ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

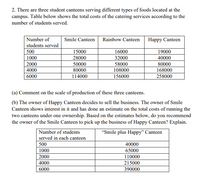

Transcribed Image Text:2. There are three student canteens serving different types of foods located at the

campus. Table below shows the total costs of the catering services according to the

number of students served.

Number of

Smile Canteen

Rainbow Canteen

Нарру Сanteen

students served

500

15000

16000

19000

1000

28000

32000

40000

2000

50000

58000

80000

4000

80000

108000

168000

6000

114000

156000

258000

(a) Comment on the scale of production of these three canteens.

(b) The owner of Happy Canteen decides to sell the business. The owner of Smile

Canteen shows interest in it and has done an estimate on the total costs of running the

two canteens under one ownership. Based on the estimates below, do you recommend

the owner of the Smile Canteen to pick up the business of Happy Canteen? Explain.

Number of students

"Smile plus Happy" Canteen

served in each canteen

500

40000

1000

65000

2000

110000

4000

215000

6000

390000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Table 1A: Costs and Total Production for a Competitive Firm Total Total Total Total Marginal Average Average Average Product Fixed Cost Variable Cost Cost Fixed Cost Variable Total (Q) (TFC) Cost (TVC) (TC) (MC) (AFC) Cost (AVC) Cost (ATC) 1 $20.00 $40.00 F. $50.00 B. 3. 4 $58.00 C. H. M $70.00 D $85.00 E J O Y Refer to Table 1A. Blanks G and S can be best filled with values of and respectively. O $10.00: $17.50 O $10.00: $18.50 O $10.50: $17.50 O $10.50: $18.50 o > 3 x > PORST A,arrow_forwardQuantity of commodity A per day Total Variable costs in U. 700 200 60.000 7-25 201 61.000 202 62.500 203 64.000 204 66.000 205 68.500 206 72.000 FO Use Table 1 above to answer question number 25 below New Generation is a perfectly competitive company selling commodity Y at the market price of OMR.500) New Generation Company has fixed costs of OMR 30.000/day and a daily variable cost schedule in Table 1 above. The profit maximizing level of output for New Generation Company is: a. 202 units per day. b. 204 units per day. 206 units per day. d. 205 units per day. 12292-arrow_forwardCompare marginal revenue, marginal cost, and marginal revenue product.arrow_forward

- 4. Various measures of cost Douglas Fur is a small manufacturer of fake-fur boots in Denver. The following table shows the company’s total cost of production at various production quantities.arrow_forwardThe graph shows the short-run cost curves of a toy producer. The market has 1,000 identical toy producers. The market price of a toy is $21. In the short run, the firm produces toys a week. 24- 21- 18- 15- 12- 9- 0 500 1000 1500 2000 MC ATC AVC 2500arrow_forwardVinnie’s Painting Company specializes in painting houses. Their cost schedule is as follows: 1. Show to calculate for the table below Output TFC TVC TC AFC AVC ATC MC 0 1000 1 100 2 100 3 400 4 450 5 1600 6 3200 7 6400 a) Given the partial data available, finish the table and calculate all the costs. b) What is the minimum efficient scale of Vinnie’s company? c) What is the marginal cost of 6 houses? d) If Vinnie charges $825 per house, how many houses he should paint to maximize profits?arrow_forward

- economicarrow_forwardCosts and Profit Maximization: Work It Out 1 Suppose Margie decides to lease a photocopier and open up a black-and-white photocopying service in her dorm room for use by faculty and students. Her total cost, as a function of the number of copies she produces per month, is given in the table. Number of Photocopies Per Month Total Cost Fixed Cost Variable Cost Total Revenue Profit 0 $100 1,000 $110 2,000 $125 3,000 $145 4,000 $175 5,000 $215 6,000 $285 a. Fill in the missing numbers in the table, assuming that Margie can charge 6 cents per black-and-white copy. Margie's fixed cost is: $ Variable cost, 0 photocopies/month: $ Variable cost, 1,000 photocopies/month: $ Variable cost, 2,000 photocopies/month: $ Variable cost, 3,000 photocopies/month: $ Variable cost, 4,000 photocopies/month: $…arrow_forwardsolution plzarrow_forward

- A small coffee house has the following costs: building and pizza oven rentals 100,000 labor 120,000owners salary given up 85,000 value of entrepreneurial talent 30,000 raw material 100,000 Bank loan payment 15,000 interest given up by owner 5,000 revenue for the firm is expected to be 420,000 for the year. a. List by name and amount the firms fixed explicit costs b. List by name and amount the forms variable explicit costs c. List by name and amount the forms implicit cost d. Calculate the firms accounting profits and its economic profit e. Should the firms continue business in the long term if revenues and costs continue at the same lev? Why or why not?arrow_forwardvariable fixed cost cost average total cost variable cost marginal total revenue marginal total cost wt price $20 revenue profit 1700 0 1700 0 0 -1700 1700 500 2200 5 5 2000 20 -200 1700 1200 2900 6 7 4000 20 1100 1700 2700 4400 9 15 6000 20 1600 1700 5200 6900 13 25 8000 20 1100 1700 9000 10700 18 38 10000 20 -700 1700 15000 16700 25 60 12000 20 -4700 1700 23800 25500 34 88 14000 20 -11500 1700 36800 38500 46 130 16000 20 -22500 1700 55800 57500 62 190 18000 20 -39500 1700 83000 84700 83 272 20000 20 -64700arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education