Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Solve Problem 20.23 using Excel.

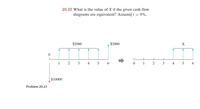

Transcribed Image Text:20.23 What is the value of X if the given cash flow

diagrams are equivalent? Assume i = 8%.

$2000

$3000

X

1

2

3

4

6.

1

2

3

4

5

6

$10000

Problem 20.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- %24 2 Project: Company Accour X DZL. 7-1 Problem Set: Module Sev X CengageNOWv2 | Online tea x Cengage Learning +| x ow.com/ilrm/takeAssignment/takeAssignmentMain.do?invoker%3&takeAssignmentSessionLocator3&inprogress%3Dfalse eBook Show Me How Horizontal Analysis The comparative accounts payable and long-term debt balances for a company follow. Current Year Previous Year Accounts payable $40,964 $41,800 Long-term debt 45,594 44,700 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Enter all answers as positive numbers. Amount of Change Increase/Decrease Percentage Accounts payable Decrease Increase Long-term debt Check My Work Calculate the change in the amount and divide by the base (older) year amount to determine the horizontal analysis percentages. Previous Check My Work 3:12 PM dp SU prt sc 144 114arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardcan you help me with D,E,F,G,and Harrow_forward

- Ⓒ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forwardQuestion 7 Answer saved Points out of 1.0 P Flag question The MID function in Excel requires how many arguments? Select one: O a. 5 O b. 4 O c. 2 d. 3 Clear my choicearrow_forwardted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forward

- Question 3arrow_forwardAutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forwardples of Managerial Acco M Question 1- Comprehensive P X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252Fmhepro Comprehensive Problem 5 Saved 1 Part 1 of 6 04:02:14 eBook Print References Required information [The following information applies to the questions displayed below.] Jasper Company, a machine tooling firm, has several plants. One plant, located in Saint Cloud, Minnesota, uses a job order costing system for its batch production processes. The Saint Cloud plant has two departments through which most jobs pass. Plantwide overhead, which includes the plant manager's salary, accounting personnel, cafeteria, and human resources, is budgeted at $250,000. During the past year, actual plantwide overhead was $242,000. Each department's overhead consists primarily of depreciation and other machine-related expenses. Selected budgeted and actual data from the Saint Cloud plant for the past year…arrow_forward

- 合日 Document1 Q. Search in Document Home Insert Draw Design Layout References Mailings Review View + Share a A. A- E -E - E , E E Times New R... - AaBbCcDc AaBbCcDdEe AaBb( AabbCcDdEe AaBbCcDdEe AaBbCcDdEe AgBbCcDdEe AgBbCcDdEe Paste в I U - abe X, x2 Normal Heading 1 Subtle Emph.. Emphasis Styles Pane No Spacing Heading 2 Title Subtitle You are considering opening your own restaurant. To do so, you will have to quit your current job, which pays $46k per year, and cash in your life savings of $200k, which have been in a certificate of deposit paying 6% per year. You will need this $200k to purchase equipment for your restaurant operations. You estimate that you will have to spend $4k during the year to maintain the equipment so as to preserve its market value at $200k. Fortunately, you own a building suitable for the restaurant. You currently rent out this building on a month-by-month basis for $2,500 per month. You anticipate that you will spend $50k for food, $40k for extra help, and…arrow_forwardin text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working!!!!!!!arrow_forwardPlease solve in Excel with explanation computation for each steps answer in text formarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education