Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

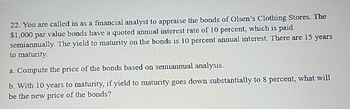

Transcribed Image Text:22. You are called in as a financial analyst to appraise the bonds of Olsen's Clothing Stores. The

$1,000 par value bonds have a quoted annual interest rate of 10 percent, which is paid

semiannually. The yield to maturity on the bonds is 10 percent annual interest. There are 15 years

to maturity.

a. Compute the price of the bonds based on semiannual analysis.

b. With 10 years to maturity, if yield to maturity goes down substantially to 8 percent, what will

be the new price of the bonds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm has some $1,000 par value bonds outstanding that pay a 12 percent interest rate. The bonds pay interest yearly and have 10 years until they mature. If bonds that bear similar risk currently earn 8 percent, how much will the firm's bond sell for today? A) $1,000 B) $805.20 C) $851.50 D) $1,268.20arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 17 years and pay 8 percent interest annually. If you purchase the bonds for $825, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forwardwhat is the annual interest that you would warn on a $1200 Treasury Bond with a current yield of 1.5% that is quoted at 98 points ?arrow_forward

- Acarrow_forwardTen bonds are purchased for $9,598.13 and are kept for 5 years. The bond coupon rate is 7% per year, payable semiannually. Immediately following the owner's receipt of the last coupon payment, the owner sells each bond for $50 less than its par value (price discount). The owner will invest in the bonds if the effective annual yield is at least 9%.What is the face value of each bond?______arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 24 years and pay 14 percent interest annually. If you purchase the bonds for $900, what is your yield to maturity? Your yield to maturity on the Abner bonds is %. (Round to two decimal places.)arrow_forward

- 44arrow_forwardBrandt Enterprises is considering a new project that has an estimated cost of $1,000,000 and cash inflows of $350,000 each year in next 5 years. The project’s WACC is 11%. After estimating the cash flows of the project, the CFO conducted a scenario analysis and found the CV (coefficient of variation) of the project’s NPV is 3.26. Given that the CV of an average project of the company is in the range of 1.0 to 2.0, how will you interpret the result of the scenario analysis? If the CFO uses a subjective adjustment of 3% in the discount rate to differentiate projects with various risk levels, what will be the risk-adjusted NPV? What do you conclude from the calculation?arrow_forwardYour company has bonds that mature in 12 years and have a face value of $1,000. The bonds have an 8 percent semi-annual coupon (pays $40 every six months). The bonds may be called in five years. The bonds have a YTM of 7 percent and a yield-to-call of 8.62 percent. Determine the bonds' call price. O $1,100 O $1,080 O $1,160 O $1,140 O $1,120arrow_forward

- (Related to Checkpoint 9.2) (Yield to maturity) Hoyden Co.'s bonds mature in 9 years and pay 8 percent interest annually. If you purchase the bonds for $725, what is their yield to maturity? The yield to maturity on the Hoyden bonds is%. (Round to two decimal places.)arrow_forwardHeather Smith is considering a bond investment in Locklear Airlines. The $1,000 par value bonds have a quoted annual interest rate of 9 percent and the interest is paid semiannually. The yield to maturity on the bonds is 12 percent annual interest. There are 9 years to maturity. Compute the price of the bonds based on semiannual analysis. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond pricearrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 18 years and pay 13 percent interest annually. If you purchase the bonds for $925, what is your yield to maturity? Your yield to maturity on the Abner bonds is %. (Round to two decimal places.) Carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education