FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

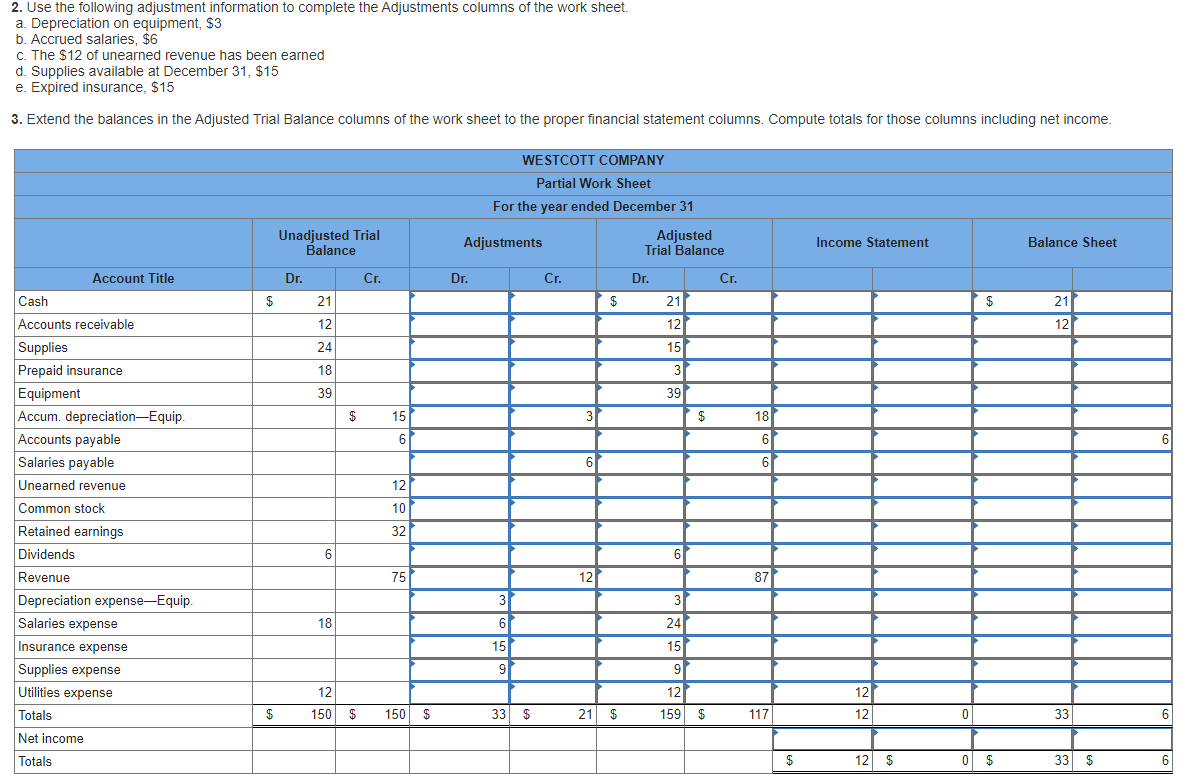

Transcribed Image Text:2. Use the following adjustment information to complete the Adjustments columns of the work sheet.

a. Depreciation on equipment, $3

b. Accrued salaries, $6

c. The $12 of unearned revenue has been earned

d. Supplies available at December 31, $15

e. Expired insurance, $15

3. Extend the balances in the Adjusted Trial Balance columns of the work sheet to the proper financial statement columns. Compute totals for those columns including net income.

WESTCOTT COMPANY

Partial Work Sheet

For the year ended December 31

Unadjusted Trial

Balance

Adjusted

Trial Balance

Adjustments

Income Statement

Balance Sheet

Account Title

Cr.

Dr.

Cr.

Dr.

Dr.

Cr.

Cash

21

21

21

S

Accounts receivable

12

12

12

15

Supplies

24

Prepaid insurance

Equipment

Accum. depreciation-Equip

Accounts payable

3

18

39

39

18

$

15

3

6

6

Salaries payable

6

6

Unearned revenue

12

Common stock

10

Retained earnings

32

6

Dividends

Revenue

87

75

12

Depreciation expense-Equip

3

3

24

Salaries expense

18

6

Insurance expense

15

15

Supplies expense

9

9

Utilities expense

12

12

12

21 $

159 $

Totals

150 $

33 $

150

117

12

C

33

6

Net income

12 $

33

6

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Record the following in the adjustment journal template then post it to the T-accounts. additional information for adjustments for December 31, 2021. a. Unexpired prepaid rent is $1,000. b. The annual prepaid insurance was paid Nov. 1 $2,500. Record the expired portion. c. Cleaning supplies on hand, $3,200. d. Depreciation expense office equipment, $110. e. Cleaning Equipment original cost $12,000 with a residual value $800, useful life is 5 years. Record the annual depreciation expense. f. Record the vehicle depreciation expense $280. g. Accrued wages $ 950.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forward

- Consider the account balances excerpted from the unadjusted trial balance and the adjustment data. Unadjusted Trial Balance Account Title Fixed Assets Accumulated Depreciation Prepaid Rent Unearned Revenue A. B. C. Debit $123,000 8,900 18,300 A. Depreciation on fixed assets, $8,900 B. Unexpired prepaid rent, $12,700 C. Remaining balance of unearned revenue, $565 Prepare adjusting journal entries, as needed. If an amount box does not require an entry, leave it blank. 24,300 X Credit 565 X $24,300 3,700 8,900 12,700 Xarrow_forwarda On December 1, $11,650 was received for a service contract to be performed from December 1 through April 30. b Assuming the work is performed evenly throughout the contract period, prepare the adjusting journal entry on December 31. Required: Record journal entries for the above transactions. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS General Ledger ASSETS 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 16 Office Building 17 Accumulated Depreciation-Office Building LIABILITIES 21 Accounts Payable 22 Notes Payable 23 Unearned Fees 24 Wages Payable 25 Interest Payable EQUITY 31 Common Stock 32 Retained Earnings 33 Dividends REVENUE 41 Fees Earned EXPENSES 51 Advertising Expense 52 Insurance Expense 53 Interest Expense 54 Wages Expense 55 Supplies Expense 56 Utilities Expense 57 Depreciation…arrow_forwardJournalize the necessary year-end adjusting entries based on the following account balances before adjustments.arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. amount due for employee salaries, $4,800 actual count of supplies inventory, $ 2,300 depreciation on equipment, $3,000arrow_forwardAt December 31, the unadjusted trial balance of H&R Tacks reports Equipment of $25,500 and zero balances in Accumulated Depreciation and Depreciation Expense. Depreciation for the period is estimated to be $5,100. Required: 1. Prepare the adjusting journal entry on December 31. 2. Post the beginning balances and adjusting entries to the following T-accounts. Complete this question by entering your answers in the tabs below. Required 11 Required 2 Post the beginning balances and adjusting entries to the following T-accounts. Accumulated Depreciation Beginning Balance Debit Ending Balance Credit Answer is not complete. 5,100 5,100 Beginning Balance Debit Ending Balance Creditarrow_forwardThe worksheet for Gibler Rental Company appears below. Using the adjustment data below, complete the worksheet. Add any accounts that are necessary. Adjustment data: a) Prepaid rent expired during August,$2 b) Depreciation expense on equipmemt for the month of August ,$8 c) Supplies on hand on August 31 amounted $6 d)Salaries and wages expense incurred at August 31 but not yet paid amount to $10.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education