FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

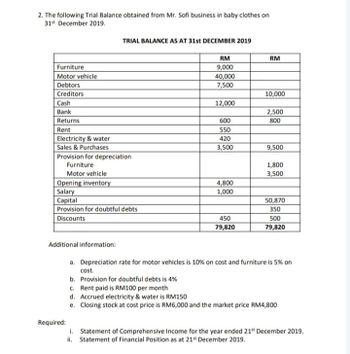

Transcribed Image Text:2. The following Trial Balance obtained from Mr. Sofi business in baby clothes on

31st December 2019.

Furniture

Motor vehicle

Debtors

Creditors

Cash

Bank

Returns

Rent

TRIAL BALANCE AS AT 31st DECEMBER 2019

Electricity & water

Sales & Purchases

Provision for depreciation

Furniture

Motor vehicle

Opening inventory

Salary

Capital

Provision for doubtful debts

Discounts

Required:

RM

9,000

40,000

7,500

12,000

600

550

420

3,500

4,800

1,000

450

79,820

RM

10,000

2,500

800

9,500

1,800

3,500

50,870

350

500

79,820

Additional information:

a. Depreciation rate for motor vehicles is 10% on cost and furniture is 5% on

cost.

b. Provision for doubtful debts is 4%

c. Rent paid is RM100 per month

d. Accrued electricity & water is RM150

e. Closing stock at cost price is RM6,000 and the market price RM4,800

i. Statement of Comprehensive Income for the year ended 21st December 2019.

ii. Statement of Financial Position as at 21st December 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 22 Salaries Payable 55 Insurance Expense 23 Unearmed Fees 59 Miscellaneous Expense The post-dosing trial balance as of April 30, 2019 Required: Journalize each of the May transactions using Kelly Consulling's clhar of accounts. (Do not Insert the account rumbers in the Post. Ref. colt compound transaction, if an amount box does not require an entry, leave it blank, May 3. Receved.cash fromn clients as an advance payrment for servies to be provided and recorded it as unearned fees, s1.500. Post. Ref. 4,500 May 5: Received cash from dlients on account, $2,450. Post. Ref. Debit 2,450 May 9: Paid cash for a newspaper advertisement, $225. Post. Ref. Debit DOOdODS日 May 13: Paid Office Station Co. for part of the debt incurred on April 5, $640. Post. Ref. Debit 640 May 15: Provided services on accournt for the period May 1-15, $9,180. Description Post. Ref. Debit 9,180 9,180 May 16: Paid part-time receptionist for two weeks' salary induding the amount owed on April 30, $750. Description Post.…arrow_forwardxamus - cdn.student.uae.examus.net/?rldbqn=1&sessi... ACCT101_FEX_2021_2_Male A company purchased merchandise on credit with terms Ac Payable if the company pays SR485 cash on this account within ten days? e18 3/15, n/3O. How much will be debited to 33 - 34 abe18ce33 b. Accounts Payable should be credited in а. 485 113:22 9 కోల С. 470.45 95abe18ce 33 d. 500 95abe18ce 95abe18ce33 95aber8ce33 95abe18ce33 95abe18ce33 95abe18ce33 MacBook Pro F3 888 F4 FS E 5 F7 67 7 V T. 8 A 9 Y 6. U 11 9.arrow_forwardquestion is attached in the ss blow thanks for help thlatpatphat ha arepoacited it top4ipt4op 4itp 4iyp4 o o4i yarrow_forward

- Carson's Bakery operates its business on a calendar year-end and uses 3% of Accounts Receivable to estimate bad debt expense. The company presents the following information at December 31, 2020 before any adjusting entries have been made. Account DR CR Accounts receivable 978,000 Allowance for doubtful accounts 23,750 667,500 Net credit sales What will the company record for bad debt expense? Debit choose your answer... type your answer... Credit choose your answer... type your answer...arrow_forwardCarson's Bakery operates its business on a calendar year-end and uses 1% of Credit Sales to estimate bad debt expense. The company presents the following information at December 31, 2020 before any adjusting entries have been made. Account DR CR Accounts receivable 978,000 Allowance for doubtful accounts 23,750 667,500 Net credit sales What will the company record for bad debt expense? Debit choose your answer.. type your answer... Credit choose your answer... type your answer...arrow_forwardB Moore's Trial Balance as at 30 September 2021 Particulars DR £ CR £ Cash at Bank £45000 Cash in Hand £6800 Accounts receivable(Debtors) £8000 Accounts Payable( Creditors) £14500 Inventory 30 September 2020 £18000 Car £25000 Drawings £7500 Fixtures and Fittings £18500 Sales £95000 Purchases £110000 Return Inwards (Sales returns) £3500 Carriage inwards £890 Return Outwards ( Purchase returns) £720 Carriage outwards £500 Motor Expenses £1400 Rent £7000 Telephone charges £830 Wages and Salaries £14000 Insurance £1030 Office Expenses £800 Sundry Expenses £250 Capital £158780 £269 000 £269 000 Inventory as at 30 September 2021 is £13 000 Required: a) Prepare an Income Statement for B Moore for the year ending 30th September 2021 b) The following table shows the profit/loss for B Moore profitable since year 2013 Year 2013 2014 2015 2016 2017 2018 2019 2020 Profit/Loss £55800…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education