FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

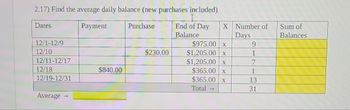

Transcribed Image Text:2.17) Find the average daily balance (new purchases included)

Payment

End of Day

Balance

Dates

12/1-12/9

12/10

12/11-12/17

12/18

12/19-12/31

Average

$840.00

Purchase

$230.00

X Number of

Days

$975.00 x

$1,205.00 x

$1,205.00 x

$365.00 X

$365.00 x

Total →

9

1

7

1

13.

31

Sum of

Balances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- previous balance apr monthly periodic rate finance charge purchase ans cash advances payments and credits new balancearrow_forwardb. Interest revenue accrued, $2,700. Accounts b. Interest Receivable Interest Revenue Journal Entry Debit 2700 Credit 2700arrow_forwardMerchandise subject to terms 1/10, n/30, FOB shipping point, is sold on account to a customer for $19,200. What is the amount of the sales discount allowable? a.$384 b.$96 c.$192 d.$480arrow_forward

- Merchandise subject to terms 4/15, n/28, FOB shipping point, is sold on account to a customer for $35,000. What is the amount of the cash discount allowed in case the customer pays within the discount period? Select one: a. $1,400 b. $9,800 c. $1,500 d. $5,250arrow_forwardEntries for notes payablearrow_forwardA credit sale of $3800 is made on April 25, terms 1/10, n/30, on which a return of $300 is granted on April 28. What amount is received as payment in full on May 4? $3465 • $3800 • $3500 Ⓒ $3762arrow_forward

- c. On 9/12 Year 7 $2,000 of ACCOUNTS PAYABLE is paid after the discount period. Phrase 1st: 2nd: Phrase 1st: Account 2nd: Accounts Account Category AL SER E contra AL SER E contra + Accounts Debit Affect d. On 9/28 Year 7 INVENTORY originally purchased for $4,000 on 9/1 Year 7 and was paid for on 9/10 Year 7 is returned by the purchaser and a debit memorandum (a debit to A/P) is received from the seller. [Hint: the amount of cash involved in this transaction must take the 2% discount into account.] Debit + Category AL SE RE contra AL SE RE contra + - + Affect Dr. or Cr. Dr Cr Dr Cr Credit Dr. or Cr. Credit Dr Cr Dr Crarrow_forwardCompute the amount to be paid for each of the four separate invoices assuming that all invoices are paid within the discount period. Merchandise Terms Рayment (gross) $ 10,000 2/10, n/60 а. b. 27,500 1/15, EOM C. 85,000 1/10, n/30 d. 22,500 3/15, n/45arrow_forward1 Find the new balance, assuming that the bank charges 2-% per month on the unpaid balance. 2 Previous New Balance Payment Purchases $592.88 $81.26 A. $575.61 B. $572.61 C. $576.51 O D. $574.41 $50.00arrow_forward

- 2.16) Find the average daily balance (new purchases included) Dates Payment End of Day Balance 4/1-4/5 4/6 4/7-4/22 4/23 4/24-4/30 Average $380.00 Purchase $110.00 Po X $300.00 x $410.00 x $410.00 X $30.00 X $30.00 x Total Number of Days v 5 1 16 1 7 30 Sum of Balances $1,500.00 $410.00 $6,560.00 $30.00 $210.00arrow_forwardTry Yourself - Question 2 Consider the following purchase history during October: Date Balance # of Days October 1 $110 8 October 9 $150 5 October 14 $260 8 October 22 $347 7 October 29 $612 3 The APR for this card is 16.45%. If the balance is not paid within the grace period, what is the total owed to the credit card company for this month? A. $261 B. $869 C. $616 D. $612 E. $704arrow_forwardWhat would be the cash disbursements for month 3? Description Month 1 Month 2 Month 3 Month 4 Material Purchases $ 175,000.00 $ 185,000.00 $ 215,000.00 $ 190,000.00 Amount paid in month of purchase 65.00% Amount paid in month after purchase 30.00% Amount paid two months after purchase 5.00% Discounts in month of purchase 3.50% Discount in month after purchase 1.00% Total Cash disbursements in month 3 Show your work below Description Month 1 Month 2 Month 3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education