ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

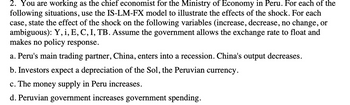

Transcribed Image Text:2. You are working as the chief economist for the Ministry of Economy in Peru. For each of the

following situations, use the IS-LM-FX model to illustrate the effects of the shock. For each

case, state the effect of the shock on the following variables (increase, decrease, no change, or

ambiguous): Y, i, E, C, I, TB. Assume the government allows the exchange rate to float and

makes no policy response.

a. Peru's main trading partner, China, enters into a recession. China's output decreases.

b. Investors expect a depreciation of the Sol, the Peruvian currency.

c. The money supply in Peru increases.

d. Peruvian government increases government spending.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. Write true or false to each on of these affirmations () A devaluation of the exchange rate does not affect the equilibrium of the general aggregate supply and demand model.arrow_forwardQuestion 10. Applying the Mundell-Fleming model analyse the impact on domestic income, interest rate, CA and KA of the following events: (a) an increase of foreign interest rate; (b) a fall of foreign demand on domestic goods. Provide an analysis for two different countries: country A with fixed exchange rate and perfect capital mobility country B with flexible exchange rate and imperfect capital mobility please do not make a long description but provide graphs and short analysisarrow_forwardAssume that prices are sticky in the short run. Use the MM-FX model to demonstrate the effects of each event below. After explaining your reasoning, answer clearly whether there is exchange rate overshooting in each case. In addition, display the time paths of the dollar interest rate, the euro interest rate, and the dollar-euro exchange rate. a) The US central bank decreases money supply by 5% and reverses the policy in three months. b. The US central bank decreases money supply by 5% and reverses the policy in three months. At the same time, US output declined by 2% over the same three-month period. Assume that the elasticity of money demand with respect to output is 1. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Imports and short-run output: In addition to depending on the exchange rate (and therefore on the interest rate), imports may depend on short-run output: when the economy is booming, consumers tend to demand more foreign goods. To incorporate this result into our short-run model, suppose the new net exports equation is Derive the IS curve with this new equation, and explain how it differs from the standard IS curve in the short-run model.arrow_forward4. Use the Mundell-Fleming model to predict what would happen to real GDP, the exchange rate, and net exports under both floating and fixed exchange rate regimes in response to each of the following shocks. Your answers should be in the form of fully-labeled graphs, where any curve shifts and new equilibrium are clearly shown. (a) Consumer confidence in the economy is falling, so consumers start to spend less. (b) Toyota designed a line of stylish new cars, making consumers prefer foreign cars over domestic cars. Banks double the number of ATMs (automatic teller machines) around the economy, reducing the demand for money.arrow_forwardExplain and show graphically how monetary and fiscal policies can be used in a closed economy IS-LM economy that is in a recession.arrow_forward

- Sub : EconomicsPls answer very fast.I ll upvote. Thank You a small open economy is described by the following equations: C = 50 + .75(Y-T) I = 200 - 20r NX = 200 -50e M/P = Y -40r G = 200 T = 200 M = 3000 P = 3 r* = 5 a. Derive and graph the IS* and LM* curves. b. Calculate the equilibrium exchange rate, level of income, and net exports c. Assume a floating exchange rate. Calculate what happens to the exchange rate, the level of income, net exports and the money supply if the government increases spending by 50. Use graph to illustrate what you find. d. Now assume fixed exchange rate. Calculate what happens to the exchange rate, the level of income, net exports and the money supply if the government increases spending by 50. Use graph to illustrate what you find.arrow_forwardHow will the following event affect variables 1 through 3 in the foreign exchange market under a flexible exchange rate system; other things unchanged. Event: The U.S. Central Bank (the Fed) starts buying Chinese currency using dollar reserves: Variable 1: Supply of dollar in the foreign exchange market ___(increase, decrease, unaffected: briefly explain why). Variable 2: Value of dollar in the foreign exchange market unaffected: briefly explain why). Variable 3: American goods exported to China unaffected: briefly explain why). (appreciate, depreciate, (increae, decrease,arrow_forwardPlease help me with this questions. Thank you 1. Using the IS–LM–FX model, illustrate how an increase in the home country’sgovernment spending affects the home country. Compare the outcome when the homecountry has a fixed exchange rate with the outcome when the home currency floats. Foreach case, state the effect of the increase in the home country’s government spending(increase, decrease, no change, or ambiguous) on the following variables: Y, i, E, C, I,TB. 2. During the 1980s, the United States experienced “twin deficits” in the currentaccount and government budget. Since 1998 the U.S. current account deficit has grownsteadily along with rising government budget deficits. Do government budget deficitslead to current account deficits? Identify other possible sources of the current accountdeficits. Do current account deficits necessarily indicate problems in the economy? 3. Suppose the Japanese government is considering two policies. One policy wouldinvolve increasing government…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education