FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:20

Sales

Contribution margin

Fixed costs

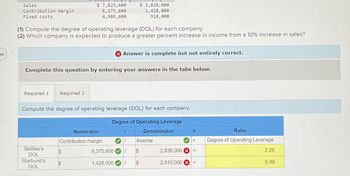

(1) Compute the degree of operating leverage (DOL) for each company.

(2) Which company is expected to produce a greater percent increase in income from a 10% increase in sales?

Required 1 Required 2

$ 7,825,600

6,375,600

4,989,600

Complete this question by entering your answers in the tabs below.

Skittles's

DOL

Starburst's

DOL

Compute the degree of operating leverage (DOL) for each company.

Degree of Operating Leverage

$

Contribution margin

$

Numerator:

$ 3,828,000

1,428,000

918,000

Answer is complete but not entirely correct.

6,375,600

1,428,000

I $

1 $

Denominator:

Income

II

2,910,000

=

=

2,836,000 =

Ratio

Degree of Operating Leverage

2.25

0.49

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- aaaarrow_forwardTom Company reports the following data: Sales Variable costs Fixed costs Determine Tom Company's operating leverage. Round your answer to one decimal place. $156,332 81,532 30,800arrow_forwardContribution Margin Ratio, Variable Cost Ratio, Break-Even Sales Revenue The controller of Ashton Company prepared the following projected income statement: Sales $88,000 Total variable cost 23,760 Contribution margin $64,240 Total fixed cost 43,800 Operating income $20,440 Required: 1. Calculate the contribution margin ratio. Note: Enter as a percent, rounded to the nearest whole number. fill in the blank 1 % 2. Calculate the variable cost ratio. Note: Enter as a percent, rounded to the nearest whole number.fill in the blank 2 % 3. Calculate the break-even sales revenue for Ashton. Note: Round your answer to the nearest dollar. $fill in the blank 3 4. How could Ashton increase projected operating income without increasing the total sales revenue? Decrease the contribution margin ratioarrow_forward

- genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Lo... r Operating Leverage Teague Co. reports the following data: Sales Variable costs Contribution margin Fixed costs $480,000 264,000 $216,000 175,200 $40,800 Income from operations Determine Teague Co.'s operating leverage. Round your answer to one decimal place.arrow_forwardNumber 3arrow_forwarddon't give answer in image formatarrow_forward

- Accounting BUY Chapte... Managerial Accounting 15th Edition ISBN: 9781337912020 Author: Carl Warren, Ph.d. Cma William B. Tayler Publisher: South-Western College Pub Problem 5BE Section... Question Sales Mix and Break-Even Analysis Megan Company has fixed costs of $299,700. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Model Selling Price Variable Cost per Unit Contribution Margin per Unit Yankee $210 $120 $90 Zoro 150 100 50 The sales mix for products Yankee and Zoro is 10% and 90%, respectively. Determine the break-even point in units of Yankee and Zoro. a. Product Model Yankee 3,330 X units b. Product Model Zoro < Feedback See similar textbooks units ▼ Check My Work Subtract the combined unit variable cost from the combined unit selling price. Divide the fixed costs by the combined unit contribution margin to find break-even point in units. Units for Yankee and Zoro will be break-even point in units…arrow_forwardCurrent Attempt in Progress Some financial information for each of three companies is reflected below in columns A, B, and C. Use your knowledge of CVP relationships to fill in the missing pieces numbered (1) through (9). Consider each company (i.e., column) separately. (Round variable cost per unit and contribution margin ratio to 2 decimal places, e.g. 0.24.) Selling price Total fixed costs Sales volume (units) Variable cost/unit Operating income Tax rate After-tax profit Contribution margin ratio A $6 $13,100 29,000 $40,840 (1) % (2) $28,588 (3) B $800 2,500 $384 25% $684,375 (4) (5) (6) с $389,000 $30.24 $229,240 40% 0.64arrow_forwardPLEASE ANSWER QUESTIONS D, E & Farrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education