variable Profit Revenues-Costs Income Sales - COGSarrow_forward

- Which is the CORRECT order for items to appear on the income statement? Group of answer choices sales revenue, gross profit, net income, operating expenses cash, accounts receivable, inventory, property/plant/equipment, intangible assets sales revenue, operating expenses, gross profit, net income sales revenue, cost of goods sold, gross profit, operating expenses sales revenue, gross profit, cost of goods sold, operating expensesarrow_forward12. Which two ratios multiplied by each other equal Return on Total Assets? (A) Profit Margin (B) Return on Equity (C) Current Ratio (D) Price Earnings Ratio (E) Total Asset Turnoverarrow_forwardCan you do 2022 income statement of this table? Statement of Profit or Loss and Other Comprehensive Income Presentation Currency Nature of Financial Statements Revenue Revenue from Finance Sector Operations Total Revenue Cost of Sales Cost of Finance Sector Operations Total Costs Gross Profit (Loss) from Commercial Operations Gross Profit (Loss) from Finance Sector Operations Gross Profit (Loss) Profit (Loss) From Operating Activities Profit (Loss) Before Financing Income (Expense) Profit (Loss) from Continuing Operations, Before Tax Profit (Loss) from Continuing Operations Profit (Loss) from Discontinued Operations Net Profit (Loss) Profit (Loss) Attributable To, Non- controlling Interests Profit (Loss) Attributable To, Owners of Parent Other Comprehensive Income (Loss) Total Comprehensive Income (Loss) Total Comprehensive Income Attributable To, Non-controlling Interests Total Comprehensive Income Attributable To, Owners of Parent 2020/12 1000TL Consolidated 21.529.210 37.824.578…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education